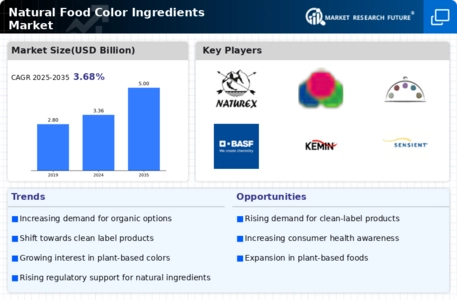

Rising Demand for Organic Products

The Natural Food Color Ingredients Market is significantly influenced by the rising demand for organic products. As consumers increasingly seek organic food options, the need for natural food color ingredients that align with organic standards is becoming more pronounced. This trend is supported by market data indicating that the organic food sector is expected to grow at a rate of 10% annually. Consequently, food manufacturers are compelled to source natural colorants that meet organic certification requirements, thereby driving the growth of the natural food color ingredients market. This alignment with organic trends is likely to enhance the market's appeal and broaden its consumer base.

Innovation in Extraction Technologies

The Natural Food Color Ingredients Market is witnessing significant advancements in extraction technologies, which are enhancing the efficiency and quality of natural colorants. Innovations such as cold extraction and supercritical fluid extraction are enabling manufacturers to obtain high-quality pigments from plant sources with minimal degradation. This technological progress not only improves the yield of natural food color ingredients but also expands the range of available colors, catering to diverse consumer preferences. Market analysis suggests that these innovations could lead to a 15% reduction in production costs, thereby making natural colorants more accessible to food manufacturers and potentially increasing their market share.

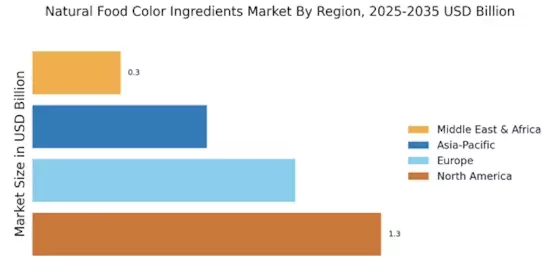

Expansion of the Food and Beverage Sector

The Natural Food Color Ingredients Market is benefiting from the expansion of the food and beverage sector, which is increasingly incorporating natural colorants into their products. As the industry evolves, there is a growing emphasis on product differentiation, with manufacturers seeking to enhance visual appeal through the use of vibrant natural colors. This trend is reflected in market data, which shows that the food and beverage sector is projected to grow by 5% annually. This expansion is likely to create new opportunities for natural food color ingredients, as companies strive to meet consumer expectations for visually appealing and health-conscious products.

Regulatory Support for Natural Ingredients

The Natural Food Color Ingredients Market is bolstered by favorable regulatory frameworks that promote the use of natural ingredients in food products. Various food safety authorities are increasingly endorsing natural colorants as safer alternatives to synthetic dyes. This regulatory support not only encourages manufacturers to adopt natural food color ingredients but also instills consumer confidence in the safety and quality of food products. As a result, the market is likely to witness a steady increase in the adoption of natural colorants, with projections indicating a potential market value exceeding USD 2 billion by 2027. This regulatory landscape is pivotal in shaping the future of the industry.

Growing Consumer Awareness of Health Benefits

The Natural Food Color Ingredients Market is experiencing a surge in consumer awareness regarding the health benefits associated with natural colorants. As consumers become increasingly informed about the potential health risks of synthetic additives, they are gravitating towards products that utilize natural ingredients. This shift is reflected in market data, which indicates that the demand for natural food colors is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years. This trend suggests that manufacturers are likely to invest more in natural food color ingredients to meet consumer preferences, thereby enhancing their product offerings and market competitiveness.