Expansion in Bioplastics Production

The Industrial Starch Market is poised for growth due to the expansion in bioplastics production. Starch-based bioplastics are gaining traction as sustainable alternatives to conventional plastics, driven by increasing environmental concerns. In 2025, the bioplastics segment is projected to grow at a compound annual growth rate of 15%, indicating a robust shift towards eco-friendly materials. This growth is supported by government initiatives promoting biodegradable materials, which further enhances the appeal of starch-based products. As industries seek to reduce their carbon footprint, the Industrial Starch Market is likely to benefit from this transition, positioning starch as a key ingredient in the development of sustainable packaging solutions.

Growth in Pharmaceutical Applications

The Industrial Starch Market is experiencing growth in pharmaceutical applications, where starches are utilized as excipients in drug formulations. Starches serve as binders, disintegrants, and fillers, playing a crucial role in the efficacy of medications. In 2025, the pharmaceutical sector is anticipated to account for approximately 10% of the total starch consumption, driven by the increasing demand for oral solid dosage forms. This trend suggests a growing recognition of the importance of starches in enhancing drug delivery systems. As the pharmaceutical industry evolves, the Industrial Starch Market is likely to expand its offerings to meet the specific needs of this sector, ensuring compliance with stringent regulatory standards.

Increased Use in Personal Care Products

The Industrial Starch Market is witnessing an increased use of starches in personal care products. Starches are valued for their thickening, binding, and absorbent properties, making them essential ingredients in cosmetics and toiletries. In 2025, the personal care segment is projected to grow at a rate of 8%, reflecting the rising consumer demand for natural and sustainable ingredients. This trend aligns with the broader movement towards clean beauty, where consumers seek products free from harmful chemicals. As manufacturers respond to these preferences, the Industrial Starch Market is likely to see a diversification of starch applications, enhancing its relevance in the personal care sector.

Rising Demand in Food and Beverage Sector

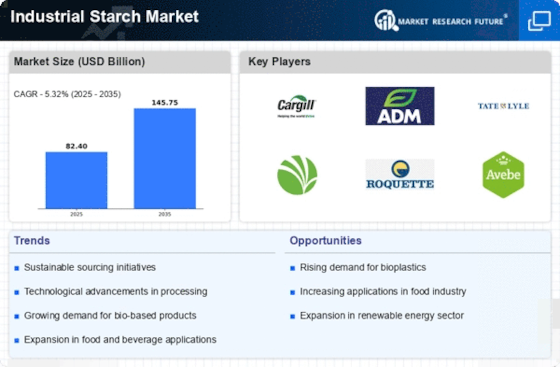

The Industrial Starch Market experiences a notable surge in demand from the food and beverage sector. Starches serve as thickeners, stabilizers, and texturizers, enhancing the quality of various products. In 2025, the food industry accounts for approximately 60% of the total starch consumption, driven by the increasing preference for convenience foods and ready-to-eat meals. This trend indicates a shift towards processed foods, which require industrial starches for improved shelf life and texture. Additionally, the growing trend of clean label products compels manufacturers to seek natural starches, further propelling the market. As consumer preferences evolve, the Industrial Starch Market is likely to adapt, ensuring that starches meet the demands of modern food formulations.

Technological Innovations in Starch Processing

Technological innovations in starch processing are transforming the Industrial Starch Market. Advances in enzymatic processes and modifications allow for the production of high-quality starches with tailored functionalities. In 2025, the market for modified starches is expected to reach a valuation of over 10 billion dollars, reflecting the increasing demand for specialized applications across various industries. These innovations enable manufacturers to create starches that meet specific requirements, such as improved solubility and enhanced stability under varying conditions. As industries continue to seek efficiency and quality, the Industrial Starch Market is likely to witness a shift towards more sophisticated processing techniques, enhancing the overall value proposition of starch products.