Collaboration Among Industry Stakeholders

Collaboration among various stakeholders in the healthcare ecosystem is becoming increasingly vital for the growth of the 3d printing-medical-device-software market. Partnerships between medical device manufacturers, software developers, and healthcare providers are fostering innovation and accelerating the development of new solutions. In France, collaborative initiatives are emerging, where universities and research institutions are working alongside industry players to advance 3D printing technologies. This synergy is expected to enhance the quality and functionality of medical devices, making them more effective in clinical settings. Moreover, such collaborations can lead to shared resources and knowledge, ultimately driving down costs and improving access to advanced medical solutions. As these partnerships continue to flourish, they are likely to play a significant role in shaping the future of the 3d printing-medical-device-software market.

Cost Efficiency and Resource Optimization

Cost efficiency is emerging as a crucial driver for the 3d printing-medical-device-software market. The ability to produce medical devices on-demand reduces inventory costs and minimizes waste, which is particularly beneficial in the context of France's healthcare budget constraints. A recent study indicates that hospitals utilizing 3D printing technologies can save up to 30% on device costs compared to traditional manufacturing methods. This financial advantage is compelling healthcare providers to invest in 3D printing capabilities, thereby expanding the market. Furthermore, the reduction in lead times for device production allows for quicker responses to patient needs, enhancing the overall efficiency of healthcare delivery. As cost pressures continue to mount, the emphasis on resource optimization will likely drive further adoption of 3D printing technologies in the medical sector.

Technological Advancements in 3D Printing

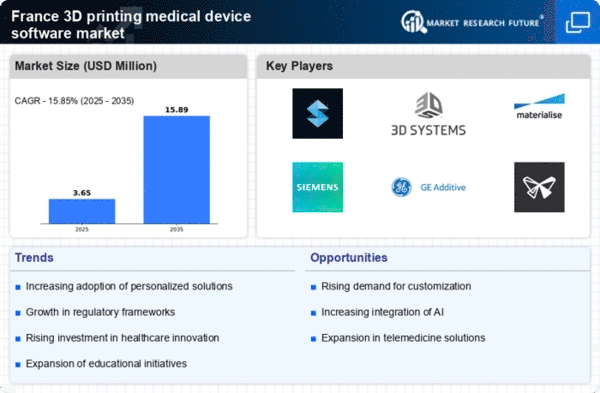

The rapid evolution of 3D printing technologies is a pivotal driver for the 3d printing-medical-device-software market. Innovations such as bioprinting and multi-material printing are enhancing the capabilities of medical devices, allowing for more complex and functional designs. In France, the market for 3D printing in healthcare is projected to grow at a CAGR of approximately 25% from 2025 to 2030. This growth is fueled by advancements in software that facilitate the design and production of customized medical devices, which are increasingly being adopted in surgical procedures and prosthetics. The integration of artificial intelligence in design software further streamlines the process, making it more efficient and cost-effective. As these technologies continue to mature, they are likely to drive further investment and interest in the 3d printing-medical-device-software market.

Regulatory Framework and Support Initiatives

The regulatory landscape surrounding 3D printing technologies is evolving, providing a supportive environment for the 3d printing-medical-device-software market. In France, regulatory bodies are increasingly recognizing the potential of 3D printed medical devices, leading to the establishment of clearer guidelines and standards. This regulatory support is crucial for fostering innovation and ensuring patient safety. Recent initiatives by the French government to promote advanced manufacturing technologies, including 3D printing, are likely to enhance the market's growth prospects. By streamlining the approval processes for new devices, these regulations may encourage more companies to enter the market, thereby increasing competition and driving technological advancements. As the regulatory framework continues to adapt, it is expected to positively impact the 3d printing-medical-device-software market.

Increasing Demand for Customized Medical Solutions

The growing demand for personalized medical solutions is significantly influencing the 3d printing-medical-device-software market. Patients are increasingly seeking tailored medical devices that cater to their specific anatomical and functional needs. In France, the healthcare system is gradually shifting towards personalized medicine, which is reflected in the rising adoption of 3D printed implants and prosthetics. This trend is supported by a market analysis indicating that the customization segment is expected to account for over 40% of the total market share by 2026. The ability to produce patient-specific devices not only enhances treatment outcomes but also reduces recovery times, thereby improving overall patient satisfaction. Consequently, this demand for customization is likely to propel the growth of the 3d printing-medical-device-software market.