Rising Pet Insurance Coverage

The increasing prevalence of pet insurance coverage is positively impacting the veterinary dental-equipment market. As more pet owners opt for insurance plans that cover dental procedures, they are more likely to seek out veterinary dental services. This trend encourages veterinary practices to invest in high-quality dental equipment to meet the rising demand for insured dental care. Reports indicate that pet insurance enrollment has grown by over 10% annually, reflecting a shift in consumer behavior towards proactive pet health management. This growth in insurance coverage is likely to drive the veterinary dental-equipment market, as practices adapt to the changing landscape of pet healthcare.

Growing Awareness of Pet Dental Health

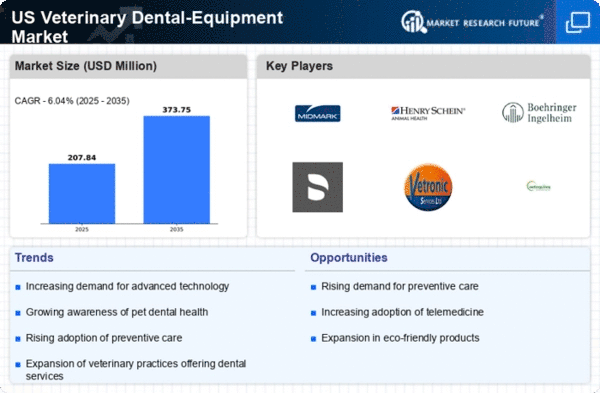

The increasing awareness regarding the importance of dental health in pets is a significant driver for the veterinary dental-equipment market. Pet owners are becoming more informed about the potential health risks associated with poor dental hygiene, such as periodontal disease and its systemic effects. This awareness is leading to a rise in demand for dental check-ups and treatments, thereby boosting the market for dental equipment. According to recent estimates, the veterinary dental-equipment market is projected to grow at a CAGR of approximately 8% over the next five years, reflecting the heightened focus on maintaining pet health. As veterinarians emphasize the necessity of regular dental care, the market is likely to see a surge in the adoption of advanced dental tools and technologies.

Regulatory Support for Veterinary Practices

Regulatory frameworks in the US are increasingly supporting veterinary practices, which in turn drives the veterinary dental-equipment market. Government initiatives aimed at improving animal health standards often include provisions for better dental care practices. This regulatory support encourages veterinary clinics to invest in modern dental equipment to comply with health regulations and provide high-quality care. As a result, the market is witnessing a steady influx of innovative dental tools that meet these regulatory requirements. Furthermore, funding opportunities and grants for veterinary practices to upgrade their facilities are becoming more common, which could further stimulate growth in the veterinary dental-equipment market.

Technological Innovations in Dental Equipment

Technological innovations are transforming the veterinary dental-equipment market, leading to enhanced diagnostic and treatment capabilities. The introduction of advanced imaging technologies, such as digital radiography, allows veterinarians to diagnose dental issues more accurately and efficiently. Additionally, the development of minimally invasive surgical tools is improving treatment outcomes for pets. These innovations not only enhance the quality of care but also increase the operational efficiency of veterinary practices. As a result, the market is expected to expand as more veterinary clinics adopt these cutting-edge technologies to stay competitive and meet the evolving needs of pet owners.

Increase in Veterinary Practices Offering Dental Services

The rise in the number of veterinary practices that offer specialized dental services is a crucial driver for the veterinary dental-equipment market. Many clinics are expanding their service offerings to include comprehensive dental care, recognizing the growing demand from pet owners. This trend is likely to lead to increased investments in dental equipment, as practices seek to provide a full range of services. According to industry reports, the number of veterinary clinics in the US has increased by approximately 5% annually, which correlates with the growing emphasis on dental health. Consequently, this expansion is expected to significantly contribute to the growth of the veterinary dental-equipment market.