Technological Advancements

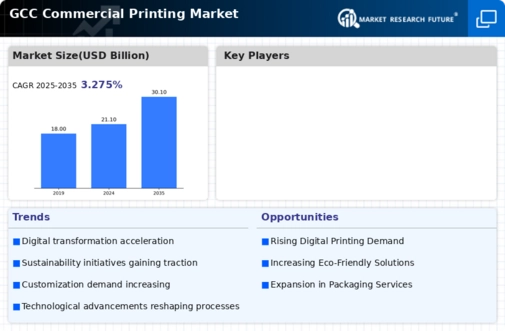

The GCC commercial printing market is experiencing a notable transformation driven by rapid technological advancements. Innovations in digital printing technologies, such as inkjet and laser printing, are enhancing print quality and efficiency. The adoption of automation and artificial intelligence in printing processes is streamlining operations, reducing costs, and improving turnaround times. According to recent data, the digital printing segment is projected to grow at a compound annual growth rate of over 10% in the GCC region. This growth is indicative of the industry's shift towards more efficient and versatile printing solutions, allowing businesses to meet the increasing demand for customized and high-quality printed materials. As a result, companies that invest in the latest printing technologies are likely to gain a competitive edge in the GCC commercial printing market.

Increased Focus on Sustainability

Sustainability has emerged as a pivotal driver in the GCC commercial printing market, as businesses increasingly prioritize eco-friendly practices. The demand for sustainable printing solutions is on the rise, with companies seeking to minimize their environmental impact through the use of recycled materials and eco-friendly inks. This shift is not only driven by regulatory pressures but also by changing consumer preferences, as customers are more inclined to support brands that demonstrate a commitment to sustainability. The GCC commercial printing market is adapting to these trends by investing in green technologies and practices, which may enhance brand reputation and customer loyalty. As sustainability becomes a core value for businesses, the industry is likely to witness a transformation in its operational practices and product offerings.

Government Initiatives and Support

Government initiatives and support play a crucial role in shaping the GCC commercial printing market. Various GCC countries are implementing policies aimed at promoting local manufacturing and reducing reliance on imports. For instance, initiatives to support small and medium-sized enterprises (SMEs) in the printing sector are fostering innovation and entrepreneurship. Additionally, investments in infrastructure and technology are enhancing the capabilities of local printing companies. The GCC governments are also encouraging the adoption of sustainable practices within the industry, aligning with global environmental standards. These supportive measures are likely to stimulate growth and development in the GCC commercial printing market, creating a more favorable business environment for local players.

Rising Demand for Packaging Solutions

The GCC commercial printing market is witnessing a surge in demand for packaging solutions, driven by the growth of e-commerce and retail sectors. As online shopping continues to expand, businesses require innovative and attractive packaging to enhance customer experience and brand visibility. The packaging segment is expected to account for a significant share of the commercial printing market, with estimates suggesting a growth rate of approximately 8% annually. This trend is further fueled by consumer preferences for sustainable and eco-friendly packaging options, prompting companies to adopt more responsible printing practices. The increasing focus on packaging design and functionality is reshaping the landscape of the GCC commercial printing market, as businesses strive to differentiate themselves in a competitive marketplace.

Customization and Personalization Trends

The trend towards customization and personalization is significantly influencing the GCC commercial printing market. As consumers increasingly seek unique and tailored products, businesses are responding by offering personalized printing solutions. This trend is particularly evident in sectors such as marketing, where customized promotional materials are gaining traction. The ability to produce short runs of personalized items is becoming more feasible due to advancements in digital printing technologies. Market data indicates that the demand for personalized printed products is expected to grow by approximately 12% in the coming years. This shift towards customization not only enhances customer engagement but also allows businesses to differentiate themselves in a crowded marketplace. Consequently, the GCC commercial printing market is likely to evolve to meet these changing consumer demands.