Growth in Non-Food Applications

The Native Starches Market is not limited to food applications; it is also witnessing growth in non-food sectors such as pharmaceuticals, cosmetics, and paper manufacturing. In pharmaceuticals, native starches are utilized as excipients, aiding in drug formulation and delivery. The cosmetic industry employs these starches for their thickening and emulsifying properties, enhancing product stability and texture. Furthermore, in paper manufacturing, native starches are used as binders and coatings, improving the quality and durability of paper products. The diversification of applications across various industries indicates a robust potential for growth in the native starches market, with estimates suggesting that non-food applications could account for nearly 30% of the overall market share by 2026.

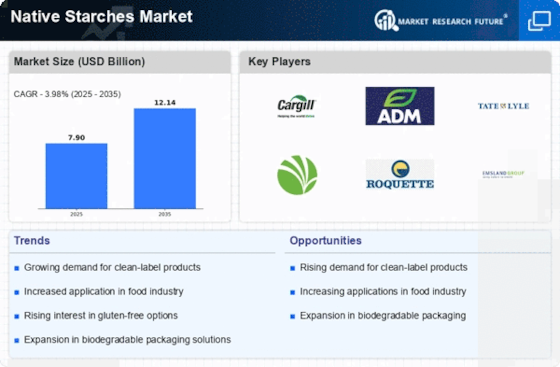

Increasing Application in Food Industry

The Native Starches Market is experiencing a notable surge in demand due to the increasing application of native starches in the food sector. These starches serve as thickeners, stabilizers, and texturizers in various food products, including sauces, soups, and baked goods. The versatility of native starches allows manufacturers to enhance the sensory attributes of food items, which is becoming increasingly important to consumers. According to recent data, the food segment accounts for a substantial share of the native starches market, with projections indicating a growth rate of approximately 4.5% annually. This trend suggests that as consumer preferences shift towards natural and minimally processed ingredients, the demand for native starches will likely continue to rise, further solidifying their role in the food industry.

Regulatory Support for Natural Ingredients

The Native Starches Market is bolstered by increasing regulatory support for the use of natural ingredients in food and other products. Regulatory bodies are progressively endorsing the use of native starches as safe and effective alternatives to synthetic additives. This regulatory backing not only enhances consumer confidence but also encourages manufacturers to adopt native starches in their formulations. For instance, recent guidelines have recognized native starches as Generally Recognized As Safe (GRAS), facilitating their incorporation into a wider array of products. This regulatory environment is likely to foster innovation and expansion within the native starches market, as companies are more inclined to explore new applications and formulations that align with regulatory standards.

Consumer Preference for Natural Ingredients

The Native Starches Market is significantly influenced by the growing consumer preference for natural and clean-label ingredients. As consumers become more health-conscious, they are increasingly seeking products that are free from artificial additives and preservatives. Native starches, being derived from natural sources such as corn, potatoes, and tapioca, align well with this trend. This shift in consumer behavior is prompting food manufacturers to reformulate their products, incorporating native starches as a means to meet the demand for transparency and authenticity. Market analysis indicates that products labeled as clean-label are experiencing a growth rate of approximately 6% annually, suggesting that the native starches market will likely benefit from this trend as manufacturers strive to cater to the evolving preferences of health-conscious consumers.

Technological Innovations in Starch Processing

The Native Starches Market is witnessing a wave of technological innovations that are enhancing the processing and functionality of native starches. Advances in processing techniques, such as enzymatic modification and extrusion, are enabling manufacturers to produce starches with tailored properties that meet specific application requirements. These innovations not only improve the performance of native starches in various applications but also increase production efficiency. Market data suggests that the introduction of new processing technologies could lead to a reduction in production costs by up to 15%, thereby making native starches more competitive against synthetic alternatives. As technology continues to evolve, it is anticipated that the native starches market will experience further growth, driven by enhanced product offerings and improved manufacturing processes.