Advancements in Genetic Research

Advancements in genetic research are reshaping the Newborn Screening Testing Market by enabling the identification of a broader range of genetic disorders. The discovery of new biomarkers and the development of next-generation sequencing technologies are facilitating more precise and comprehensive screening methods. These advancements not only improve the detection rates of rare genetic conditions but also allow for personalized treatment approaches. As research continues to evolve, the market is expected to expand, with an increasing number of tests being developed and implemented in newborn screening programs. This trend highlights the importance of integrating cutting-edge research into clinical practice, ultimately benefiting newborn health outcomes.

Regulatory Support for Newborn Screening

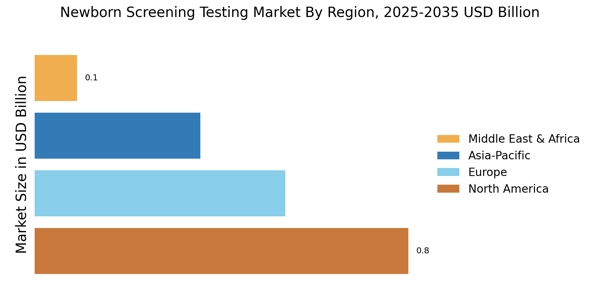

Regulatory support plays a pivotal role in shaping the Newborn Screening Testing Market. Governments and health organizations are increasingly recognizing the importance of early detection of congenital disorders, leading to the establishment of comprehensive screening programs. For instance, many countries have implemented mandatory newborn screening policies, which have significantly expanded the scope of tests performed. This regulatory framework not only ensures that newborns receive essential screenings but also fosters public trust in healthcare systems. As a result, the market is likely to witness sustained growth, with an estimated increase in screening rates contributing to a larger patient base for testing services.

Rising Incidence of Congenital Disorders

The Newborn Screening Testing Market is significantly influenced by the rising incidence of congenital disorders. Studies indicate that approximately 1 in 33 infants is born with a birth defect, underscoring the critical need for effective screening programs. As the prevalence of these disorders increases, the demand for comprehensive newborn screening services is expected to rise correspondingly. This trend is prompting healthcare systems to adopt more robust screening protocols, thereby expanding the market. Additionally, the identification of new conditions that can be screened for is likely to further enhance the scope of testing, making it an essential component of neonatal care.

Technological Advancements in Newborn Screening Testing

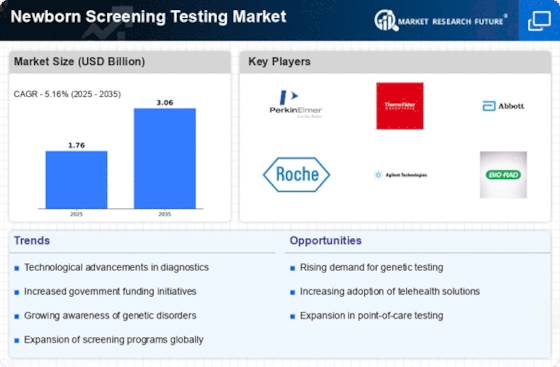

The Newborn Screening Testing Market is experiencing a surge in technological advancements that enhance the accuracy and efficiency of screening processes. Innovations such as tandem mass spectrometry and genetic testing are becoming increasingly prevalent, allowing for the detection of a wider array of metabolic and genetic disorders. These technologies not only improve diagnostic capabilities but also reduce the time required for results, which is critical for timely interventions. The market is projected to grow at a compound annual growth rate of approximately 10% over the next few years, driven by these advancements. Furthermore, the integration of artificial intelligence in data analysis is expected to streamline workflows, thereby increasing the overall effectiveness of newborn screening programs.

Increased Awareness Among Parents and Healthcare Providers

The Newborn Screening Testing Market is benefiting from heightened awareness among parents and healthcare providers regarding the importance of early detection of health issues in newborns. Educational campaigns and outreach programs have been instrumental in informing families about the benefits of newborn screening, leading to higher participation rates. This increased awareness is reflected in the rising number of newborns screened annually, which has reached over 98% in several regions. As more parents advocate for comprehensive screening, healthcare providers are also more inclined to recommend these tests, further driving market growth. The emphasis on preventive healthcare is likely to continue influencing the market positively.