Epoxy Resin Market Type Insights

The epoxy resin market segmentation, based on epoxy resin type, includes DGBEA, novolac, DGBEF, aliphatic, glycidylamine, and others. The DGBEA type of epoxy resin segment held the majority share in 2021, contributing to around ~35-40% concerning the global epoxy resin market revenue. This is primarily owing to the surge in demand for automotive and other end-use industries globally will eventually raise the demand for epoxy resin, thereby expanding the epoxy resin industry. For instance, as per the International Organization of Motor Vehicle Manufacturers, the automotive industry has grown by 3% in 2021 with an increased production capacity of 80,145,988 units.

The growing adoption of electric vehicles and the rise in demand for vehicles is accelerating the growth of epoxy resins during the forecast period.

In November 2021, Solvay has launched an alkylphenol ethoxylates-free (APE) and non-ionic reactive water-based emulsifier Reactsurf 0092, for solid epoxy resins mainly for use in industrial coatings and paints or binders.

Epoxy Resin Market Technology Insights

The market, based on technology, is segmented into solvent-cut epoxy, liquid epoxy, waterborne epoxy, and others. The liquid epoxy segment dominated the epoxy resin industry in 2021 and is projected to be the faster-growing segment during the forecast period, 2022-2030. This is due to the rapid industrialization and rise in demand for consumer electronics, flourishing the market during the forecast period. The liquid epoxy resin has been used for years as it possesses superior quality and has strong resistance power to corrosion, chemical, heat, and others. Hence, the growing application of liquid epoxy technology in various end-use industries will positively impact the market.

In June 2022, Swancor, Taiwan based company, introduced two new products, CleaVER and EzCiclo, to provide a new solution to wind turbine blades using recycle and reuse process. EzCiclo is a recyclable and reusable thermosetting epoxy resin that can be recycled and degraded via the CleaVER technology using carbon or glass fiber reinforcement.

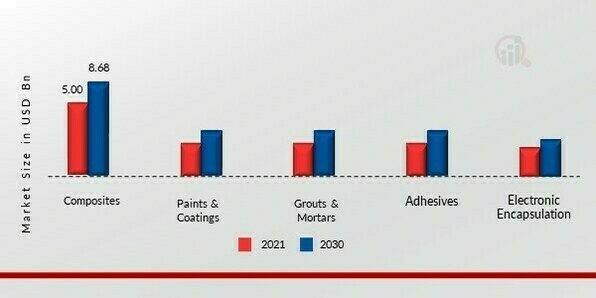

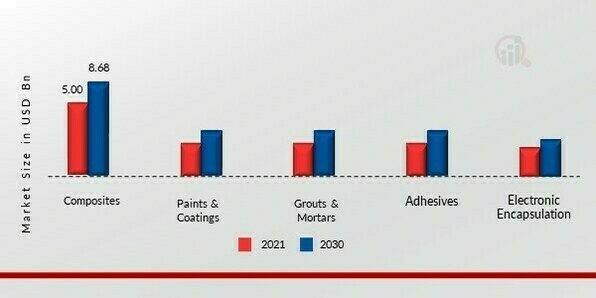

Epoxy Resin Market Application Insights

The market, based on application, is segmented into composites, paints & coatings, grouts & mortars, adhesives, electronic encapsulation, and others. The paint & coatings segment dominated the epoxy resin industry in 2021 and is projected to be the faster-growing segment during the forecast period, 2022-2030. This is due to the high demand for environment-friendly coating products along with the rising end-use industry flourishing the market during the forecast period.

Figure 1: Epoxy Resin Market, by Application, 2021 & 2030 (USD Billion) Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

In May 2022, Hexcel has introduced a new product HexPly Nature Range to provide a sustainable solution for industrial, automotive, winter sports, marine, and wind energy applications. The product is formed in combination with bio-derived epoxy resin content with natural fiber reinforcements to create material solutions.

Epoxy Resin Market End-Use Industry Insights

Based on End-Use Industry, the global epoxy resin industry has been segmented as aerospace, automotive & transportation, building & construction, electrical & electronics, marine, and others. According to the market research, the electrical & electronics segment held the largest segment share in 2021, owing to the rapid adoption of advanced epoxy resin in electronics products such as smart home appliances, smartphones, gaming devices, laptops, and other demands are increasing with the growing economy & population.

The fastest-growing segment in the epoxy resin industry is aerospace owing to the rapid adoption of advanced epoxy resin products and the surge in the production of aircraft, jets, and others. According to the market forecast, there will be a surge in demand for epoxy resin due to these factors eventually boosting the market.

In March 2020, Sicomin, a Bio-based epoxy resins supplier launched a series of epoxy resin products SGi 128 suited for Gelcoat application in the automotive, wind energy, civil engineering, and marine sectors.

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review