Increasing Veterinary Expenditures

The veterinary dental-equipment market in France is experiencing a surge in demand, driven by rising expenditures on veterinary services. Pet owners are increasingly willing to invest in their pets' health, including dental care, which is often viewed as a critical component of overall well-being. This trend is reflected in the growing number of veterinary clinics offering specialized dental services, which in turn drives the need for advanced dental equipment. Reports indicate that veterinary spending in France has increased by approximately 15% over the past few years, suggesting a robust market for veterinary dental equipment. As pet owners prioritize dental health, the veterinary dental-equipment market is likely to expand, providing opportunities for manufacturers to introduce innovative products tailored to meet these evolving needs.

Rising Awareness of Pet Dental Health

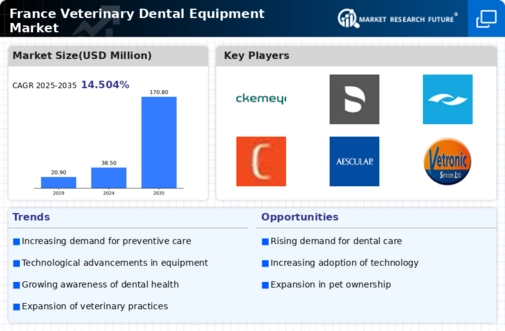

The veterinary dental-equipment market in France is experiencing growth due to increasing awareness among pet owners regarding the importance of dental health for their animals. As more pet owners recognize that dental issues can lead to serious health problems, they are more inclined to seek veterinary care that includes dental services. This shift in perception is likely to drive demand for advanced dental equipment, as veterinarians require high-quality tools to provide effective treatments. Reports indicate that the market for veterinary dental equipment in France could expand by approximately 8% annually, reflecting the growing emphasis on comprehensive pet care. Consequently, the veterinary dental-equipment market is poised to benefit from this heightened focus on dental health, as practitioners invest in the necessary tools to meet the evolving needs of their clients.

Regulatory Support for Veterinary Practices

The veterinary dental-equipment market in France is positively influenced by supportive regulatory frameworks that encourage the adoption of advanced dental technologies. Government initiatives aimed at improving animal health standards often include provisions for veterinary practices to upgrade their equipment. This regulatory environment not only fosters innovation but also ensures that veterinarians have access to the latest dental tools and technologies. As a result, the market is likely to see an influx of new products designed to enhance dental care for pets. Furthermore, compliance with these regulations may necessitate investments in modern equipment, thereby driving growth in the veterinary dental-equipment market. The potential for increased funding and grants for veterinary practices could further stimulate this trend, leading to a more robust market landscape.

Expansion of Veterinary Clinics and Services

The veterinary dental-equipment market in France is poised for growth due to the expansion of veterinary clinics and the diversification of services offered. As more clinics open and existing ones expand their service offerings, there is a corresponding increase in the demand for specialized dental equipment. This trend is particularly evident in urban areas, where the concentration of pet owners is higher. The expansion of services often includes comprehensive dental care, necessitating the acquisition of advanced dental tools and technologies. Market projections indicate that the veterinary dental-equipment market could grow by 7% annually, driven by this expansion. As veterinary practices evolve to meet the needs of pet owners, the veterinary dental-equipment market is likely to benefit from increased investments in dental care capabilities.

Technological Integration in Veterinary Practices

The veterinary dental-equipment market in France is benefiting from the integration of advanced technologies into veterinary practices. Innovations such as digital imaging, laser dentistry, and telemedicine are becoming increasingly prevalent, allowing veterinarians to provide more accurate diagnoses and effective treatments. This technological evolution not only enhances the quality of care but also streamlines operations within veterinary clinics. As practices adopt these technologies, the demand for specialized dental equipment is expected to rise. Market analysts suggest that the veterinary dental-equipment market could see a growth rate of around 10% over the next few years, driven by the need for modern tools that complement these technological advancements. Consequently, the veterinary dental-equipment market is likely to evolve rapidly, reflecting the changing landscape of veterinary care.