Research Methodology on Image Intensifier Tube Market

Introduction

Market research methodology is a process of collecting, recording, analyzing and interpreting data in order to answer questions posed for a certain study. It is a systematic way of collecting and processing data needed to validate research hypotheses. This document provides the research methodology used for the market research report titled Global Image Intensifier Tube Market Research Report by Application (Medical, Defense & Aerospace, Industrial, Security & Surveillance, and Others), by Region Forecast to 2030 available at https://www.marketresearchfuture.com/reports/image-intensifier-tube-market-7684.

Systematic Research Approach

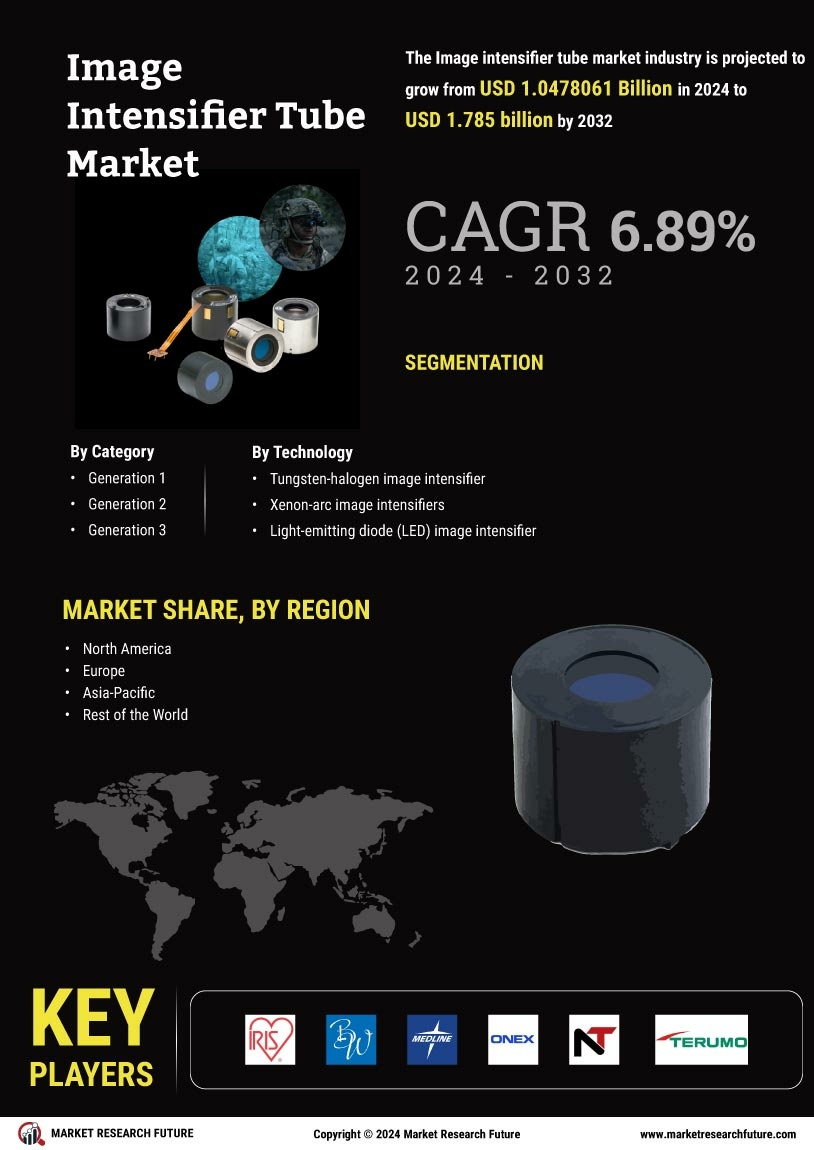

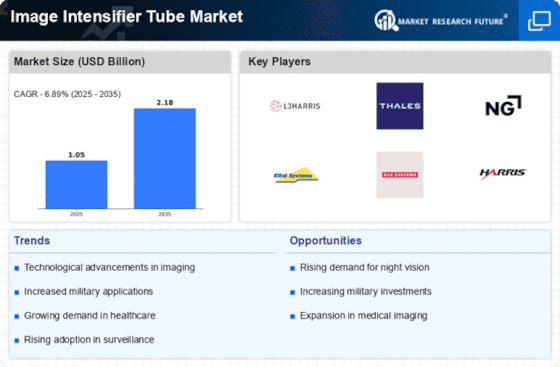

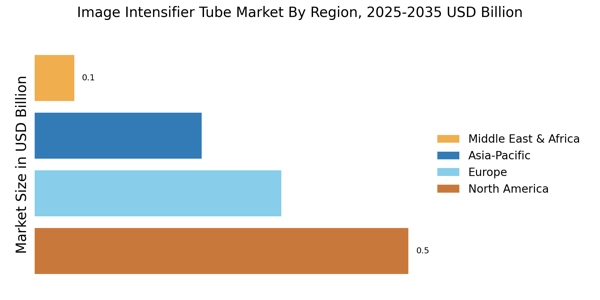

Market Research Future (MRFR) has designed a systematic research approach in order to accurately forecast the market outlook for the global image intensifier tube market by application (medical, defence & aerospace, industrial, security & surveillance, and others) and by region (North America, Europe, Asia Pacific, and Rest of the World) for a period of 7 years from 2023 to 2030. Research is conducted to first identify the key trends, insights, recent developments and other potential areas of investigation in the global market. These pieces of information are then used to form the basis of the research design which was used to answer the research questions posed.

Secondary Research

The secondary research was conducted using various sources such as company websites, company annual reports, industry reports, published market research reports, journals, books, government sources, and other well-known sources. The sources provide detailed information about the image intensifier tube market in terms of market size and market dynamics concerning application and region. The information gathered through secondary research was used to draw an understanding of the existing market size and related findings.

Primary Research

The primary research was conducted to select a sample size that conforms to the industry standards. With the help of a questionnaire, the collected responses from respondents were converted to quantitative data and correlated to the industry and market segments. Some of the major industry players in the image intensifier tube market have been surveyed.

Data Collection, Validation, and Analysis

Data is collected for the market size estimation for the global image intensifier tube market. Data is collected with the help of primary research and secondary research. The collected data was validated with the help of extensive data triangulation. Responses to the primary research survey were analysed with the help of descriptive statistical analysis. With the help of SPSS and Excel software, the data was analysed. The collected data was analysed and presented in tabulated form, graphical form and in a form of infographics.

The collected data was then validated with the help of the triangulation method by comparing the same data coming from two different sources. The triangulation method also enables the comparison of the market dynamics which includes the market size, key trends, market dynamics, market segmentation, market trends, and the projected expected demand for image intensifier tubes by application and region. After the triangulation method, a thorough analysis was done with the help of Porter's Five Forces Analysis.

Market Estimation and Forecasting

After the above-mentioned activities, Market Research Future estimates the market size and makes the forecast for the global image intensifier tube market for a period of 7 years from 2023 to 2030. The forecast presented in the market report consists of the current market size and associated projections. The forecast is done with the help of bottom-up and top-down approaches. The bottom-up approach is used to calculate the total sales of image intensifier tubes by application and region at the global level. The top-down approach is used to estimate the region-wise market size after allotting the splits to different regions.

Conclusion

The research methodology applied by MRFR for the research report on the global image intensifier tube was a comprehensive and methodical process which included the data collection, validation, analysis and forecasting of the market size for the image intensifier tube market by application and by region. The response to the primary research survey was analysed with the help of descriptive statistical analysis for the estimation of the market size and projections for the period of 7 years from 2023 to 2030.