Research Methodology on Knitwear Market

Introduction

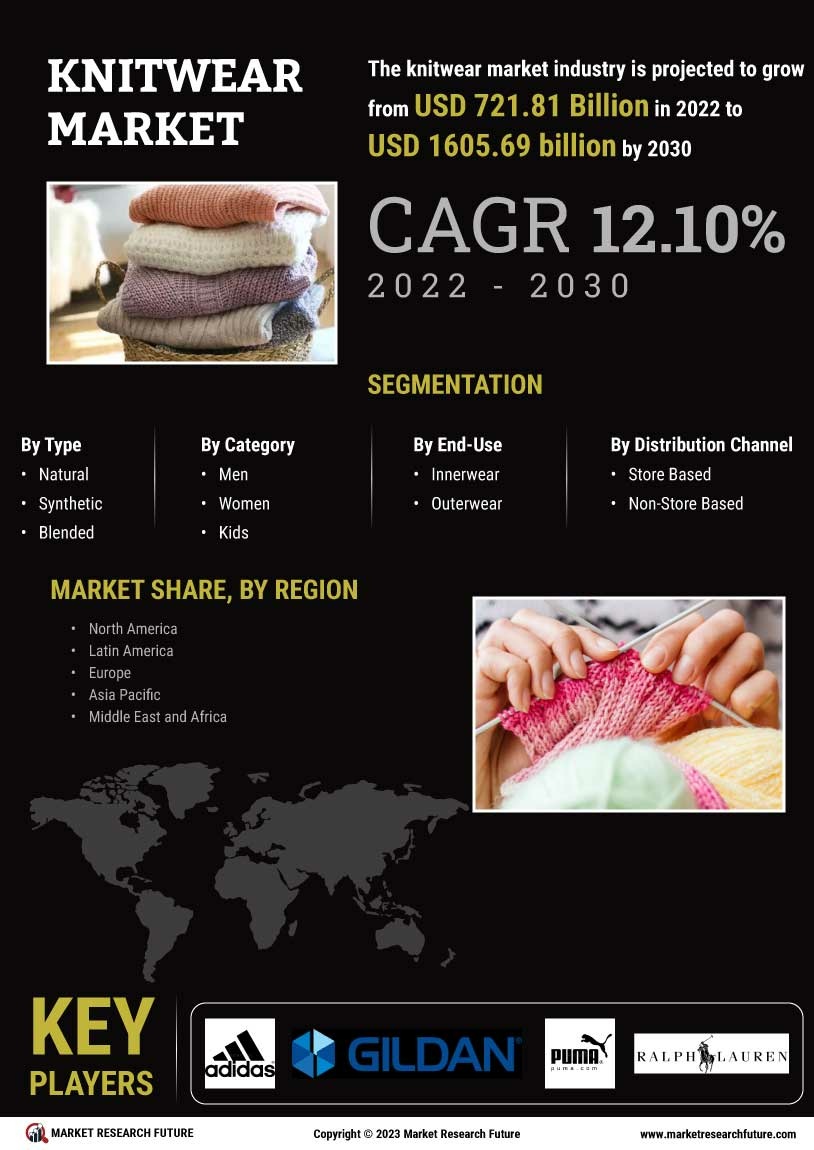

MarketResearchFuture.com (MRFR) presents its latest comprehensive research report on the global knitwear market in which it has analyzed the market dynamics and data of the historical period from 2017 to 2022 and estimated the statistics for the forecast period from 2023 to 2030.

Research Methodology

This research looks at knitwear, its associated products, and services in the forecast period to provide insight into the current and future trends in the industry. The research methodology used for this report is a combination of primary and secondary research.

Primary Research:

The primary research for the report formed the basis of the project, to provide the most up-to-date analysis of the knitwear market. To achieve this, MRFR conducted interviews and surveys with manufacturers, distributors, and retailers in the knitwear industry, as well as with industry experts. Interviews were conducted and analysed to gain insights into the market landscape, competitive landscape, and current trends in the knitwear industry.

Secondary Research:

The secondary research enables us to gain insights into the current and past trends occurring in the knitwear market. The information obtained was further used to assess the current market size and revenue. Various sources have been used to develop the secondary research, such as online databases and reports, press releases, and company websites.

Data Collection:

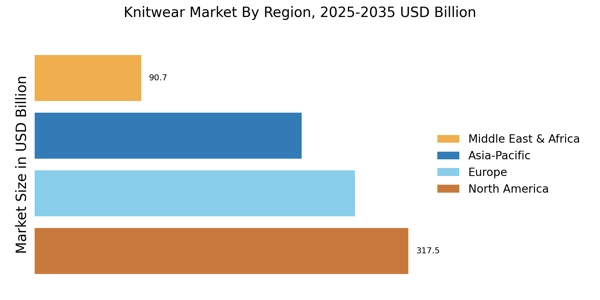

The data collection process includes the global and regional market size of the knitwear industry, technological advancements and other developments. MRFR also looked into the market opportunity, demand and supply drivers, and Porter’s five forces to better understand the product landscape of the knitwear industry. Furthermore, data is collected from industry experts and market players to further supplement the research work. Extensive data analysis is done on all the collected data to draw meaningful inferences from the information.

Data Analysis:

The data analysis is done through various methods, including qualitative and quantitative analysis. These methods are used to analyse the collected data and understand the situation of the knitwear market. The data analysis is performed to understand the current size and forecast growth of the market.

Report Writing:

Finally, the collected and analysed data is used to draft the report. The report is drafted based on the findings of the research and analysis. The report contains market forecasts, analysis, and insights for the forecast period from 2023 to 2030. The report also provides an in-depth examination of the market drivers, restraints, growth prospects, supply-demand analysis, and market trends.

Conclusion:

The research report provides a detailed analysis and understanding of the global knitwear market. The report covers the past, present, and future trends of the industry and provides insight into the current and future market scenarios. The research methodology used for this report is a combination of primary and secondary research. Qualitative and quantitative analysis approaches are used to analyse the collected data. The report also contains an in-depth examination of the market drivers, restraints, growth prospects, supply-demand analysis, and market trends. The report also provides the market forecast, analysis, and insights for the forecast period from 2023 to 2030.