Growing Health Consciousness

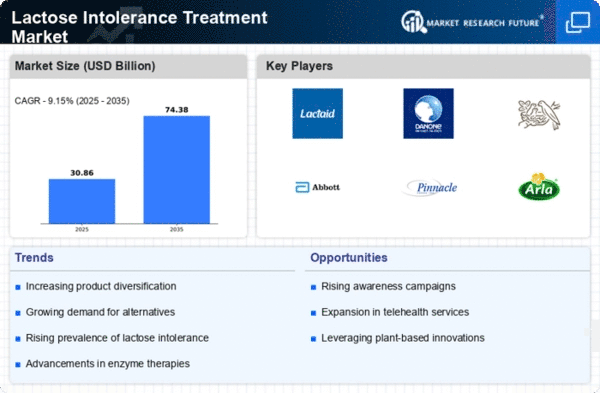

A surge in health consciousness among consumers significantly influences the Global Lactose Intolerance Treatment Market Industry. Individuals are increasingly prioritizing their dietary choices, leading to a demand for lactose-free products and treatments. This trend is particularly evident in developed regions, where consumers are more informed about dietary restrictions and their implications on health. As a result, the market is expected to experience a compound annual growth rate of 6.58% from 2025 to 2035, with projections indicating a market size of 34.8 USD Billion by 2035. This shift underscores the importance of lactose intolerance management in contemporary dietary practices.

Innovations in Lactose-Free Products

Innovations in lactose-free products are reshaping the Global Lactose Intolerance Treatment Market Industry. Manufacturers are increasingly developing a variety of lactose-free dairy products, such as milk, cheese, and yogurt, catering to the diverse preferences of lactose-intolerant consumers. These innovations not only enhance product availability but also improve taste and nutritional value, making lactose-free options more appealing. The introduction of fortified lactose-free products further supports the market's growth, as consumers seek alternatives that align with their health goals. This trend is likely to sustain the market's expansion in the coming years.

Rising Demand for Personalized Nutrition

The rising demand for personalized nutrition is influencing the Global Lactose Intolerance Treatment Market Industry. Consumers are increasingly seeking tailored dietary solutions that address their specific health needs, including lactose intolerance. This trend is prompting manufacturers to develop customized lactose-free products and treatments that cater to individual preferences and dietary restrictions. As personalized nutrition gains traction, the market is likely to see a surge in innovative offerings that align with consumer demands. This shift towards individualized dietary solutions may further enhance the market's growth trajectory in the coming years.

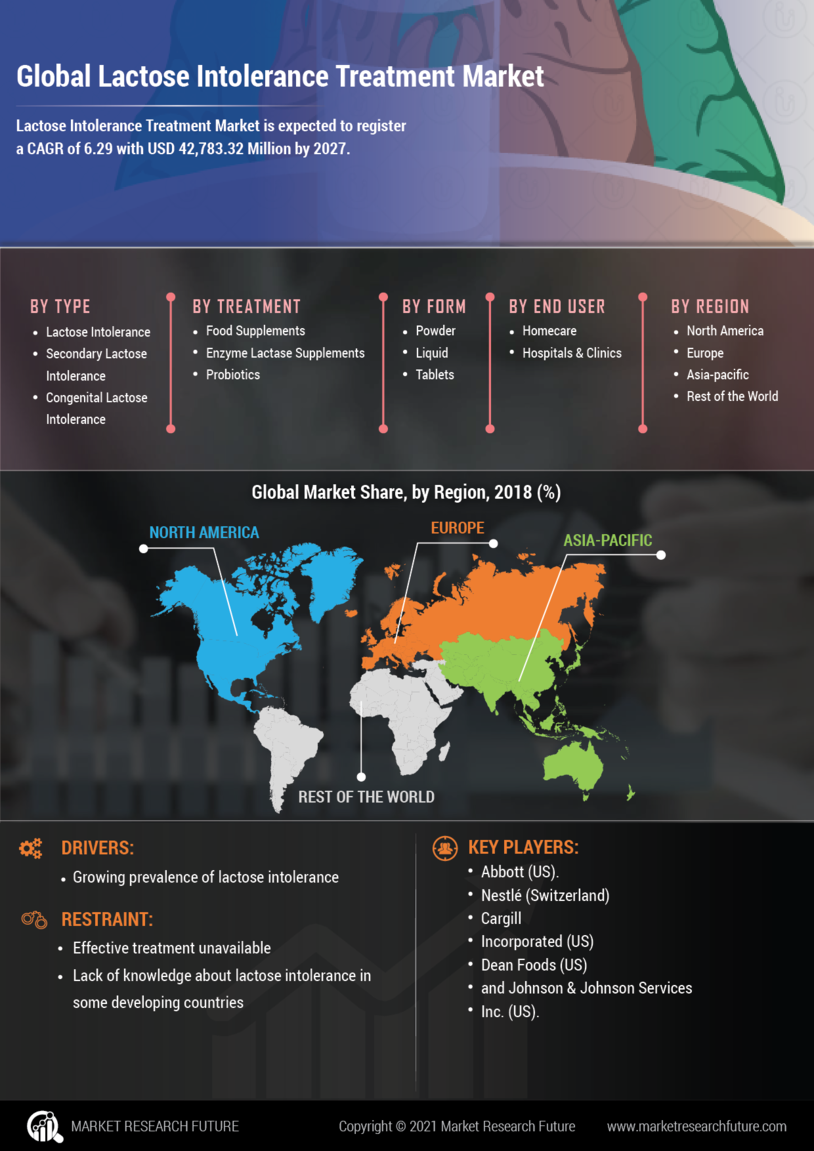

Rising Prevalence of Lactose Intolerance

The increasing prevalence of lactose intolerance globally drives the Global Lactose Intolerance Treatment Market Industry. Approximately 68% of the world's population experiences some form of lactose malabsorption, with higher rates observed in certain ethnic groups. This growing awareness of lactose intolerance leads to a heightened demand for treatment options, including lactase supplements and lactose-free products. As more individuals seek solutions to manage their symptoms, the market is projected to reach 17.3 USD Billion in 2024, reflecting a significant shift in consumer behavior towards lactose-free alternatives.

Increased Availability of Lactase Supplements

The increased availability of lactase supplements is a key driver in the Global Lactose Intolerance Treatment Market Industry. These supplements provide a convenient solution for individuals who wish to enjoy dairy products without experiencing discomfort. As awareness of lactose intolerance grows, more consumers are turning to lactase supplements as a proactive measure. Pharmacies and health food stores are expanding their offerings, making these products more accessible. This trend is anticipated to contribute to the market's growth, as consumers increasingly seek effective solutions to manage their lactose intolerance symptoms.