Stringent Regulatory Frameworks

The regulatory landscape in India is evolving, with authorities implementing stringent guidelines for viral clearance in the production of biological products. Regulatory bodies, such as the Central Drugs Standard Control Organization (CDSCO), emphasize the necessity of robust viral clearance validation to ensure the safety of therapeutic products. Compliance with these regulations is not merely a legal obligation but also a market differentiator. Companies that adhere to these guidelines are likely to gain a competitive edge, as they can assure stakeholders of their commitment to safety and quality. This regulatory pressure is driving investments in advanced viral clearance technologies, thereby stimulating growth in the viral clearance market. As the industry adapts to these evolving standards, the demand for effective viral clearance solutions is expected to rise, further solidifying the market's importance.

Growing Awareness of Product Safety

There is a growing awareness among consumers and healthcare professionals regarding the importance of product safety, particularly in the context of biopharmaceuticals. This heightened awareness is influencing purchasing decisions and driving demand for products that meet rigorous safety standards. As a result, manufacturers are increasingly prioritizing viral clearance processes to ensure their products are free from viral contaminants. This trend is particularly evident in the viral clearance market, where companies are investing in advanced technologies and methodologies to enhance their safety profiles. The emphasis on product safety is not only a response to consumer demand but also a proactive approach to mitigate potential risks associated with viral contamination, thereby fostering trust in biopharmaceutical products.

Rising Demand for Biopharmaceuticals

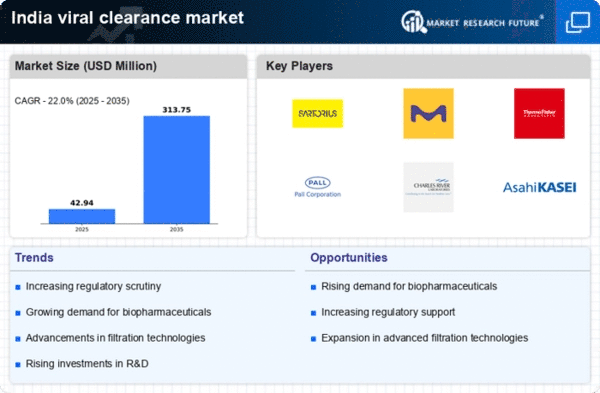

The increasing demand for biopharmaceuticals in India is a key driver for the viral clearance market. As the biopharmaceutical sector expands, the need for effective viral clearance methods becomes paramount to ensure product safety and efficacy. The market for biopharmaceuticals in India is projected to reach approximately $100 billion by 2025, indicating a robust growth trajectory. This surge necessitates advanced viral clearance technologies to meet regulatory standards and consumer expectations. Consequently, companies are investing in innovative solutions to enhance their viral clearance processes, thereby propelling the viral clearance market forward. The focus on patient safety and product integrity further underscores the importance of viral clearance in the biopharmaceutical manufacturing process, making it a critical component of the industry landscape.

Investment in Healthcare Infrastructure

The Indian government is making substantial investments in healthcare infrastructure, which is likely to impact the viral clearance market positively. Enhanced healthcare facilities and increased funding for research and development are creating an environment conducive to the growth of the biopharmaceutical sector. As healthcare infrastructure improves, the demand for high-quality biopharmaceutical products is expected to rise, necessitating effective viral clearance solutions. This investment trend is indicative of a broader commitment to improving public health outcomes, which in turn drives the need for stringent viral clearance measures. Consequently, the viral clearance market is poised for growth as manufacturers seek to align with the evolving healthcare landscape and meet the increasing demand for safe and effective biopharmaceuticals.

Technological Innovations in Viral Clearance

Technological advancements play a pivotal role in shaping the viral clearance market in India. Innovations such as improved filtration techniques, chromatography methods, and viral inactivation processes are enhancing the efficiency and effectiveness of viral clearance. These technologies not only reduce the risk of viral contamination but also optimize production processes, leading to cost savings for manufacturers. The introduction of automated systems and real-time monitoring tools is further streamlining operations, allowing for quicker response times and improved compliance with regulatory standards. As the industry embraces these technological innovations, the viral clearance market is likely to experience significant growth, driven by the need for safer and more efficient biopharmaceutical production.