Supportive Regulatory Environment

A supportive regulatory environment is essential for the growth of the 3d printing-medical-device-software market. In Spain, regulatory bodies are increasingly recognizing the potential of 3D printing technologies in healthcare. Recent initiatives aim to streamline the approval process for 3D printed medical devices, thereby encouraging innovation and investment in this sector. The European Union's Medical Device Regulation (MDR) has also provided a framework that facilitates the introduction of new technologies while ensuring patient safety. This regulatory support is likely to foster a more favorable landscape for manufacturers and developers, potentially leading to a market expansion of approximately 12% over the next few years. As regulations evolve, they may further enhance the credibility and acceptance of 3D printed medical devices.

Cost Efficiency and Resource Optimization

Cost efficiency is becoming increasingly crucial in the healthcare sector, driving the growth of the 3d printing-medical-device-software market. The ability to produce medical devices on-demand reduces inventory costs and minimizes waste, which is particularly beneficial for hospitals and clinics in Spain. By utilizing 3D printing technology, healthcare providers can significantly lower production costs, with estimates suggesting savings of up to 30% compared to traditional manufacturing methods. This financial advantage is compelling healthcare institutions to invest in 3D printing capabilities. Moreover, the reduction in lead times for device production allows for quicker patient treatment, further enhancing the appeal of this technology. As cost pressures continue to mount, the market is poised for substantial growth.

Technological Advancements in 3D Printing

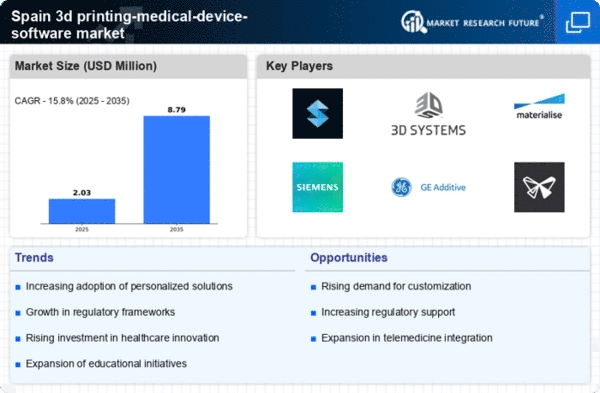

The 3d printing-medical-device-software market is experiencing a surge due to rapid technological advancements. Innovations in materials and printing techniques are enhancing the capabilities of 3D printing in medical applications. For instance, the introduction of biocompatible materials allows for the production of patient-specific implants and prosthetics. In Spain, the market is projected to grow at a CAGR of approximately 20% over the next five years, driven by these advancements. Furthermore, the integration of artificial intelligence in design software is streamlining the development process, making it more efficient and cost-effective. This technological evolution not only improves the quality of medical devices but also expands their applications, thereby increasing the overall market potential.

Growing Investment in Healthcare Innovation

Investment in healthcare innovation is a critical driver for the 3d printing-medical-device-software market. In Spain, both public and private sectors are increasingly allocating funds towards research and development in 3D printing technologies. This influx of capital is aimed at enhancing the capabilities of medical devices and improving patient care. Reports indicate that investment in healthcare technology is expected to rise by 25% in the coming years, with a significant portion directed towards 3D printing initiatives. Such investments not only support the development of advanced medical devices but also encourage collaboration between technology firms and healthcare providers. As the focus on innovation intensifies, the 3d printing-medical-device-software market is likely to benefit from enhanced product offerings and improved healthcare outcomes.

Rising Demand for Customized Medical Solutions

The increasing demand for personalized healthcare solutions is a significant driver for the 3d printing-medical-device-software market. Patients are seeking tailored medical devices that cater to their unique anatomical and physiological needs. In Spain, the trend towards customization is evident, with a growing number of healthcare providers adopting 3D printing technologies to create bespoke implants and surgical tools. This shift is expected to contribute to a market growth of around 15% annually. The ability to produce customized solutions not only enhances patient outcomes but also reduces the risk of complications associated with ill-fitting devices. As healthcare systems continue to prioritize personalized medicine, the 3d printing-medical-device-software market is likely to expand further.