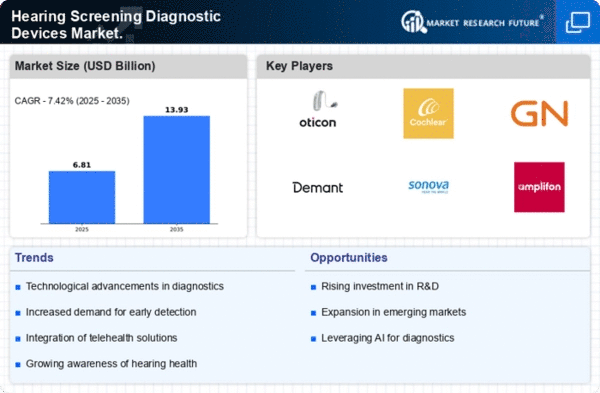

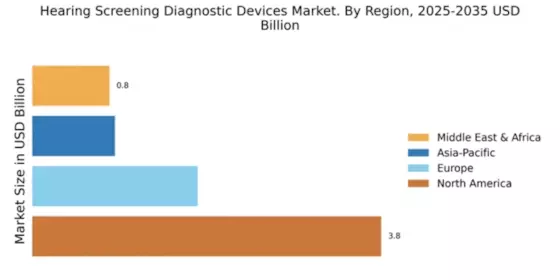

North America : Market Leader in Innovation

North America is poised to maintain its leadership in the Hearing Screening Diagnostic Devices Market, holding a significant market share of 3.8 billion. The region's growth is driven by increasing awareness of hearing health, advancements in technology, and supportive regulatory frameworks.

The demand for early detection and intervention in hearing loss is also on the rise, further propelling market expansion. Regulatory bodies are promoting initiatives to enhance access to hearing screening services, which is expected to boost market growth significantly. The competitive landscape in North America is robust, featuring key players such as Oticon, Eargo, and Starkey Hearing Technologies.

The U.S. is the largest market, driven by high healthcare expenditure and a growing aging population. Companies are focusing on innovation and product development to meet the diverse needs of consumers. The presence of established firms and a strong distribution network further solidifies North America's position as a market leader in hearing diagnostic devices.

Europe : Emerging Market with Potential

Europe's Hearing Screening Diagnostic Devices Market is valued at 1.8 billion, reflecting a growing demand for innovative hearing solutions. Factors such as an aging population, increased awareness of hearing health, and advancements in technology are driving this growth.

Regulatory support from the European Union, including initiatives to improve hearing health services, is expected to further enhance market dynamics. The region is witnessing a shift towards more personalized and accessible hearing solutions, catering to diverse consumer needs. Leading countries in Europe include Germany, France, and the UK, where the presence of key players like Sonova and Amplifon is notable.

The competitive landscape is characterized by a mix of established companies and emerging startups focusing on innovative technologies. The market is also influenced by collaborations and partnerships aimed at enhancing product offerings and expanding market reach.

As the demand for hearing solutions continues to rise, Europe is set to become a significant player in the global market.

Asia-Pacific : Rapidly Growing Market

The Asia-Pacific region, with a market size of 0.9 billion, is witnessing rapid growth in the Hearing Screening Diagnostic Devices Market. This growth is fueled by increasing awareness of hearing health, rising disposable incomes, and advancements in technology.

Countries like China and India are experiencing a surge in demand for hearing solutions, driven by a growing aging population and urbanization. Regulatory initiatives aimed at improving healthcare access are also contributing to market expansion, making hearing screening more accessible to the public.

In the competitive landscape, key players such as Cochlear and GN Store Nord are making significant inroads into the market. The presence of local manufacturers is also increasing, providing cost-effective solutions to meet the rising demand.

As the region continues to develop economically, the focus on healthcare, including hearing health, is expected to grow, positioning Asia-Pacific as a vital market for hearing diagnostic devices.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region, valued at 0.84 billion, presents significant growth opportunities in the Hearing Screening Diagnostic Devices Market. Factors such as increasing awareness of hearing health, rising healthcare expenditure, and government initiatives to improve healthcare access are driving market growth.

The region is witnessing a gradual shift towards modern healthcare solutions, including hearing screening services, which are becoming more accessible to the population. Regulatory frameworks are evolving to support the integration of advanced hearing technologies into healthcare systems.

Leading countries in this region include South Africa and the UAE, where the presence of key players is gradually increasing. The competitive landscape is characterized by a mix of international and local companies striving to capture market share.

As healthcare infrastructure improves and awareness of hearing health rises, the Middle East and Africa are expected to become increasingly important players in The Hearing Screening Diagnostic Devices.