Expansion of 5G Networks

The rollout of 5G networks significantly influences the Global Wireless Network Infrastructure Ecosystem Market Industry. With its promise of ultra-low latency and high data rates, 5G technology is expected to reshape various sectors, including healthcare, automotive, and entertainment. As countries invest heavily in 5G infrastructure, the market is anticipated to grow substantially, potentially reaching 60.5 USD Billion by 2035. This expansion not only enhances user experiences but also enables new applications such as augmented reality and autonomous vehicles, thereby creating a robust demand for advanced wireless infrastructure.

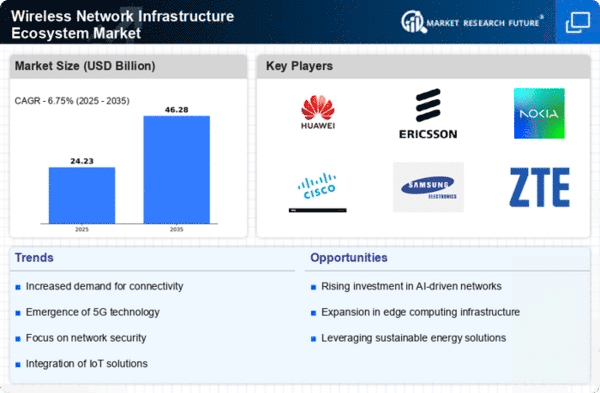

Market Growth Projections

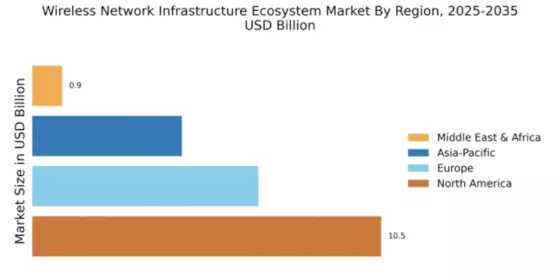

The Global Wireless Network Infrastructure Ecosystem Market Industry is poised for remarkable growth, with projections indicating a rise from 22.7 USD Billion in 2024 to 60.5 USD Billion by 2035. This trajectory suggests a compound annual growth rate of 9.33% from 2025 to 2035, reflecting the increasing reliance on wireless connectivity across various sectors. The growth is driven by factors such as the expansion of 5G networks, the rising adoption of IoT devices, and the ongoing development of smart city initiatives. These dynamics collectively underscore the critical role of wireless infrastructure in shaping the future of global connectivity.

Rising Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices is a key driver of the Global Wireless Network Infrastructure Ecosystem Market Industry. As more devices become interconnected, the demand for reliable wireless networks increases. This trend is evident in sectors such as agriculture, healthcare, and manufacturing, where IoT applications enhance operational efficiency and data collection. The market is expected to witness a compound annual growth rate of 9.33% from 2025 to 2035, reflecting the growing importance of wireless infrastructure in supporting the vast network of IoT devices that require seamless connectivity.

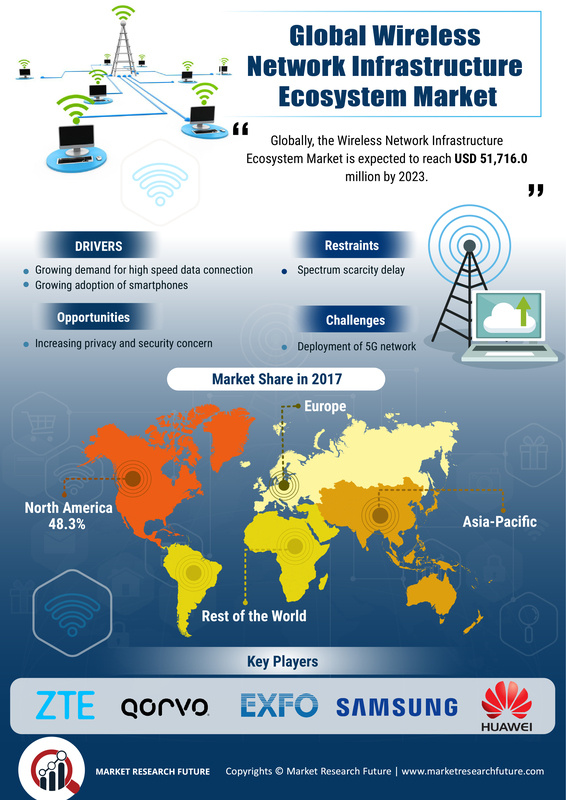

Growing Demand for High-Speed Connectivity

The Global Wireless Network Infrastructure Ecosystem Market Industry experiences a surge in demand for high-speed connectivity, driven by the increasing reliance on digital services and applications. As businesses and consumers seek faster internet access, the market is projected to reach 22.7 USD Billion in 2024. This growth is indicative of a broader trend where enhanced connectivity is essential for supporting emerging technologies such as IoT and smart cities. The need for robust wireless infrastructure is further underscored by the proliferation of mobile devices and the demand for seamless connectivity, which collectively propel the market forward.

Emergence of Advanced Wireless Technologies

The Global Wireless Network Infrastructure Ecosystem Market Industry is significantly impacted by the emergence of advanced wireless technologies, including Wi-Fi 6 and future iterations. These technologies offer improved performance, capacity, and efficiency, catering to the increasing demands for data-intensive applications. As organizations and consumers upgrade their networks to accommodate these advancements, the market is likely to experience substantial growth. The integration of these technologies into existing infrastructure not only enhances user experiences but also supports the evolving landscape of digital communication, thereby driving further investment in wireless network infrastructure.

Increased Investment in Smart City Initiatives

The Global Wireless Network Infrastructure Ecosystem Market Industry is bolstered by increased investments in smart city initiatives worldwide. Governments are recognizing the potential of smart technologies to improve urban living conditions, enhance public safety, and optimize resource management. As a result, there is a growing need for reliable wireless infrastructure to support various smart applications, including traffic management and energy efficiency. This trend is likely to drive market growth as cities implement interconnected systems that rely on robust wireless networks, further emphasizing the importance of infrastructure development in urban planning.