APAC Gas Turbine Market Summary

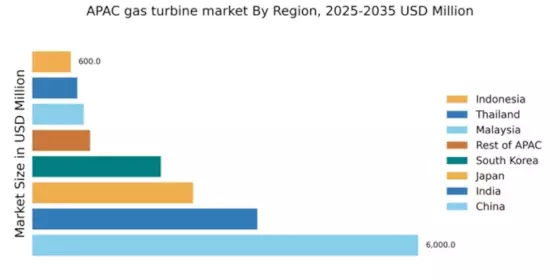

As per Market Research Future analysis, the APAC Gas Turbine Market Size was valued at USD 12,168.4 million in 2024. The Gas Turbine Market industry is projected to grow from USD 12,288.8 million in 2025 to USD 14,503.82 million by 2035, exhibiting a compound annual growth rate (CAGR) of 1.671% during the forecast period (2025 - 2035).

Key Market Trends & Highlights

The APAC gas turbine market supports power generation and industrial applications across Asia-Pacific countries, driven by rising energy demand and shifts toward cleaner fuels like natural gas:

- Governments prioritize natural gas over coal to cut emissions, with China's coal-to-gas mandates and India's 25% coal reduction target by 2030 boosting installations.

- Net zero and NDC commitments push countries to retire or limit new coal, positioning gas turbines as a “transition” technology that can back up intermittent renewable.

- Carbon pricing, emission standards, and air quality regulations are favoring high efficiency combined cycle plants over older simple cycle and coal assets.

- OEMs and utilities are adopting digital twins, AI based predictive maintenance, and remote monitoring to cut unplanned outages and extend maintenance intervals.

- Grid operators increasingly value fast ramping turbines that can cycle frequently to balance solar and wind, shifting focus from baseload to flexible operation.

Market Size & Forecast

| 2024 Market Size | 12,168.4 (USD Million) |

| 2035 Market Size | 14,503.82 (USD Million) |

| CAGR (2025 - 2035) | 1.671% |

Major Players

Siemens Energy, General Electric, Ansaldo Energia, IHI Corporation, Kawasaki Heavy Industries Ltd., Mitsubishi Heavy Industries, Ltd., Bharat Heavy Electricals Limited, Solar Turbines Incorporated, Rolls-Royce, Baker Hughes and Others.