Supportive Regulatory Environment

A supportive regulatory environment plays a pivotal role in the growth of the 3d printing-medical-device-software market. In Germany, regulatory bodies are increasingly recognizing the potential of 3D printing technologies in healthcare. The establishment of clear guidelines and frameworks for the approval of 3D printed medical devices is fostering innovation and encouraging manufacturers to enter the market. This regulatory support is crucial, as it provides assurance to both manufacturers and healthcare providers regarding the safety and efficacy of 3D printed products. As regulations continue to evolve, the market is likely to see an influx of new entrants and innovative solutions.

Cost Efficiency and Resource Optimization

Cost efficiency is a critical driver for the 3d printing-medical-device-software market, particularly in Germany's healthcare landscape. The ability to produce medical devices on-demand reduces inventory costs and minimizes waste, which is increasingly important in a resource-constrained environment. Studies suggest that hospitals utilizing 3D printing can save up to 30% on device costs compared to traditional manufacturing methods. This financial incentive encourages healthcare providers to invest in 3D printing technologies and software solutions, thereby expanding the market. Additionally, the potential for rapid prototyping allows for quicker iterations and improvements in device design, further enhancing cost-effectiveness.

Technological Advancements in 3D Printing

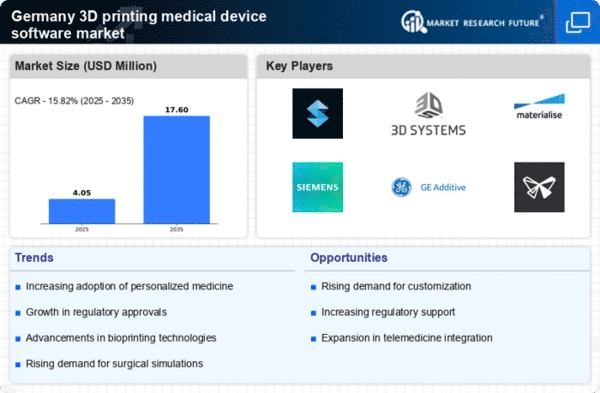

The 3D printing medical device software market is experiencing a surge due to rapid technological advancements in 3D printing technologies. Innovations such as bioprinting and multi-material printing are enhancing the capabilities of medical devices, allowing for the creation of complex structures that closely mimic human anatomy. In Germany, the market for 3D printing in healthcare is projected to grow at a CAGR of approximately 25% from 2025 to 2030. This growth is driven by the increasing demand for customized implants and prosthetics, which are tailored to individual patient needs. Furthermore, advancements in software solutions that facilitate the design and production processes are streamlining workflows, thereby improving efficiency and reducing costs in the medical sector.

Collaboration Between Industry and Academia

Collaboration between industry and academia is emerging as a significant driver for the 3d printing-medical-device-software market. In Germany, partnerships between universities and medical device manufacturers are facilitating research and development in 3D printing technologies. These collaborations are essential for advancing the science behind 3D printing and ensuring that new innovations are effectively translated into practical applications. Such initiatives not only enhance the quality of medical devices but also contribute to the training of skilled professionals in the field. As these partnerships grow, they are expected to accelerate the development of cutting-edge solutions in the 3D printing-medical-device-software market.

Rising Demand for Personalized Healthcare Solutions

The 3d printing-medical-device-software market is significantly influenced by the rising demand for personalized healthcare solutions. Patients increasingly seek treatments and devices that are tailored to their specific medical conditions, which 3D printing technology can provide. In Germany, the healthcare system is adapting to this trend, with a notable increase in the adoption of 3D printed medical devices. Reports indicate that the market for personalized medical devices is expected to reach €1 billion by 2026. This shift towards personalization not only enhances patient outcomes but also fosters a more patient-centric approach in healthcare, driving further investment in 3D printing technologies and associated software.