Expanding Automotive Applications

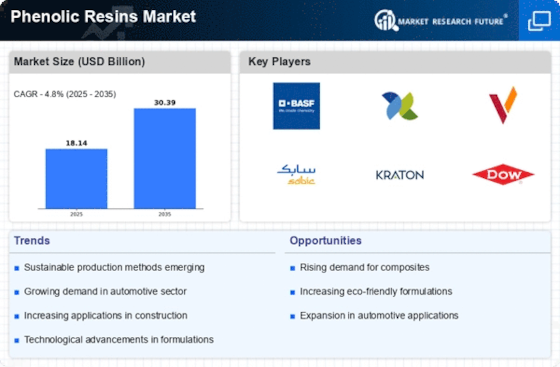

The automotive industry is increasingly adopting phenolic resins due to their lightweight and high-performance characteristics. These resins are utilized in various applications, including interior components, electrical systems, and composite materials. The shift towards electric vehicles and the need for fuel efficiency are propelling the demand for lightweight materials, which enhances the appeal of phenolic resins. The Phenolic Resins Market is poised to capitalize on this trend, as the automotive sector is expected to witness a growth rate of around 4% annually. This growth indicates a promising future for phenolic resin manufacturers, as they align their products with the evolving requirements of the automotive industry.

Rising Demand in Construction Sector

The construction sector is experiencing a notable surge in demand for phenolic resins, primarily due to their excellent adhesive properties and thermal stability. These resins are extensively utilized in the production of plywood, laminates, and insulation materials, which are essential for modern construction projects. As urbanization continues to expand, the Phenolic Resins Market is likely to benefit from increased investments in infrastructure development. Reports indicate that the construction industry is projected to grow at a compound annual growth rate of approximately 5% over the next few years, further driving the demand for phenolic resins. This trend suggests a robust market potential for manufacturers and suppliers within the Phenolic Resins Market, as they cater to the evolving needs of the construction sector.

Sustainability Trends in Manufacturing

Sustainability is becoming a critical focus in manufacturing processes, influencing the Phenolic Resins Market. Manufacturers are increasingly seeking eco-friendly alternatives and practices, leading to the development of bio-based phenolic resins. These sustainable options not only meet regulatory requirements but also appeal to environmentally conscious consumers. The market for sustainable materials is expected to grow significantly, with estimates suggesting a compound annual growth rate of 7% in the coming years. This trend indicates a shift in consumer preferences and presents an opportunity for the Phenolic Resins Market to innovate and adapt to the changing landscape, ensuring long-term viability and competitiveness.

Technological Innovations in Resin Production

Technological advancements in the production of phenolic resins are significantly influencing the market landscape. Innovations such as the development of bio-based phenolic resins and improved curing processes are enhancing the performance and sustainability of these materials. The Phenolic Resins Market is likely to see increased adoption of these advanced technologies, which not only improve product quality but also reduce environmental impact. As manufacturers invest in research and development, the market is expected to expand, with projections indicating a growth rate of approximately 6% over the next five years. This trend underscores the importance of innovation in driving the Phenolic Resins Market forward.

Growing Demand for Electrical Insulation Materials

The demand for electrical insulation materials is on the rise, driven by the increasing need for safety and efficiency in electrical applications. Phenolic resins are widely used in the production of electrical insulators, circuit boards, and other components due to their excellent dielectric properties and thermal stability. The Phenolic Resins Market is likely to benefit from this growing demand, as the electrical and electronics sector continues to expand. Market analysis suggests that the electrical insulation materials segment is projected to grow at a rate of around 5% annually, indicating a strong potential for phenolic resin manufacturers to capture market share in this lucrative segment.