Rising Awareness of Pet Dental Health

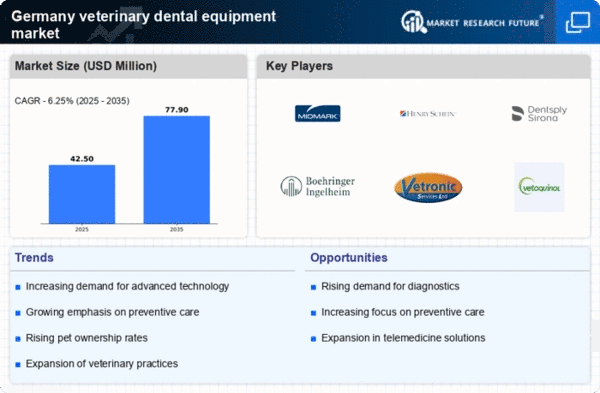

The veterinary dental equipment market in Germany is experiencing growth due to increasing awareness among pet owners regarding the importance of dental health for their animals. As more pet owners recognize that dental issues can lead to serious health problems, they are more likely to seek veterinary care that includes dental services. This trend is reflected in the rising demand for advanced dental equipment, which is essential for effective diagnosis and treatment. According to recent data, the market for veterinary dental equipment is projected to grow at a CAGR of approximately 6.5% over the next five years. This heightened awareness is driving veterinarians to invest in state-of-the-art dental tools, thereby enhancing the overall quality of care provided to pets.

Increasing Veterinary Practice Expenditures

The veterinary dental-equipment market in Germany is positively impacted by rising expenditures in veterinary practices. As pet owners are willing to spend more on their pets' health, veterinary clinics are expanding their services, including dental care. This trend is evident in the increasing budgets allocated for purchasing advanced dental equipment. Reports indicate that veterinary practices are investing approximately 15% more in dental equipment compared to previous years. This increase in spending is likely to drive the demand for high-quality dental tools, as veterinarians seek to provide comprehensive care that meets the expectations of pet owners. Consequently, the market is poised for growth as practices enhance their dental service offerings.

Regulatory Support for Veterinary Practices

The veterinary dental-equipment market in Germany benefits from supportive regulatory frameworks that encourage the adoption of advanced dental technologies. Regulatory bodies are increasingly recognizing the need for high standards in veterinary care, which includes dental health. This has led to the implementation of guidelines that promote the use of modern dental equipment in veterinary practices. As a result, veterinarians are more inclined to upgrade their tools to comply with these regulations, thereby improving the quality of care. The market is likely to see a boost in sales of dental equipment as practices invest in compliance-driven upgrades. This regulatory support is crucial for fostering innovation and ensuring that veterinary practices can provide the best possible dental care for pets.

Technological Innovations in Dental Equipment

The veterinary dental equipment market in Germany is significantly influenced by ongoing technological innovations. Advancements in dental imaging, anesthesia, and surgical tools are transforming the way veterinarians approach dental care. For instance, the introduction of digital radiography has improved diagnostic accuracy and reduced the time required for procedures. This technological evolution is not only enhancing the efficiency of veterinary practices but also improving patient outcomes. As a result, the demand for innovative dental equipment is on the rise, with projections indicating a potential market growth of 7% annually over the next few years. The integration of new technologies is likely to attract more veterinary professionals to invest in modern dental solutions.

Shift Towards Comprehensive Veterinary Services

The veterinary dental equipment market in Germany is benefiting from a broader shift towards comprehensive veterinary services. As pet owners increasingly view their pets as family members, there is a growing expectation for veterinarians to provide a full range of services, including dental care. This shift is prompting veterinary practices to expand their service offerings, which in turn drives the demand for specialized dental equipment. The market is likely to see an increase in the adoption of dental tools that facilitate a wide array of procedures, from routine cleanings to complex surgeries. This trend suggests a potential market growth of around 5% annually as practices adapt to meet the evolving needs of pet owners.