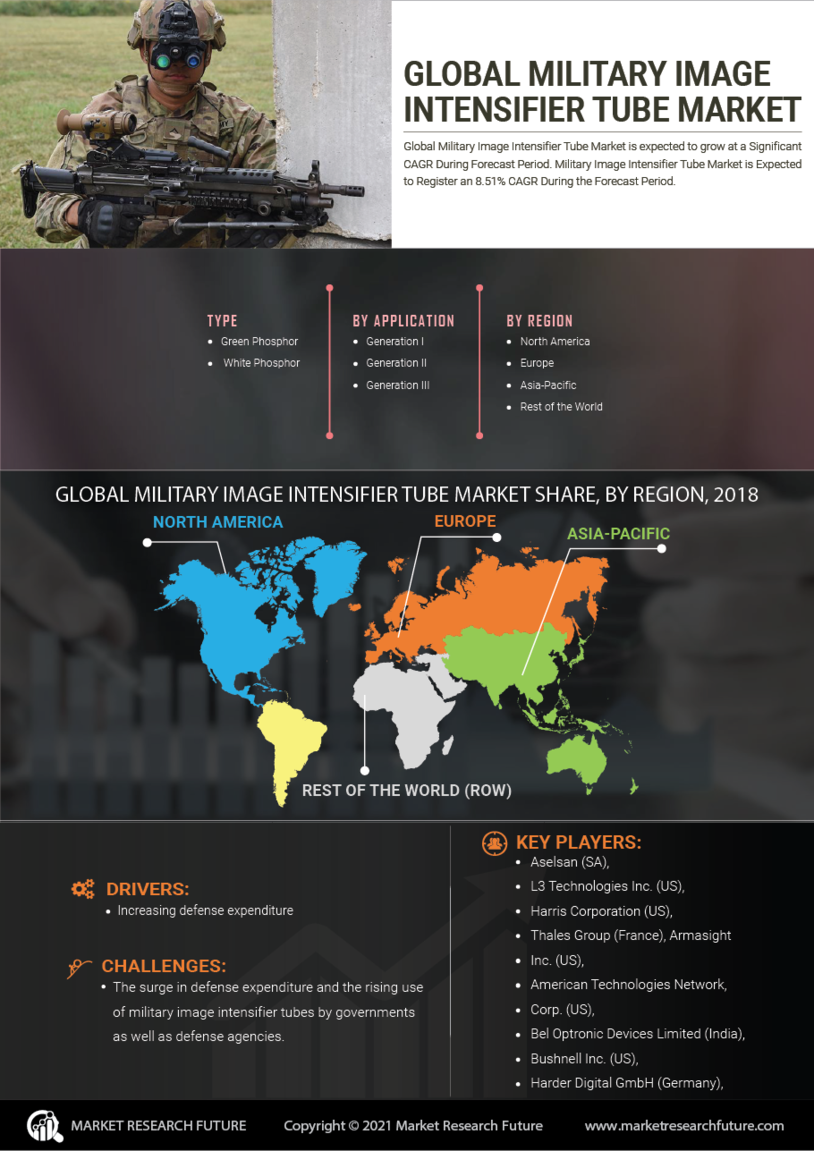

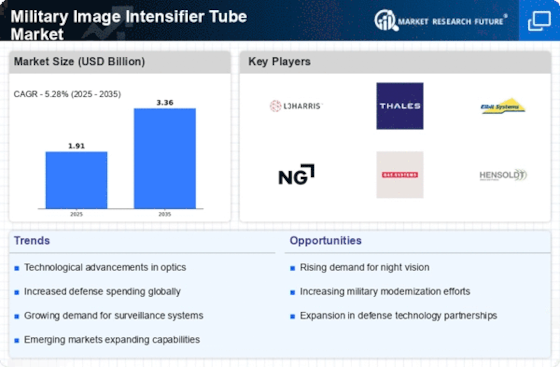

Increased Defense Spending

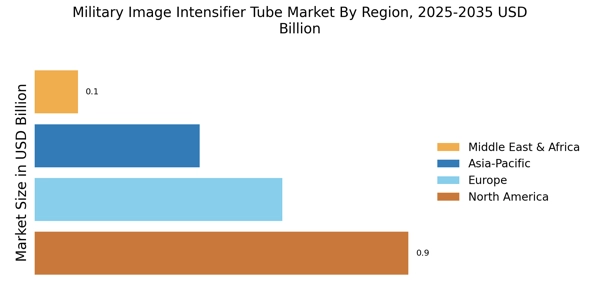

The military image intensifier Tube Market is poised for growth as nations increase their defense budgets. Recent reports indicate that several countries are allocating more resources to modernize their military capabilities, which includes upgrading night vision technologies. This increase in defense spending is particularly evident in regions with heightened security concerns, where governments prioritize investments in advanced military equipment. The demand for image intensifier tubes is likely to rise as military forces seek to enhance their operational readiness and effectiveness. Furthermore, the competitive landscape among nations to develop superior military technologies suggests that the Military Image Intensifier Tube Market will continue to expand, driven by the need for enhanced surveillance and reconnaissance capabilities.

Focus on Modernization Programs

The Military Image Intensifier Tube Market is significantly influenced by ongoing modernization programs within various armed forces. Many military organizations are actively pursuing initiatives to upgrade their existing equipment, which includes the integration of advanced image intensifier tubes. These modernization efforts are often driven by the need to replace outdated systems with more efficient and effective technologies. As a result, there is a growing demand for high-performance image intensifier tubes that can operate in challenging environments. The emphasis on modernization not only enhances the operational capabilities of military units but also ensures that they remain competitive on the global stage. This trend is expected to sustain the growth of the Military Image Intensifier Tube Market in the coming years.

Emerging Markets and Geopolitical Tensions

The Military Image Intensifier Tube Market is also influenced by emerging markets and geopolitical tensions. Countries in regions experiencing instability are increasingly investing in military capabilities to address security challenges. This trend is leading to a heightened demand for advanced military technologies, including image intensifier tubes. As nations seek to bolster their defense systems, the Military Image Intensifier Tube Market is expected to benefit from increased procurement activities. Furthermore, the competitive dynamics among nations to secure technological superiority may further stimulate growth in this sector. The interplay between geopolitical factors and military modernization efforts suggests a promising outlook for the Military Image Intensifier Tube Market.

Technological Advancements in Imaging Technology

The Military Image Intensifier Tube Market is experiencing a surge in demand due to rapid technological advancements. Innovations in image intensification technology, such as the development of Gen 3 and Gen 4 tubes, enhance night vision capabilities significantly. These advancements allow for improved resolution, sensitivity, and overall performance in low-light conditions. As military forces seek to maintain a tactical advantage, the integration of these advanced tubes into various platforms, including helmets and weapon sights, is becoming increasingly prevalent. The market is projected to grow as defense contractors invest in research and development to create next-generation systems that meet the evolving needs of armed forces. This trend indicates a robust future for the Military Image Intensifier Tube Market, driven by the necessity for superior operational effectiveness in diverse environments.

Rising Demand for Enhanced Surveillance Capabilities

The Military Image Intensifier Tube Market is witnessing a rising demand for enhanced surveillance capabilities. As military operations become increasingly complex, the need for effective reconnaissance and intelligence-gathering tools has never been more critical. Image intensifier tubes play a vital role in providing clear visibility in low-light conditions, which is essential for successful missions. The growing emphasis on situational awareness and threat detection is driving military forces to invest in advanced night vision technologies. This trend is likely to propel the Military Image Intensifier Tube Market forward, as armed forces seek to leverage these technologies to improve their operational effectiveness and decision-making processes.