Government Initiatives and Regulations

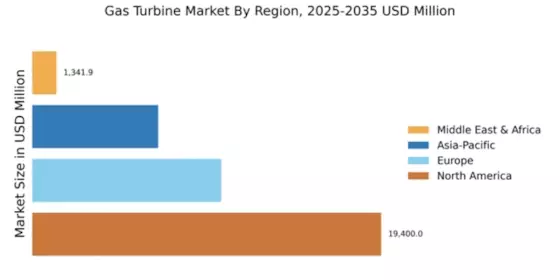

Government policies and regulations significantly influence the Global Gas Turbine Market Industry. Many countries are implementing stringent emissions standards and promoting the use of cleaner energy sources. These initiatives often include financial incentives for adopting gas turbines, which are viewed as a transitional technology towards a more sustainable energy future. For instance, various nations are investing in infrastructure to support natural gas usage, thereby increasing the demand for gas turbines. This regulatory environment is expected to contribute to a compound annual growth rate of 3.82% from 2025 to 2035, further solidifying the market's growth trajectory.

Increasing Demand for Energy Efficiency

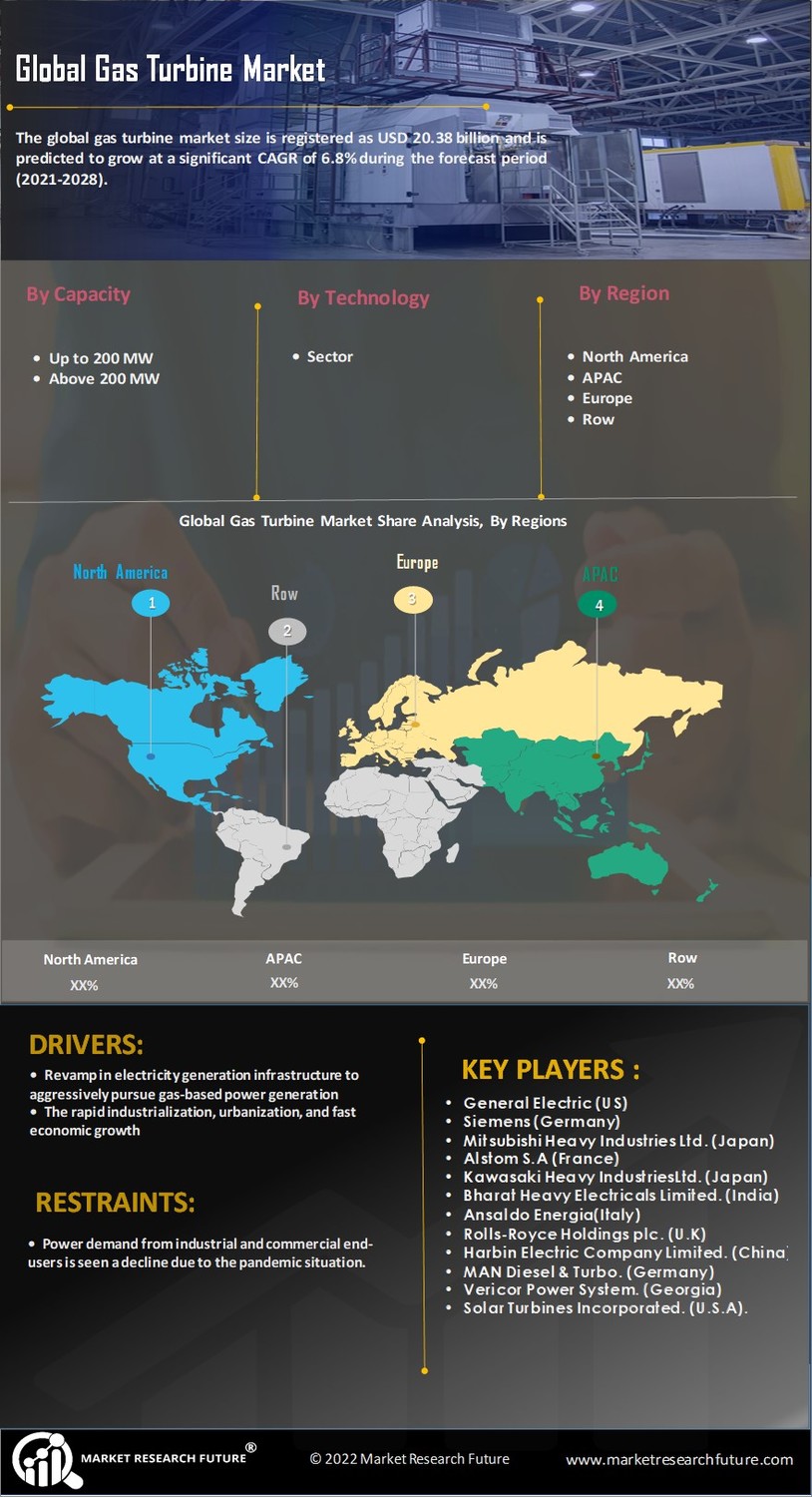

The Global Gas Turbine Market Industry experiences a notable surge in demand for energy-efficient solutions. As industries and governments strive to reduce carbon footprints, gas turbines are increasingly favored for their ability to generate power with lower emissions compared to traditional coal-fired plants. This trend aligns with global initiatives aimed at sustainable energy production. The market is projected to reach 38.8 USD Billion in 2024, reflecting a growing preference for cleaner energy sources. The shift towards natural gas as a primary fuel is likely to further bolster the adoption of gas turbines, enhancing their role in the global energy landscape.

Rising Industrialization and Urbanization

The Global Gas Turbine Market Industry is significantly impacted by the ongoing trends of industrialization and urbanization. As developing economies expand, the demand for reliable and efficient power generation increases. Gas turbines are particularly well-suited for meeting the energy needs of industrial sectors, including manufacturing and construction. Urban areas, characterized by high energy consumption, are increasingly turning to gas turbines for their ability to provide quick and flexible power solutions. This trend is likely to drive market growth, as urbanization continues to accelerate globally, necessitating robust energy infrastructure.

Technological Advancements in Turbine Design

Technological innovations play a pivotal role in shaping the Global Gas Turbine Market Industry. Recent advancements in turbine design, such as improved materials and cooling techniques, enhance efficiency and performance. These innovations enable gas turbines to operate at higher temperatures and pressures, resulting in increased power output and reduced fuel consumption. The integration of digital technologies, including predictive maintenance and real-time monitoring, further optimizes turbine operations. As a result, the market is expected to grow significantly, with projections indicating a rise to 58.7 USD Billion by 2035, driven by these technological enhancements.

Growing Interest in Renewable Energy Integration

The Global Gas Turbine Market Industry is witnessing a growing interest in integrating gas turbines with renewable energy sources. As the world transitions towards a more sustainable energy mix, gas turbines are being utilized as backup power sources for intermittent renewable technologies like wind and solar. This hybrid approach enhances grid stability and reliability, making gas turbines an attractive option for energy producers. The increasing focus on energy diversification and security is likely to propel the market forward, as stakeholders seek to balance renewable energy goals with the need for dependable power generation.