Market Share

Lactose Intolerance Treatment Market Share Analysis

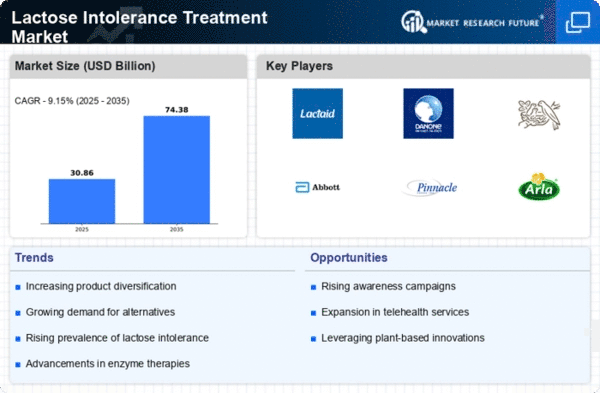

To maintain and enhance their market share, players in the lactose intolerance treatment market employ different strategies. Differentiation is seen as a major strategy where each company strives to develop sophisticated and improved products for lactase deficiency. Such alternative treatments may include newly developed enzyme supplements, dietary solutions, and probiotics that help in digestion and minimize symptoms caused by lactose intolerance. Cost leadership continues to play an important role within the Lactose Intolerance Treatment Market. This way, companies will be able to optimize their manufacturing processes, hence reducing costs incurred during production while making cost-effective therapies for patients with lactose intolerance. Niche positioning could be observed as many players are serving specific categories of patients within this industry niche. While adapting their lactose intolerance treatments to suit regional diets, health needs, and regulations, geographical positioning is an important strategic consideration. An understanding of local healthcare ecosystems and adherence of products to regional guidelines facilitates effective market penetration. The Lactose Intolerance Treatment Market also heavily relies on collaboration and partnerships, which enable the companies to join hands in order to improve their abilities as well as the expansion of their markets. Collaboration may also include working with physicians, nutritionists, or other organizations specializing in digestion health to develop and validate new lactose intolerance therapies together. By combining strengths and resources, firms can foster innovation, enlarge their product portfolios, and gain a more solid grip on ongoing transformation in the field of digestive wellbeing. Mergers and acquisitions are strategic moves that shape the competitive landscape of the Lactose Intolerance Treatment Market. Acquisitions enable companies to access complementary technologies, expand their IP portfolio, or reinforce their position as leading providers of lactose intolerance treatment approaches. Continuous innovation is a key driver behind the lactose intolerance treatment market; thus, research on new enzyme formulations for dietary supplements and companies undertake personalized treatment measures. Being at par with technological advancements enables them to respond better to changing challenges regarding digestive health conditions alongside regulatory requirements besides market trends. Companies also gain a reputation among stakeholders by adhering to this kind of strategy, which ensures that they remain relevant within lactase-intolerant populations.

Leave a Comment