The global market players in the carbon fiber composites market adopt strategies such as expansion, mergers & acquisitions, supply, and distribution agreements, and new product launches to maintain their market dominance and increase their global presence. For instance, in November 2017, one of the prominent company - Solvay, which is the parent company of Cytec, acquired European Carbon Fiber GmbH ("ECF"). This company is a major manufacturer of high-quality precursors for large tow (50K) polyacrylonitrile carbon fibers.

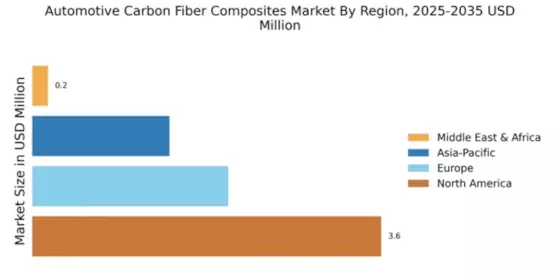

Stringent regulations imposed by the government of Europe, such as the European Automotive Manufacturers Association (ACEA) and the European Union Automotive Fuel Economy standard, have set limits for carbon emission, which has put pressure on automakers. For instance, the European Union Commission (E.C.) has enforced increasing the E.U.'s GHG reduction target for 2032- from a 40% cut in CO2 emission to a 50 or 55% cut. Therefore, increasing fuel efficiency requirements and the lightweight nature of vehicles have enforced the use of automotive composites in automotive applications driving the demand for a product in the region.

The exterior application of automotive composites accounted for 55%, in terms of value and 50% in terms of volume, of the overall market in 2019. Exterior application contributes a significant share of the automotive carbon fiber composites market. Significant components of a car body, such as bumper beam, fender, front end module, door panels, and hood, are made of composite materials. Furthermore, the use of composites in the exterior parts such as fenders, hoods, bumper beams, deck lids, and others added to the durability of cars, ensuring a long lifecycle and lowering maintenance costs.

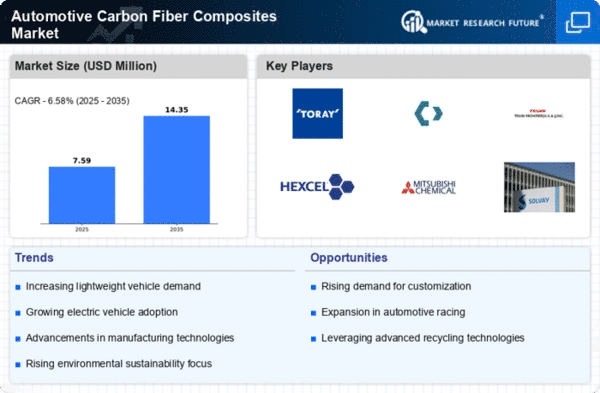

The automotive carbon fiber composites market report has been prepared to understand the dynamics available to the market during the period ending in 2027. The report highlights the impact of the pandemic outbreak on the market, followed by the growing reasons that enhance the global market competition. The global automotive carbon fiber composites market report highlights the recent developments undertaken by the market players during the period that have an impact on the investment and buying decisions for the continuous period.

In February 2024, inventors at the Department of Energy's Oak Ridge National Laboratory achieved a significant breakthrough in chemistry. They successfully developed a closed-loop process for creating an extremely durable carbon-fiber-reinforced polymer (CFRP) and subsequently recovering all of the initial components used in its synthesis. CFRP, a composite material that is lightweight, durable, and resilient, is highly advantageous in terms of reducing the weight and enhancing the fuel efficiency of automobiles, airplanes, and spacecraft. Nevertheless, traditional carbon fiber reinforced polymers (CFRPs) pose challenges when it comes to recycling.

The majority of these materials have been designed for one-time usage, resulting in a substantial carbon impact. A standard thermoset material undergoes permanent crosslinking. Once the material is synthesized, cured, molded, and shaped, it becomes irreparable and cannot be reprocessed. Conversely, the technique developed by ORNL introduces dynamic chemical groups to both the polymer matrix and the carbon fibers that are embedded within it. The polymer matrix and carbon fibers may endure numerous reprocessing cycles without experiencing any degradation in mechanical qualities, such as strength and toughness.

Thermoset epoxies, which are conventional polymers, are commonly employed to permanently join various materials like metal, carbon, concrete, glass, ceramic, and plastic.

Automotive Carbon Fiber Composites Market Industry Developments

- Q2 2024: Lotus Unveils Eletre Carbon, Ultra-Luxury Electric Hyper-SUV with Extensive Carbon Fiber Design In April 2024, Lotus launched the Eletre Carbon, a new electric hyper-SUV variant featuring extensive use of carbon fiber composites in both exterior and interior components, marking the debut of Lotus's new performance SUV lineage.

- Q1 2024: Mitsubishi Rayon Carbon Fibre and Composites (MRCFAC) Established Following Acquisition of SGL Carbon’s North American Business Mitsubishi Chemical Group completed the acquisition of SGL Carbon’s North American carbon fiber business and established a new entity, MRCFAC, to expand its carbon fiber composites production capacity and market presence in the automotive sector.