Innovation in Product Development

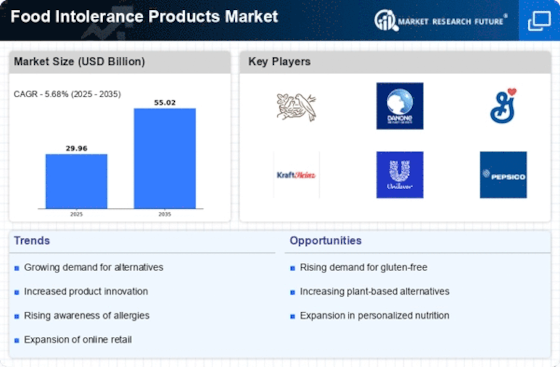

Innovation plays a crucial role in shaping the Food Intolerance Products Market. Companies are increasingly investing in research and development to create new formulations that cater to various food intolerances. This includes the development of alternative ingredients that mimic the taste and texture of traditional foods while being free from allergens. For instance, the introduction of innovative dairy substitutes and gluten-free grains has gained traction among consumers. Market data indicates that the demand for innovative food products is expected to grow by 15% annually, reflecting a shift towards more inclusive dietary options. As a result, the Food Intolerance Products Market is likely to witness a surge in new product launches, enhancing consumer choice and satisfaction.

Growing Awareness of Food Intolerances

The increasing awareness of food intolerances among consumers is a pivotal driver for the Food Intolerance Products Market. As individuals become more informed about the potential health impacts of certain foods, they are actively seeking alternatives that cater to their dietary restrictions. This trend is reflected in the rising demand for gluten-free, lactose-free, and nut-free products. According to recent surveys, approximately 20% of the population reports some form of food intolerance, which has led to a substantial increase in product offerings. Consequently, manufacturers are innovating to create diverse options that meet these needs, thereby expanding their market reach. The Food Intolerance Products Market is thus experiencing a transformation, as brands strive to educate consumers and provide solutions that align with their health-conscious choices.

Rise in Health-Conscious Consumer Behavior

The rise in health-conscious consumer behavior is significantly influencing the Food Intolerance Products Market. As more individuals prioritize their health and well-being, they are increasingly scrutinizing food labels and seeking products that align with their dietary preferences. This trend is particularly evident among millennials and Generation Z, who are more likely to adopt diets that exclude certain allergens. Market Research Future suggests that the health and wellness food segment is projected to grow by 10% over the next five years, driven by this demographic's preferences. Consequently, brands are adapting their marketing strategies to highlight the health benefits of their food intolerance products, thereby capturing the attention of a more discerning consumer base.

Increased Availability of Specialty Retailers

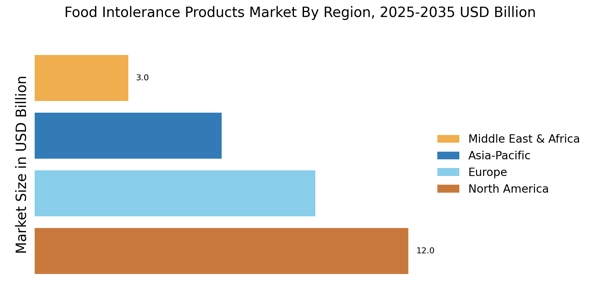

The increased availability of specialty retailers is a notable driver for the Food Intolerance Products Market. As consumer demand for food intolerance products rises, retailers are expanding their offerings to include dedicated sections for gluten-free, dairy-free, and other allergen-free products. This trend is not only enhancing accessibility for consumers but also fostering a more inclusive shopping experience. Data indicates that specialty food stores have seen a 25% increase in sales of food intolerance products over the past year, reflecting a growing market segment. As these retailers continue to emerge, the Food Intolerance Products Market is likely to benefit from enhanced visibility and consumer engagement, ultimately driving sales and brand loyalty.

Regulatory Support for Allergen-Free Products

Regulatory support for allergen-free products is emerging as a significant driver in the Food Intolerance Products Market. Governments are increasingly recognizing the importance of food safety and labeling, leading to stricter regulations that promote transparency in food production. This regulatory environment encourages manufacturers to develop and market products that are free from common allergens, thereby catering to the needs of consumers with food intolerances. Recent legislation has mandated clearer labeling practices, which has resulted in a more informed consumer base. As a consequence, the Food Intolerance Products Market is likely to experience growth as brands comply with these regulations and consumers feel more confident in their purchasing decisions.