Rising Demand for Lightweight Materials

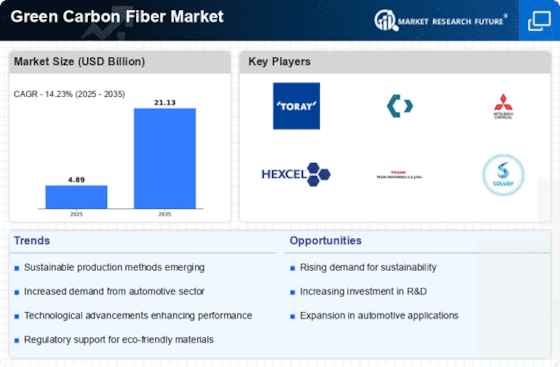

The Green Carbon Fiber Market is experiencing a notable surge in demand for lightweight materials across various sectors, particularly in automotive and aerospace. As manufacturers strive to enhance fuel efficiency and reduce emissions, the adoption of lightweight materials becomes paramount. Green carbon fiber, known for its high strength-to-weight ratio, is increasingly favored for its potential to significantly lower vehicle weight, thereby improving fuel economy. Reports indicate that the automotive sector alone is projected to witness a compound annual growth rate of approximately 5% in the coming years, driven by the need for sustainable solutions. This trend suggests that the Green Carbon Fiber Market is well-positioned to capitalize on the growing preference for lightweight alternatives, potentially leading to increased market penetration and innovation.

Technological Innovations in Production

Technological advancements play a crucial role in shaping the Green Carbon Fiber Market. Innovations in production techniques, such as improved processing methods and the development of bio-based precursors, are enhancing the efficiency and cost-effectiveness of green carbon fiber manufacturing. These advancements not only lower production costs but also improve the material properties of green carbon fiber, making it more competitive with traditional carbon fibers. For instance, recent developments have led to a reduction in energy consumption during production, which is a significant factor for manufacturers. As technology continues to evolve, the Green Carbon Fiber Market is expected to witness a transformation that could lead to increased adoption across various applications, including automotive, aerospace, and sporting goods.

Growing Awareness of Environmental Impact

The Green Carbon Fiber Market is witnessing a shift in consumer awareness regarding environmental impact. As individuals and organizations become more conscious of their ecological footprint, there is a growing demand for products made from sustainable materials. This trend is particularly evident in sectors such as fashion, automotive, and construction, where consumers are actively seeking eco-friendly alternatives. Market Research Future indicates that approximately 70% of consumers are willing to pay a premium for sustainable products, which bodes well for the green carbon fiber sector. This heightened awareness is likely to drive demand for green carbon fiber applications, as companies respond to consumer preferences by integrating sustainable materials into their offerings. Consequently, the Green Carbon Fiber Market is expected to expand as it aligns with the values of environmentally conscious consumers.

Government Incentives for Green Technologies

The Green Carbon Fiber Market is poised to benefit from government incentives aimed at promoting green technologies. Many governments are implementing policies that encourage the use of sustainable materials, including green carbon fiber, through subsidies, tax breaks, and research funding. These initiatives are designed to stimulate innovation and adoption of eco-friendly solutions across industries. For example, recent legislation in several regions has allocated significant funding for research and development in sustainable materials, which could bolster the growth of the green carbon fiber sector. As these incentives continue to evolve, the Green Carbon Fiber Market may experience accelerated growth, driven by increased investment and collaboration between public and private sectors.

Increased Focus on Sustainable Manufacturing

The Green Carbon Fiber Market is benefiting from an increased focus on sustainable manufacturing practices. As industries face mounting pressure to reduce their carbon footprints, the shift towards eco-friendly materials is becoming more pronounced. Green carbon fiber, produced from renewable resources, aligns with the sustainability goals of many companies. This shift is not merely a trend; it reflects a broader commitment to environmental stewardship. Data indicates that the sustainable materials market is expected to grow at a rate of 8% annually, suggesting a robust future for green carbon fiber applications. Consequently, the Green Carbon Fiber Market is likely to see enhanced investment and innovation as companies seek to integrate sustainable materials into their production processes.