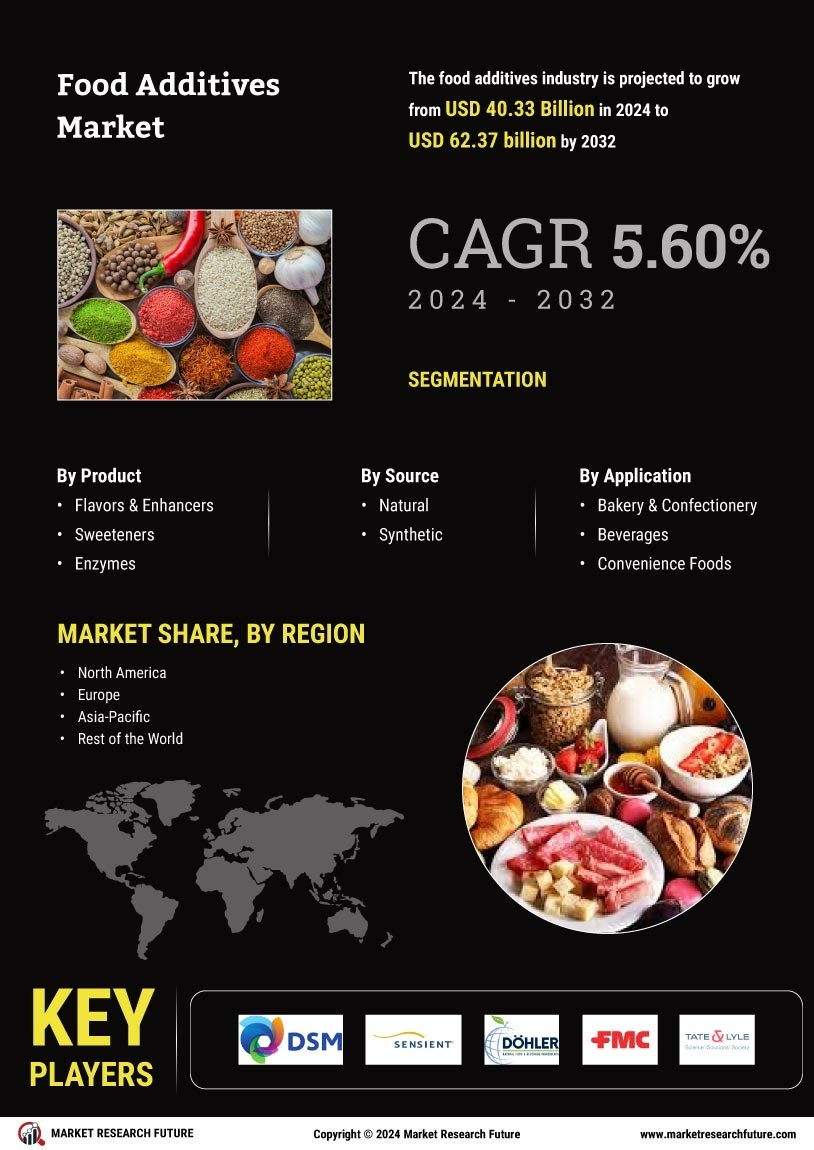

Growth of Convenience Foods

The Food Additives Market is significantly influenced by the rising demand for convenience foods. As lifestyles become busier, consumers are increasingly opting for ready-to-eat and processed food products. This trend is driving the need for food additives that enhance flavor, texture, and shelf life. Data indicates that the convenience food segment is expected to grow at a rate of 4.2% annually, further propelling the demand for various additives. Manufacturers are responding by developing innovative solutions that cater to this market segment, thereby positioning themselves favorably within the Food Additives Market.

Increasing Consumer Awareness

The Food Additives Market is experiencing a notable shift as consumers become increasingly aware of the ingredients in their food. This heightened awareness drives demand for transparency in food labeling and ingredient sourcing. As consumers seek healthier options, the market for natural and organic food additives is expanding. According to recent data, the market for natural food additives is projected to grow at a compound annual growth rate of 6.5% over the next five years. This trend indicates a significant opportunity for manufacturers to innovate and reformulate products to meet consumer preferences, thereby enhancing their market position within the Food Additives Market.

Regulatory Changes and Compliance

Regulatory frameworks governing food safety and additives are evolving, impacting the Food Additives Market. Stricter regulations regarding food safety and labeling are being implemented in various regions, compelling manufacturers to adapt their practices. Compliance with these regulations not only ensures consumer safety but also enhances brand reputation. The market is witnessing a surge in demand for additives that meet these regulatory standards, particularly in regions with stringent food safety laws. This shift presents both challenges and opportunities for companies in the Food Additives Market, as they must invest in research and development to create compliant products.

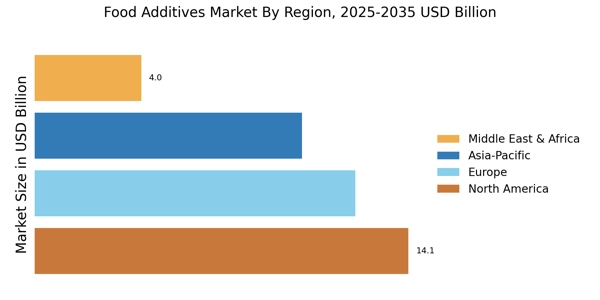

Emerging Markets and Economic Growth

Emerging markets are witnessing rapid economic growth, which is positively impacting the Food Additives Market. As disposable incomes rise, consumers in these regions are increasingly willing to spend on processed and packaged foods. This trend is leading to a surge in demand for food additives that enhance product appeal and quality. Market analysts suggest that the Asia-Pacific region, in particular, is poised for substantial growth, with a projected increase in food additive consumption of approximately 5.8% over the next few years. This presents a lucrative opportunity for companies looking to expand their footprint in the Food Additives Market.

Innovation in Food Preservation Techniques

Advancements in food preservation techniques are reshaping the Food Additives Market. Innovative methods such as high-pressure processing and natural preservatives are gaining traction as manufacturers seek to extend shelf life without compromising quality. These innovations not only meet consumer demand for fresher products but also align with the growing trend towards clean label products. The market for food preservatives is expected to grow at a rate of 4.5% annually, indicating a robust opportunity for companies to invest in research and development. This focus on innovation is likely to drive growth and competitiveness within the Food Additives Market.