Emergence of Smart Cities

The GCC network slicing market is significantly influenced by the emergence of smart city initiatives across the region. Countries like Saudi Arabia and the UAE are investing heavily in smart city projects, which require robust and flexible network solutions. Network slicing enables the creation of virtual networks tailored to specific smart city applications, such as traffic management, public safety, and energy efficiency. For instance, the NEOM project in Saudi Arabia aims to integrate advanced technologies, necessitating a sophisticated network infrastructure. The demand for dedicated network resources to support these initiatives is likely to drive the adoption of network slicing in the GCC network slicing market, as it allows for efficient management of diverse applications.

Investment in Digital Infrastructure

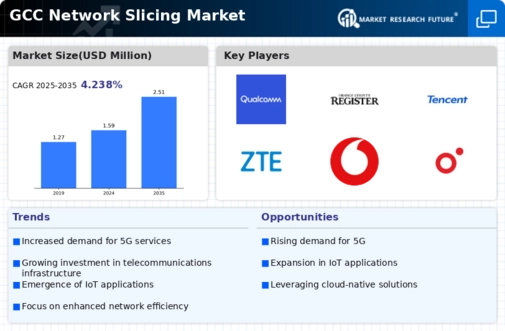

The GCC network slicing market is benefiting from substantial investments in digital infrastructure. Governments across the region are prioritizing the development of advanced telecommunications networks to support economic diversification and digital transformation. For example, the UAE's National Digital Economy Strategy aims to enhance the country's digital infrastructure, which includes the deployment of 5G networks. This investment is expected to exceed USD 10 billion by 2025, creating a conducive environment for network slicing technologies. As operators upgrade their networks to support 5G, the implementation of network slicing becomes essential to maximize resource utilization and meet diverse customer needs. This trend underscores the critical role of infrastructure investment in shaping the future of the GCC network slicing market.

Rising Demand for Customized Services

The GCC network slicing market is witnessing a rising demand for customized services tailored to specific user needs. As businesses and consumers seek more personalized experiences, network slicing offers the flexibility to create dedicated virtual networks for various applications. This trend is particularly evident in sectors such as healthcare, automotive, and entertainment, where specific performance requirements are critical. For instance, the healthcare sector in the GCC is increasingly adopting telemedicine solutions, which require reliable and low-latency connections. Network slicing enables telecom operators to allocate resources efficiently, ensuring that these services meet the necessary standards. This growing demand for customized services is likely to drive the expansion of the GCC network slicing market, as operators strive to meet diverse customer expectations.

Growing Demand for Enhanced Connectivity

The GCC network slicing market is experiencing a surge in demand for enhanced connectivity solutions. As businesses and consumers increasingly rely on high-speed internet and seamless connectivity, network slicing emerges as a pivotal technology. This demand is driven by the proliferation of IoT devices and applications that require dedicated network resources. For instance, the number of IoT devices in the GCC region is projected to reach over 50 million by 2026, necessitating efficient network management. Network slicing allows operators to allocate specific resources to different applications, ensuring optimal performance. This trend indicates a shift towards more tailored connectivity solutions, which is likely to propel the growth of the GCC network slicing market in the coming years.

Regulatory Frameworks Supporting Innovation

The GCC network slicing market is supported by evolving regulatory frameworks that encourage innovation in telecommunications. Regulatory bodies in the region are increasingly recognizing the importance of advanced technologies like network slicing in enhancing service delivery. For example, the Communications and Information Technology Commission (CITC) in Saudi Arabia has initiated policies to promote 5G deployment and network slicing capabilities. These regulations aim to foster competition and improve service quality, which is essential for the growth of the network slicing market. As regulatory support strengthens, it is expected that more operators will invest in network slicing technologies, thereby accelerating the development of the GCC network slicing market.