Market Trends

Key Emerging Trends in the Network Slicing Market

The Network Slicing business sector has seen critical development lately, impelled by the steadily expanding interest for rapid and solid correspondence administrations. The idea of Network Slicing, which enables the creation of multiple virtual networks on a shared physical infrastructure, has gained prominence as technology continues to advance. This imaginative methodology empowers network administrators to take care of different prerequisites and use cases, going from huge Web of Things (IoT) organizations to super low dormancy applications like independent vehicles and expanded reality.

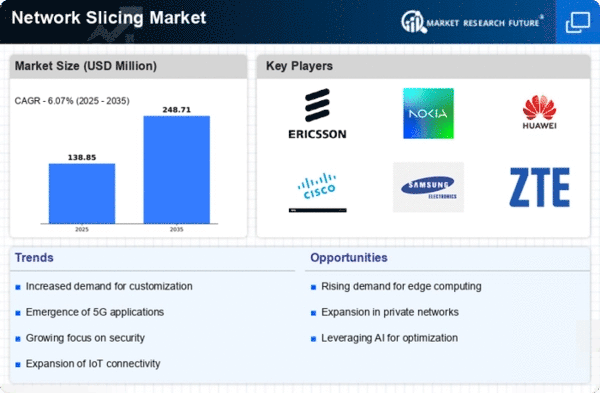

One of the key market patterns driving the reception of Organization Cutting is the rising arrangement of 5G organizations. With 5G innovation turning out to be more broad, the requirement for productive organization the executives and customization has become significant. Network Cutting tends to this interest by permitting administrators to allot assets powerfully founded on the particular necessities of various administrations and applications. This adaptability is especially imperative in enhancing the utilization of organization assets and guaranteeing a consistent client experience across different use cases.

Besides, the expansion of IoT gadgets across ventures has energized the interest for Organization Cutting arrangements. These arrangements empower the production of committed network cuts for various IoT applications, guaranteeing solid availability and proficient information move. Businesses like medical care, assembling, and savvy urban areas benefit from the capacity to alter network boundaries to meet the interesting prerequisites of their applications, prompting worked on functional productivity and improved generally execution.

One more eminent pattern in the Organization Cutting business sector is the attention on giving start to finish cutting arrangements. Merchants and specialist organizations are progressively offering complete arrangements that cover the whole organization cutting lifecycle, from creation and coordination to observing and advancement. This approach works on the execution of organization cutting for administrators, decreasing intricacy and speeding up chance to-showcase for new administrations.

Besides, the reconciliation of computerized reasoning (artificial intelligence) and AI (ML) advancements into Organization Cutting arrangements is getting forward momentum. These cutting edge innovations empower wise robotization of organization the executives undertakings, like asset portion and streamlining. By utilizing simulated intelligence and ML calculations, administrators can upgrade the proficiency of their organizations, anticipate possible issues, and proactively address them, at last working on the general nature of administration.

The Network Slicing business sector is additionally seeing expanded cooperation among industry players. Associations and unions between network hardware suppliers, programming designers, and telecom administrators are turning out to be more normal. These coordinated efforts mean to make normalized approaches and interoperable arrangements, encouraging a more consistent execution of Organization Cutting across various organizations and biological systems.

Leave a Comment