Increasing Energy Demand

The Renewable Power Generation Market is experiencing a surge in energy demand, driven by urbanization and industrial growth. As populations expand, the need for sustainable energy sources becomes more pressing. According to recent data, energy consumption is projected to rise by approximately 30% by 2040. This trend necessitates a shift towards renewable energy solutions, as traditional fossil fuels are increasingly scrutinized for their environmental impact. The Renewable Power Generation Market is thus positioned to meet this demand, offering alternatives such as solar, wind, and hydroelectric power. The transition to renewables not only addresses energy needs but also aligns with global sustainability goals, making it a pivotal driver in the market.

Technological Innovations

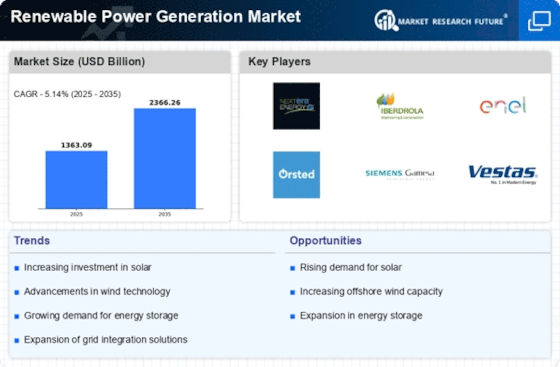

Technological advancements are a cornerstone of the Renewable Power Generation Market, enhancing efficiency and reducing costs. Innovations in solar panel technology, such as bifacial panels and perovskite cells, have significantly improved energy conversion rates. Additionally, advancements in wind turbine design, including larger rotor diameters and improved materials, have increased energy capture. The levelized cost of electricity (LCOE) for renewables has decreased dramatically, with onshore wind and solar PV now often cheaper than fossil fuels in many regions. This trend suggests that continued investment in research and development will further propel the Renewable Power Generation Market, making renewable sources more accessible and economically viable.

Government Incentives and Policies

Supportive government policies and incentives are crucial for the growth of the Renewable Power Generation Market. Many countries have implemented tax credits, subsidies, and renewable portfolio standards to encourage the adoption of clean energy technologies. For instance, the introduction of feed-in tariffs has provided financial stability for renewable energy projects, fostering investment. As of 2025, over 100 nations have set ambitious renewable energy targets, aiming for a significant share of their energy mix to come from renewables by 2030. This regulatory environment not only stimulates market growth but also enhances investor confidence in the Renewable Power Generation Market.

Corporate Sustainability Initiatives

The increasing emphasis on corporate sustainability is driving demand within the Renewable Power Generation Market. Companies are increasingly committing to net-zero emissions targets, prompting investments in renewable energy sources. A significant number of Fortune 500 companies have pledged to source 100% of their energy from renewables by 2030. This trend indicates a shift in corporate responsibility, where businesses recognize the importance of sustainable practices not only for compliance but also for brand reputation. As corporations seek to align with consumer values, the Renewable Power Generation Market stands to benefit from this growing commitment to sustainability.

Public Awareness and Consumer Demand

Public awareness regarding climate change and environmental issues is a key driver for the Renewable Power Generation Market. As consumers become more informed about the impacts of fossil fuels, there is a noticeable shift towards renewable energy solutions. Surveys indicate that a significant percentage of consumers are willing to pay a premium for green energy options. This heightened demand is prompting utilities and energy providers to expand their renewable offerings. Furthermore, community solar projects and residential solar installations are gaining traction, reflecting a desire for decentralized energy solutions. This consumer-driven approach is likely to further accelerate the growth of the Renewable Power Generation Market.