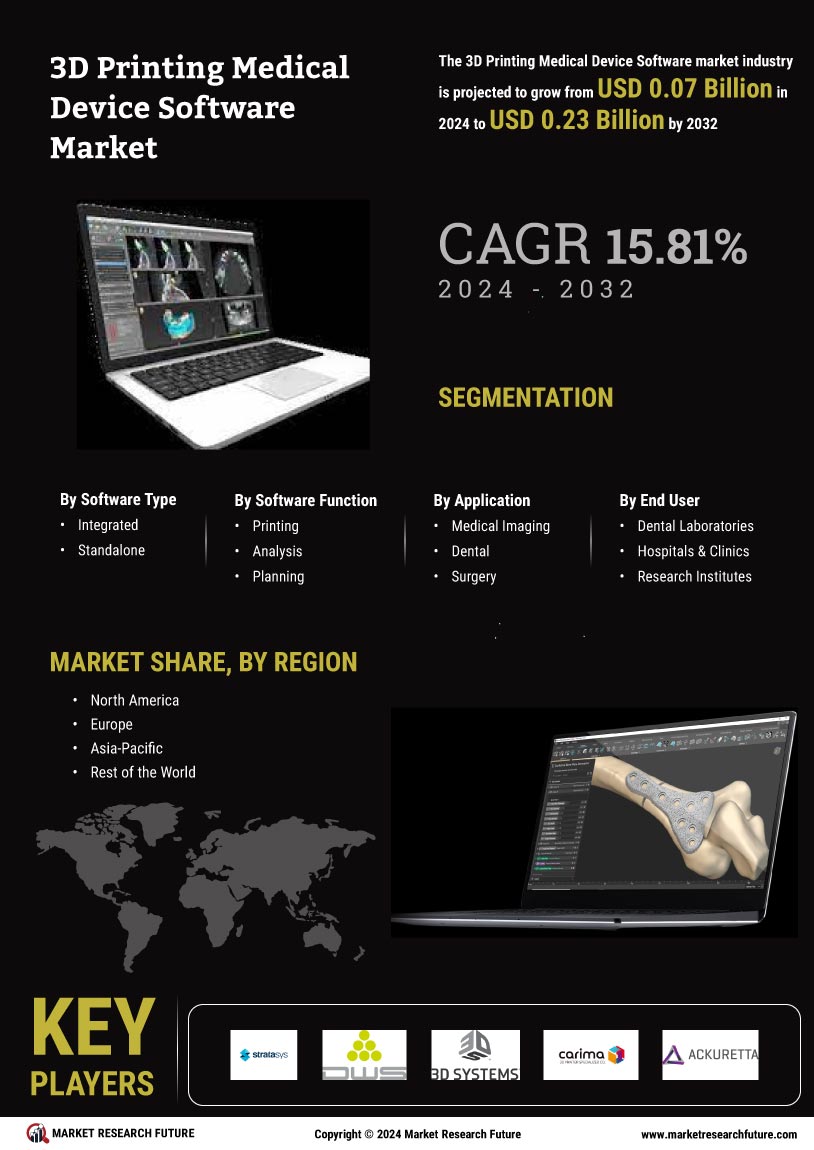

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the 3D Printing Medical Device Software Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, 3D Printing Medical Device Software industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the 3D Printing Medical Device Software industry to benefit clients and increase the market sector. In recent years, the 3D Printing Medical Device Software industry has offered some of the most significant advantages to medicine. Major players in the 3D Printing Medical Device Software Market, including Stratasys Ltd, Nemotec, PS-Medtech, DWS Systems, 3D Systems Corporation, Carima, Real Dimension Inc, Regenhu, 3D Totem, Ackuretta Technologies, and Materialise NV, are attempting to increase market demand by investing in research and development Types.

Comprehensive 3D printing solutions are provided by 3D Systems Corp (3D Systems). The business creates, develops, produces, and sells 3D printers, software, materials made of plastic and metal, and digital design tools. Stereolithography (SLA), selective laser sintering (SLS), direct metal printing (DMP), multijet printing (MJP), and colour jet printing (CJP) printers are all available from 3D Systems. Various 3D printers, 3D scanners, software, digitizers, healthcare simulators, and materials are also available. Additionally, the business provides dental, individualised healthcare, medical equipment, and regenerative medicine services.

Companies in the automobile, aerospace, government, defence, technology, electronics, education, consumer goods, energy, and healthcare industries can purchase its products. Through distributors, channel partners, and direct sales agents, 3D Systems offers its goods. The region of the Americas, Asia Pacific, Europe, the Middle East, and Oceania all have businesses operated by the corporation. The U.S. city of Rock Hill, South Carolina, is where 3D Systems is headquartered. VSP Hybrid Guides for maxillofacial treatments composed of titanium and nylon and customised for each patient were introduced by 3D Systems (US) in April 2021.

The company Stratasys Ltd. (Stratasys) provides 3D printing services and additive manufacturing services. The business sells 3D printers, consumables, and operating system packages. Along with this, it offers other services including strategic advice, quick prototyping, contract engineering, on-site installation, customer support and warranty, direct manufacturing paid-parts services, maintenance, and training. Dental laboratories now have access to the J5 DentaJet 3D Printer PolyJet printer from Stratasys Ltd. (US) as of March 2021.