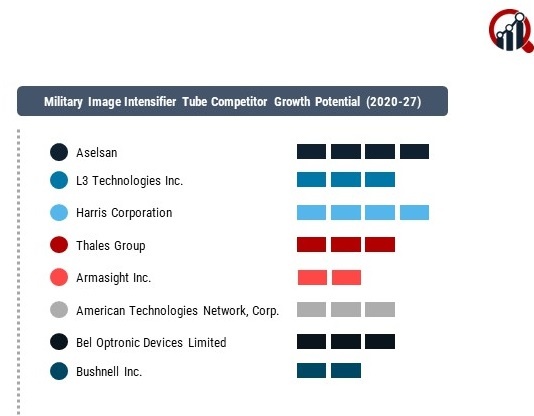

Top Industry Leaders in the Military Image Intensifier Tube Market

Companies Covered:

Aselsan (SA)

L3 Technologies Inc. (US)

Harris Corporation (US)

Thales Group (France)

Armasight Inc. (US)

American Technologies Network, Corp. (US)

Bel Optronic Devices Limited (India)

Bushnell Inc. (US)

Harder Digital GmbH (Germany)

JSC Katod (Russia)

New Con International Limited (Canada)

Night Owl Optics Inc. (US)

Photek Limited (UK)

Photonis Technologies (US)

Yukon Advanced Optics Worldwide Ltd (Lithuania)

Strategies Adopted

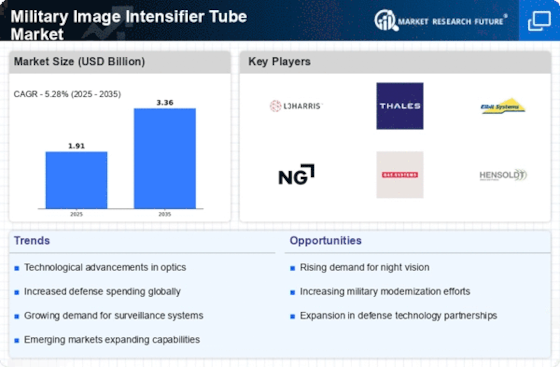

Industry news within the Military Image Intensifier Tube market reflects ongoing trends, regulatory changes, and technological advancements driving the sector forward. News related to successful tube demonstrations, military contracts for night vision systems, and advancements in image sensor technology showcase efforts to improve night vision capabilities and operational effectiveness. Moreover, developments in tube manufacturing techniques, such as wafer-scale processing and thin-film deposition, are frequently covered in industry news, highlighting the industry's commitment to enhancing tube performance and reliability. Additionally, news related to export controls, export restrictions, and international collaborations in night vision technology underscore the global nature of the military image intensifier tube market and the geopolitical factors influencing industry dynamics.

Current investment trends in the Military Image Intensifier Tube industry underscore a focus on research and development, manufacturing capabilities, and supply chain resilience. Key players are directing investments towards developing next-generation image intensifier tubes, optimizing production processes, and improving tube performance and reliability. Investments in advanced manufacturing technologies such as ion implantation, vacuum tube assembly, and quality control measures are prevalent, reflecting the industry's commitment to ensuring tube quality and performance. Additionally, strategic investments in regulatory compliance, export controls, and intellectual property protection aim to safeguard proprietary technologies and maintain market competitiveness.

Emerging Companies

As defense agencies prioritize enhancing night vision capabilities, new and emerging companies are entering the market, contributing to innovation and product development. Start-ups and specialized firms such as Photonis Technologies S.A.S., Harris Corporation, and Collins Aerospace are gaining recognition by providing novel image intensifier tube solutions tailored to specific military applications, such as reconnaissance, surveillance, and target acquisition. These companies leverage expertise in semiconductor technology, optoelectronics, and manufacturing processes to develop lightweight, compact, and high-performance image intensifier tubes with improved low-light sensitivity and reduced blooming effects. The industry is witnessing a trend towards the development of digital image intensifier tubes with integrated image processing algorithms, enabling enhanced image contrast, target recognition, and situational awareness in challenging operational environments.

The overall competitive scenario in the Military Image Intensifier Tube market is characterized by established manufacturers and innovative newcomers, each navigating the industry with distinct strategies. Market share analysis considers factors such as tube performance, reliability, lifecycle cost, and customer support. The industry's responsiveness to technological advancements, regulatory requirements, and defense procurement priorities further shapes competitiveness. As defense agencies continue to invest in enhancing night vision capabilities, companies in this sector are striving to balance innovation, reliability, and affordability to maintain a competitive edge in a dynamic and highly specialized market landscape.

Recent News

L3Harris Technologies (USA):

Focus on Enhanced Performance Tubes: L3Harris introduced the ENVG-B, a lightweight and compact Gen 3+ IIT offering improved resolution, sensitivity, and field of view for enhanced soldier performance.

Acquisition of Global Vision (GVI): This strategic move strengthens L3Harris' position in the commercial night vision market, potentially leading to technology transfer and cost reduction for military IITs.

Elbit Systems (Israel):

Emphasis on Uncooled Thermal Imaging: Elbit Systems develops advanced uncooled thermal imaging tubes for lightweight and cost-effective night vision solutions, complementing traditional IITs.

Partnership with Safran (France): Elbit collaborates with Safran on the development of next-generation IITs, combining expertise for enhanced capabilities and market reach.

Photonis (France):

Focus on Cost-Effective Solutions: Photonis caters to budget-conscious militaries with affordable Gen 2+ IITs, offering basic night vision capabilities for specific applications.

Increased Export Presence: Photonis expands its global presence through export deals, particularly in emerging markets with growing defense budgets.

JSC Katod (Russia):

Emphasis on Domestic Military Supply: Katod remains a key supplier of IITs for the Russian military, focusing on ruggedness, reliability, and cost-effectiveness for harsh operational environments.

Development of Gen 4 IITs: Katod invests in research and development of Gen 4 IITs, aiming to maintain technological competitiveness in the global market.

North American Night Vision (USA):

Focus on Niche Applications: North American Night Vision specializes in IITs for special forces and law enforcement, offering customized solutions for unique operational needs.

Emphasis on Innovation and Adaptability: North American Night Vision actively develops new technologies and adapts existing IITs for emerging applications, such as helmet-mounted displays and weapon sights.

Emerging Trends in Military IIT Companies:

Increased competition for Gen 3+ and Gen 4 IITs with enhanced performance.

Growing demand for uncooled thermal imaging as a cost-effective alternative.

Focus on miniaturization and integration with other soldier systems.

Emphasis on cybersecurity and counter-counterfeiting measures.

Exploration of augmented reality and artificial intelligence integration in IITs.