Health and Wellness Trends

The ongoing health and wellness trends are significantly influencing the Gluten-Free Oat Market. As consumers prioritize nutritious and wholesome food options, gluten-free oats are increasingly recognized for their health benefits, including high fiber content and essential nutrients. This trend is reflected in market data, which shows a steady increase in the consumption of gluten-free oats among health-conscious individuals. Furthermore, the rise of plant-based diets has also contributed to the popularity of gluten-free oats, as they serve as a versatile ingredient in various recipes. Consequently, brands that align their marketing strategies with these health trends are likely to see enhanced consumer engagement and loyalty.

Innovative Product Development

Innovation plays a crucial role in the Gluten-Free Oat Market, as companies strive to differentiate their offerings. The introduction of new flavors, textures, and formats, such as oat-based snacks and ready-to-eat meals, is becoming increasingly prevalent. This diversification not only attracts a wider consumer base but also addresses the varying preferences of health-conscious individuals. Market data suggests that innovative product development could account for a significant portion of the market's growth, as consumers are more likely to experiment with novel products. As a result, brands that prioritize research and development are likely to gain a competitive edge in this dynamic industry.

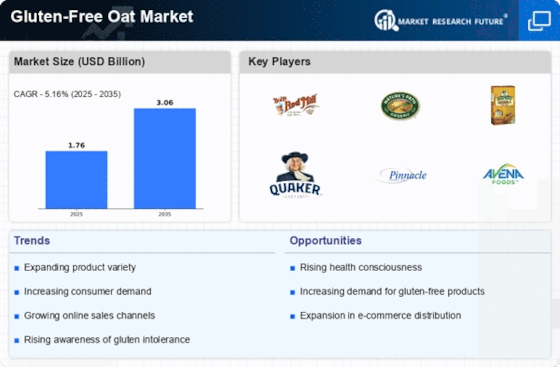

Rising Demand for Gluten-Free Products

The increasing prevalence of celiac disease and gluten sensitivity has led to a notable rise in the demand for gluten-free products, including oats. As consumers become more health-conscious, they actively seek alternatives that align with their dietary restrictions. The Gluten-Free Oat Market is experiencing a surge, with market data indicating a compound annual growth rate of approximately 10% over the next few years. This trend is further fueled by the growing awareness of the health benefits associated with gluten-free diets, such as improved digestion and reduced inflammation. Consequently, manufacturers are expanding their product lines to cater to this burgeoning demand, thereby enhancing the overall market landscape.

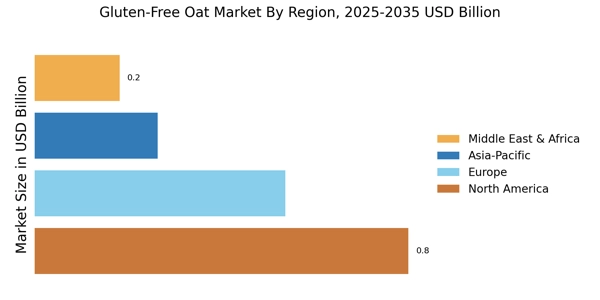

Increased Availability of Gluten-Free Oats

The accessibility of gluten-free oats has improved significantly, contributing to the growth of the Gluten-Free Oat Market. Retailers are increasingly stocking gluten-free options, and online platforms are expanding their offerings, making it easier for consumers to find these products. Market data indicates that the availability of gluten-free oats in mainstream grocery stores has increased by over 30% in recent years. This enhanced accessibility not only meets consumer demand but also encourages trial and repeat purchases. As more consumers become aware of gluten-free oats, the market is likely to witness sustained growth, driven by the convenience of purchasing these products.

Growing Interest in Sustainable Food Sources

Sustainability is becoming a pivotal factor in consumer purchasing decisions, impacting the Gluten-Free Oat Market. As individuals become more environmentally conscious, they are inclined to choose products that are sustainably sourced and produced. This shift in consumer behavior is prompting manufacturers to adopt eco-friendly practices, such as sourcing oats from organic farms and utilizing sustainable packaging. Market data suggests that products labeled as organic or sustainably sourced are witnessing higher sales growth compared to conventional options. As the demand for sustainable food sources continues to rise, the gluten-free oat segment is likely to benefit, appealing to a broader audience that values ethical consumption.