North America : Market Leader in Sports Nutrition Market

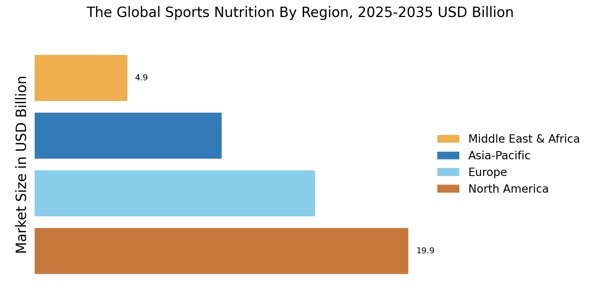

North America is the largest market for sports nutrition, holding approximately 40% of the global share. The region's growth is driven by increasing health consciousness, rising participation in fitness activities, and a growing trend towards protein-rich diets. Regulatory support for health supplements and a robust distribution network further catalyze Sports Nutrition Market expansion. The North America sports nutrition market leads globally due to high consumer awareness, advanced distribution networks, and strong brand presence.

The United States is the primary contributor, with Canada following as the second-largest Sports Nutrition Market. The US sports nutrition market dominates regional demand, driven by widespread gym culture and product innovation. The Canada sports nutrition market is expanding steadily, supported by increasing health consciousness and regulatory support. Key players like GNC Holdings and Herbalife dominate the landscape, offering a wide range of products. The competitive environment is characterized by innovation and aggressive marketing strategies, ensuring a diverse product offering to meet consumer demands.

Europe : Emerging Market with Growth Potential

Europe is witnessing significant growth in the sports nutrition market, accounting for around 30% of the global share. Factors such as increasing awareness of fitness and wellness, along with a rise in sports participation, are driving demand. Regulatory frameworks in the EU promote transparency and safety in nutritional products, enhancing consumer trust and Sports Nutrition Market growth. The Europe sports nutrition market is growing as consumers adopt fitness-oriented lifestyles and clean-label nutrition products. The Germany sports nutrition market is supported by a strong fitness culture and demand for scientifically backed nutrition products.

Growth in the sports nutrition market Europe is supported by innovation, sustainability initiatives, and rising sports participation. The Europe sports nutrition market outlook remains positive, with strong growth anticipated across Germany, France, and the UK. The UK sports nutrition market benefits from increasing adoption of protein-rich diets and functional beverages. The France sports nutrition market is driven by rising wellness awareness and demand for premium nutrition products. Leading countries include Germany, the UK, and France, with a competitive landscape featuring major players like GlaxoSmithKline and Nestle. The Sports Nutrition Marketis characterized by a mix of established brands and emerging startups, focusing on innovative formulations and sustainable practices. The presence of diverse distribution channels further supports market accessibility.

Asia-Pacific : Rapid Growth and Innovation Hub

Asia-Pacific is rapidly emerging as a key player in The Global Sports Nutrition Market, holding approximately 20% of the Sports Nutrition Marketshare. The region's growth is fueled by rising disposable incomes, increasing health awareness, and a growing youth population engaged in fitness activities. Regulatory bodies are also becoming more supportive, ensuring product safety and quality.

Countries like China, Japan, and Australia are leading the charge, with a competitive landscape that includes both local and international brands. The China sports nutrition market is witnessing rapid growth due to rising disposable incomes and increasing fitness awareness. The India sports nutrition market is expanding rapidly as urbanization and youth participation in fitness activities increase. Growth in the sports nutrition market in India is supported by evolving dietary habits and greater exposure to organized fitness programs. Key players such as Abbott Laboratories and PepsiCo are expanding their presence, focusing on innovative products tailored to regional tastes. The Sports Nutrition Marketis characterized by a shift towards plant-based and organic options, reflecting changing consumer preferences.

Middle East and Africa : Emerging Market with Unique Challenges

The Middle East and Africa region is gradually developing its sports nutrition market, currently holding about 10% of the global share. The growth is driven by increasing urbanization, a rise in health consciousness, and a growing interest in fitness among the youth. However, regulatory challenges and Sports Nutrition Marketfragmentation pose hurdles to rapid expansion.

Leading countries include South Africa and the UAE, where the market is characterized by a mix of local and international brands. Key players are beginning to establish a foothold, focusing on tailored products that cater to regional preferences. The competitive landscape is evolving, with an increasing emphasis on quality and safety standards to meet consumer expectations.