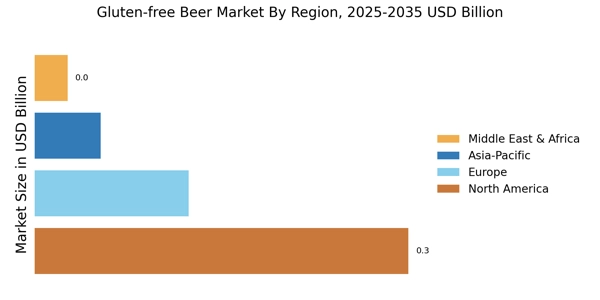

North America : Market Leader in Gluten-free Beer

North America is the largest market for gluten-free beer, holding approximately 60% of the global share, reflecting strong regional gluten free beer market share supported by regulatory clarity and growing consumer awareness. The region's growth is driven by increasing health consciousness among consumers, a rise in celiac disease diagnoses, and a growing demand for gluten-free products. Regulatory support, such as the FDA's labeling guidelines for gluten-free products, further catalyzes market expansion. The U.S. leads this market, followed by Canada, which contributes around 15% to the overall share. The competitive landscape in North America is robust, featuring key players like Omission Brewing Company, New Belgium Brewing Company, and Dogfish Head Craft Brewery. These companies are innovating with new flavors and brewing techniques to cater to the growing consumer base. The presence of a well-established distribution network and increasing availability in retail and online channels also bolster market growth, making it a vibrant hub for gluten-free beer enthusiasts.

Europe : Emerging Market with Growth Potential

Europe is witnessing a significant rise in the gluten-free beer market, currently holding about 25% of the global share, supported by favorable regulations and an improving gluten free beer market outlook across major economies. The growth is fueled by increasing awareness of gluten-related disorders and a shift towards healthier lifestyles. Countries like Germany and the UK are leading this trend, with Germany accounting for approximately 10% of the market. Regulatory frameworks, such as the EU's food labeling regulations, support the gluten-free movement, enhancing consumer trust and product visibility. The competitive landscape in Europe is characterized by a mix of established breweries and innovative startups. Key players include Brunehaut from Belgium and Green's Gluten Free Brewery from the UK, both of which are gaining traction with unique offerings. The market is also seeing collaborations between traditional breweries and gluten-free brands, expanding product lines and reaching a broader audience. This dynamic environment positions Europe as a promising region for gluten-free beer growth.

Asia-Pacific : Emerging Powerhouse for Gluten-free Beer

The Asia-Pacific region is emerging as a significant player in the gluten-free beer market, currently holding about 10% of the global share. The growth is driven by increasing disposable incomes, changing consumer preferences, and a rising awareness of gluten-related health issues. Countries like Australia and Japan are at the forefront, with Australia contributing approximately 5% to the market. Regulatory support, including food safety standards, is also enhancing market growth and consumer confidence. The competitive landscape in Asia-Pacific is evolving, with both local and international brands entering the market. Key players are beginning to establish a presence, focusing on innovative flavors and marketing strategies tailored to local tastes. The region's growing e-commerce platforms are also facilitating access to gluten-free products, making it easier for consumers to explore and purchase gluten-free beer options. This trend indicates a promising future for the gluten-free beer market in Asia-Pacific.

Middle East and Africa : Untapped Market with Potential

The Middle East and Africa region is still in the nascent stages of the gluten-free beer market, holding approximately 5% of the global share. However, there is a growing interest in gluten-free products driven by health trends and dietary changes. Countries like South Africa are leading the way, with increasing awareness of gluten-related health issues. Regulatory frameworks are gradually evolving to support gluten-free labeling, which is crucial for market growth. The competitive landscape is relatively underdeveloped, with few key players currently operating in the region. However, the potential for growth is significant, as local breweries begin to explore gluten-free options. The increasing availability of gluten-free products in retail and online channels is expected to drive consumer interest. As awareness continues to rise, the Middle East and Africa could become a key market for gluten-free beer in the coming years.