Emergence of 5G Technology

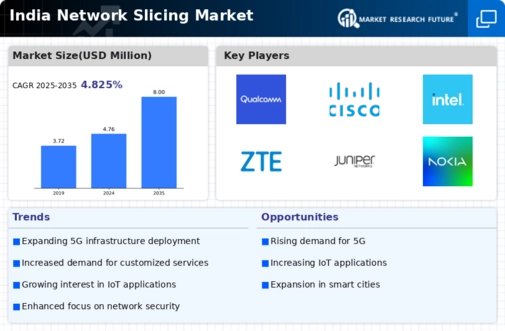

The rollout of 5G technology is a pivotal driver for the India network slicing market. With the introduction of 5G, the demand for network slicing is expected to escalate, as it allows operators to create multiple virtual networks on a single physical infrastructure. This capability is essential for supporting diverse applications, from enhanced mobile broadband to ultra-reliable low-latency communications. The Telecom Regulatory Authority of India (TRAI) has indicated that 5G services could generate an economic impact of USD 1 trillion by 2035, underscoring the potential of network slicing to facilitate this growth. As telecom operators invest in 5G infrastructure, the network slicing market is poised for substantial expansion.

Increased Demand for Customized Services

The India network slicing market is witnessing a surge in demand for customized services tailored to specific user requirements. Enterprises are increasingly seeking solutions that allow them to optimize their network resources for various applications, such as IoT, smart cities, and autonomous vehicles. This trend is driven by the need for enhanced performance and reliability in critical applications. According to recent data, the market for IoT in India is projected to reach USD 15 billion by 2025, indicating a growing appetite for specialized network solutions. As businesses recognize the potential of network slicing to deliver differentiated services, the industry is likely to expand, catering to diverse sectors and enhancing overall user experience.

Government Initiatives and Policy Support

The India network slicing market benefits significantly from government initiatives aimed at promoting digital transformation and 5G deployment. The Indian government has introduced various policies to facilitate the rollout of advanced telecommunications infrastructure, including the National Digital Communications Policy. This policy emphasizes the importance of 5G technology and its applications, which inherently rely on network slicing for efficient resource allocation. Furthermore, the government has allocated substantial funds for research and development in telecommunications, which is expected to bolster the growth of the network slicing market. As regulatory frameworks evolve, they are likely to create a conducive environment for innovation and investment in this sector.

Rising Demand for Enhanced User Experience

The India network slicing market is increasingly influenced by the rising demand for enhanced user experience across various sectors. Consumers and businesses alike are seeking seamless connectivity and reliable services, which network slicing can provide by allocating dedicated resources for specific applications. This demand is particularly evident in sectors such as healthcare, entertainment, and transportation, where quality of service is paramount. As organizations strive to meet customer expectations, the implementation of network slicing is likely to become a strategic priority. The growing emphasis on user experience is expected to drive investments in network slicing solutions, further propelling the growth of the industry in India.

Growing Investment in Telecommunications Infrastructure

Investment in telecommunications infrastructure is a critical driver for the India network slicing market. As telecom operators and private players invest heavily in upgrading their networks to support advanced technologies, the need for efficient resource management becomes paramount. The Indian telecommunications sector is projected to attract investments exceeding USD 100 billion by 2025, driven by the demand for high-speed internet and enhanced connectivity. This influx of capital is likely to accelerate the adoption of network slicing, as operators seek to optimize their networks for various applications. Consequently, the network slicing market is expected to flourish, providing innovative solutions to meet the evolving demands of consumers and businesses alike.