Rising Geopolitical Tensions

The US Military Image Intensifier Tube Market is also shaped by rising geopolitical tensions that necessitate enhanced military readiness. As global conflicts and security threats evolve, the demand for advanced surveillance and reconnaissance capabilities has intensified. Image intensifier tubes play a critical role in providing situational awareness during operations, particularly in hostile environments. The US military's focus on maintaining operational superiority has led to increased investments in night vision technologies, including image intensifier tubes. This trend suggests that as geopolitical tensions persist, the US Military Image Intensifier Tube Market will likely experience continued growth, driven by the need for effective and reliable night vision solutions.

Government Funding and Defense Budgets

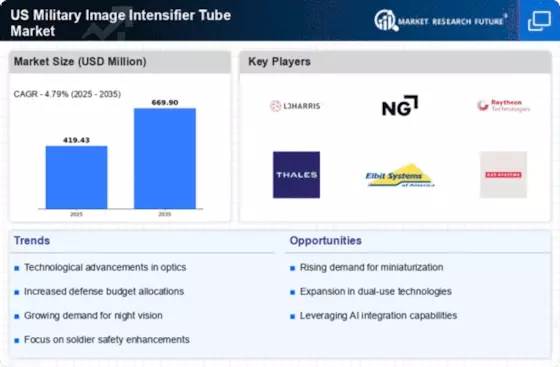

The US Military Image Intensifier Tube Market is significantly influenced by government funding and defense budgets allocated for modernization and procurement of military equipment. The US government has consistently prioritized investments in advanced technologies, including image intensifier tubes, to maintain a competitive edge in global military capabilities. Recent budget proposals indicate an increase in funding for research and development of night vision technologies, which directly impacts the growth of the image intensifier tube market. This financial support is crucial for manufacturers to innovate and enhance their product lines, ensuring that military personnel have access to the latest advancements. As defense budgets continue to expand, the US Military Image Intensifier Tube Market is poised for sustained growth.

Strategic Collaborations and Partnerships

The US Military Image Intensifier Tube Market is benefiting from strategic collaborations and partnerships between defense contractors and technology firms. These alliances are aimed at developing next-generation image intensifier tubes that meet the rigorous demands of modern warfare. For instance, partnerships between established defense manufacturers and innovative tech startups are fostering the creation of advanced night vision systems that incorporate artificial intelligence and machine learning. Such collaborations not only enhance product offerings but also streamline the development process, allowing for quicker deployment of new technologies. The trend of strategic partnerships is likely to continue, further propelling the growth of the US Military Image Intensifier Tube Market as stakeholders seek to leverage each other's strengths.

Increased Demand for Night Vision Capabilities

The US Military Image Intensifier Tube Market is witnessing an increased demand for night vision capabilities among military forces. As military operations often occur in low-light or nighttime environments, the necessity for effective night vision systems has become paramount. The US Department of Defense has allocated substantial budgets for upgrading existing night vision equipment, which includes image intensifier tubes. Recent reports suggest that the market for night vision devices is expected to reach several billion dollars by the end of the decade, reflecting a growing emphasis on enhancing operational effectiveness. This heightened demand is likely to drive innovation and investment in the US Military Image Intensifier Tube Market, as manufacturers strive to meet the evolving needs of military personnel.

Technological Advancements in Image Intensification

The US Military Image Intensifier Tube Market is experiencing a surge in technological advancements that enhance the performance and capabilities of image intensifier tubes. Innovations such as improved photocathode materials and advanced microchannel plate designs are leading to higher resolution and sensitivity in low-light conditions. The integration of digital technologies with traditional image intensification systems is also becoming prevalent, allowing for better image processing and data integration. According to recent data, the market for advanced night vision systems, which includes image intensifier tubes, is projected to grow significantly, driven by the need for superior situational awareness in military operations. This trend indicates a robust demand for cutting-edge technologies within the US Military Image Intensifier Tube Market.