Rising Pet Ownership

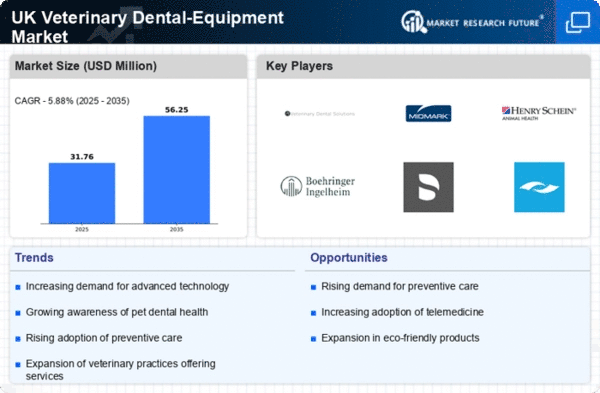

The veterinary dental-equipment market is experiencing growth due to the increasing number of pet owners in the UK. Recent statistics indicate that approximately 50% of households in the UK own a pet, leading to a heightened demand for veterinary services, including dental care. As pet owners become more aware of the importance of oral health for their pets, the need for advanced dental equipment is likely to rise. This trend suggests that veterinary practices are investing in modern dental tools to cater to the growing clientele. Consequently, the market for veterinary dental equipment is projected to expand, with an estimated growth rate of around 6% annually over the next few years. This driver highlights the correlation between pet ownership trends and the demand for veterinary dental services.

Expansion of Veterinary Services

The veterinary dental-equipment market is positively impacted by the expansion of veterinary services across the UK. As veterinary practices diversify their offerings to include specialized dental care, the demand for advanced dental equipment is expected to increase. This expansion is driven by a competitive market where clinics aim to attract more clients by providing comprehensive services. The veterinary dental-equipment market could experience a growth rate of around 7% as practices invest in new technologies and equipment to enhance their service portfolio. This driver illustrates the relationship between service expansion and the demand for veterinary dental tools, indicating a robust market outlook.

Increased Awareness of Pet Health

The veterinary dental-equipment market is benefiting from a growing awareness among pet owners regarding the significance of dental health. Educational campaigns and veterinary recommendations have led to a shift in perception, where dental care is now viewed as an essential aspect of overall pet health. This increased awareness is driving demand for specialized dental equipment, as veterinarians seek to provide comprehensive care. The market is projected to see a rise in sales of dental tools, with estimates suggesting a potential increase of 8% in the next year. As pet owners prioritize preventive care, the veterinary dental-equipment market is likely to witness sustained growth, reflecting the changing attitudes towards pet health and wellness.

Regulatory Standards and Compliance

The veterinary dental-equipment market is shaped by stringent regulatory standards and compliance requirements. In the UK, veterinary practices must adhere to specific guidelines to ensure the safety and efficacy of dental procedures. This regulatory landscape compels veterinary clinics to invest in high-quality dental equipment that meets these standards. As compliance becomes increasingly critical, the demand for reliable and certified dental tools is likely to rise. The market may see a growth rate of approximately 5% as practices upgrade their equipment to align with regulatory expectations. This driver highlights the interplay between regulatory frameworks and the veterinary dental-equipment market, emphasizing the need for quality assurance in veterinary care.

Technological Innovations in Equipment

The veterinary dental-equipment market is significantly influenced by ongoing technological innovations. Advancements in dental imaging, anesthesia, and surgical tools are enhancing the capabilities of veterinary practices. For instance, the introduction of digital radiography has improved diagnostic accuracy, allowing for better treatment planning. As a result, veterinary clinics are increasingly investing in state-of-the-art dental equipment to remain competitive. The market is expected to grow as these innovations become more accessible, with a projected increase in sales of around 10% over the next two years. This driver underscores the importance of technology in shaping the future of veterinary dental care and the equipment used in the industry.