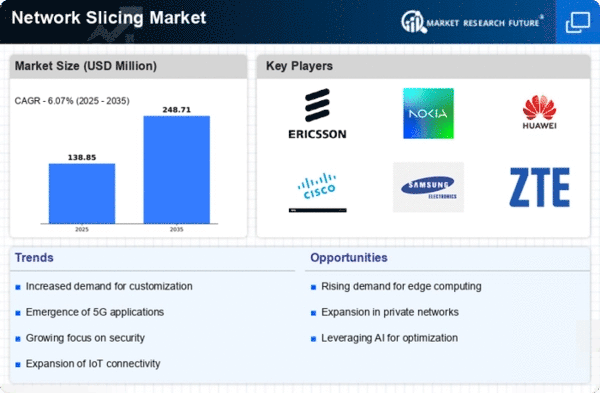

Market Growth Projections

The Global Network Slicing Market Industry is poised for substantial growth, with projections indicating a market size of 12.5 USD Billion in 2024 and an anticipated increase to 45 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 12.35% from 2025 to 2035. Such figures underscore the increasing adoption of network slicing technologies across various sectors, driven by the demand for tailored network solutions. The market's expansion is likely to be fueled by advancements in 5G technology, IoT applications, and regulatory support, positioning network slicing as a cornerstone of future telecommunications infrastructure.

Emergence of IoT Applications

The proliferation of Internet of Things (IoT) applications is a significant driver of the Global Network Slicing Market Industry. As more devices connect to the internet, the demand for dedicated network resources becomes paramount. Network slicing enables operators to allocate bandwidth and optimize performance for various IoT applications, such as smart cities and industrial automation. This tailored approach not only enhances user experience but also ensures reliability and security. With the market expected to grow at a CAGR of 12.35% from 2025 to 2035, the integration of IoT with network slicing is likely to reshape the telecommunications landscape, fostering innovation and efficiency.

Increasing Demand for 5G Services

The Global Network Slicing Market Industry is experiencing a surge in demand for 5G services, driven by the need for enhanced connectivity and lower latency. As industries increasingly adopt 5G technology, network slicing emerges as a critical solution, allowing operators to create multiple virtual networks on a single physical infrastructure. This capability supports diverse applications, from IoT to autonomous vehicles, thereby expanding market opportunities. In 2024, the market is projected to reach 12.5 USD Billion, reflecting the growing reliance on 5G networks. The ability to tailor network resources to specific use cases positions network slicing as a pivotal component in the evolution of telecommunications.

Support for Diverse Industry Verticals

The Global Network Slicing Market Industry is increasingly recognized for its ability to support diverse industry verticals, including healthcare, automotive, and entertainment. Each sector has unique requirements, necessitating customized network solutions. For instance, in healthcare, network slicing can facilitate real-time remote monitoring and telemedicine services, while in the automotive sector, it can enhance vehicle-to-everything (V2X) communication. This versatility not only drives adoption but also encourages investment in network slicing technologies. As the market evolves, the potential for tailored solutions across various industries may contribute to its projected growth to 45 USD Billion by 2035, indicating a robust future for network slicing.

Regulatory Support and Standardization Efforts

Regulatory support and standardization efforts play a vital role in the Global Network Slicing Market Industry. Governments and industry bodies are increasingly recognizing the importance of network slicing for enabling next-generation networks. Initiatives aimed at creating standards for network slicing facilitate interoperability and encourage investment in this technology. As regulatory frameworks evolve, they provide a conducive environment for operators to implement network slicing solutions. This support is likely to accelerate market growth, as stakeholders seek to align with emerging standards. The collaborative efforts between regulators and industry players may significantly influence the trajectory of the network slicing market in the coming years.

Enhanced Network Efficiency and Resource Management

The Global Network Slicing Market Industry benefits from enhanced network efficiency and resource management capabilities. By allowing operators to dynamically allocate resources based on demand, network slicing optimizes the use of existing infrastructure. This efficiency is particularly crucial as data traffic continues to escalate. Operators can create slices that prioritize critical applications while ensuring that less urgent traffic does not compromise performance. This approach not only improves user satisfaction but also reduces operational costs. As the market matures, the emphasis on efficient resource management is likely to drive further adoption of network slicing solutions, reinforcing its role in modern telecommunications.