Lactose Intolerance Treatment Size

Lactose Intolerance Treatment Market Growth Projections and Opportunities

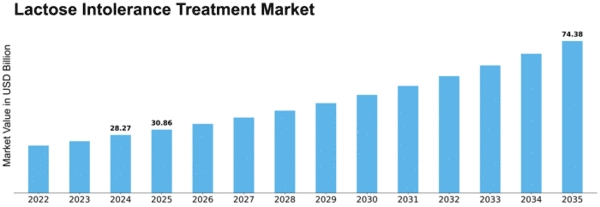

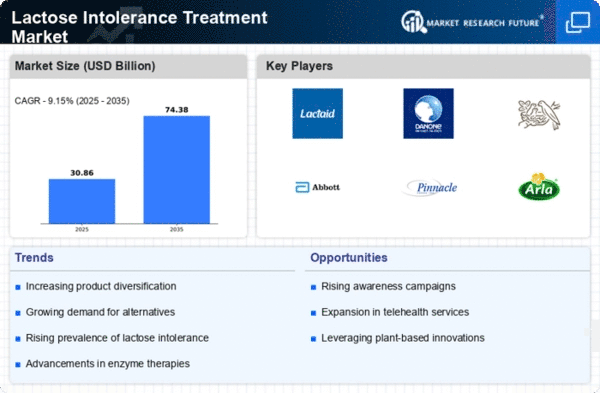

The global market for lactose intolerance treatment is expected to reach USD 26.12 billion during the forecast period from 2022-2030, with a CAGR of approximately 5.9%. Several factors collectively influence the dynamics and growth of the lactose intolerance treatment market. The main driver here is the high prevalence of lactose intolerance, a common digestive disorder characterized by the inability to digest lactose – milk sugar. Technological advancements significantly shape the landscape of lactose intolerance treatment. Constant innovation in lactase supplements, diagnosis tools, and improved production technologies for lactose-free foods make treatment more convenient and accessible. Moreover, advanced investigations carried out in the digestion health sector contribute to a better comprehension of mechanisms underlying lactase deficiency, leading to the refinement of targeted interventions. Economic factors such as healthcare spending and consumer purchasing power also affect market dynamics. This economy-based factor determines whether it would be feasible financially to absorb treatments for lactose intolerance within normal dietary practices. Additionally, geographical variations contribute to shaping this market since different regions face varied challenges in terms of dietary practices related to lactose intolerance. For instance, cultural dietary patterns and levels of awareness about lactase deficiency vary from one region to another, therefore influencing the type or mode of intervention required to address these needs. Despite all these factors, the competitive nature contributes to increased innovations in this sector as well as the expansion of markets in relation to addressing issues related to the lack of enzymes causing intolerant behavior towards the consumption of milk, among others. Furthermore, awareness drives development, although not as central as economic aspects have been too far-reaching. Initiatives have been made to avoid ignorance regarding who knows what. As knowledge of both symptoms and remedies continues to be absorbed by people, the majority will then seek appropriate medical approaches, which will eventually reflect upon their diets later on. In fact, education programs, including campaigns aimed at building confidence in safety and efficacy in dealing with lactase insufficiency, have provided room for trustworthiness in incorporating these interventions into the lives of lactose-intolerant people.

Leave a Comment