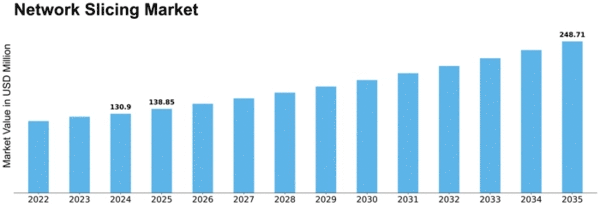

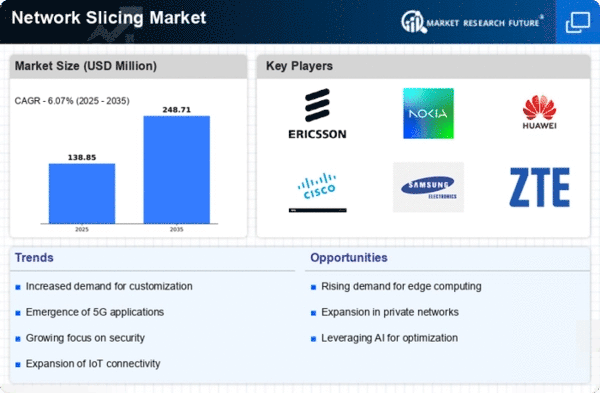

Network Slicing Size

Network Slicing Market Growth Projections and Opportunities

The Network Slicing business is impacted by different market factors that assume a significant part in molding its elements and development direction. One critical variable is the quick development of 5G innovation. The coming of 5G has introduced another time of availability, offering remarkable speed and low dormancy. Network Slicing, as a critical element of 5G, permits administrators to make numerous virtual organizations on a solitary actual framework. This adaptability empowers the customization of administrations for different applications, like shrewd urban communities, modern robotization, and increased reality. The interest for network cutting is accordingly pushed by the rising reception of 5G across enterprises.

Another market factor driving the development of Network Slicing is the flood in Web of Things (IoT) gadgets. The multiplication of associated gadgets across different areas, from medical services to assembling, requires an organization framework equipped for taking care of different necessities. Network cutting gives an answer by permitting administrators to designate explicit cuts for various sorts of IoT applications. This guarantees upgraded execution, security, and asset use, tending to the interesting requirements of each utilization case. As IoT keeps on extending, the interest for network cutting is supposed to proportionately rise.

Moreover, the market for Network Slicing is affected by the raising interest for upgraded portable broadband administrations. The demand for advanced network capabilities is being driven by the consumer demand for high-speed internet, seamless connectivity, and immersive multimedia experiences. Network cutting empowers administrators to designate committed cuts for upgraded portable broadband, guaranteeing that clients get the ideal degree of administration quality. This is especially pivotal in thickly populated metropolitan regions where network blockage is a typical test. As urbanization and cell phone use keep on developing, the market for network cutting is ready for extension.

Interoperability and normalization likewise assume a vital part in molding the organization cutting business sector. Keeping equipment and networks from various vendors compatible and seamlessly integrated becomes increasingly important as technology advances. Normalization endeavors by industry associations and cooperation among partners are fundamental to lay out a bound together system for network cutting sending. The foundation of normal guidelines works with interoperability, lessens organization intricacy, and advances a sound cutthroat scene. Market players are intently checking and effectively partaking in these normalization drives to profit by the learning experiences introduced by a blended biological system.

Additionally, the market dynamics of Network Slicing are influenced by regulatory initiatives and policies. States and administrative bodies assume an essential part in molding the media communications scene. Strategies that advance 5G organization and backing the execution of cutting edge innovations like Network Slicing can altogether influence market development. Administrative structures that encourage development, contest, and interest in broadcast communications framework establish a helpful climate for the extension of Network Slicing administrations.

Leave a Comment