Regulatory Framework Enhancements

The Blood Screening Market is significantly influenced by the evolving regulatory landscape. Governments and health authorities are increasingly implementing stringent regulations to ensure the safety and efficacy of blood screening processes. These regulations often mandate comprehensive testing protocols for blood products, thereby driving the demand for advanced screening technologies. For instance, the introduction of new guidelines for blood safety has led to an uptick in the adoption of automated screening systems. This regulatory push is expected to propel the Blood Screening Market forward, as compliance with these standards necessitates investment in innovative screening solutions.

Expansion of Healthcare Infrastructure

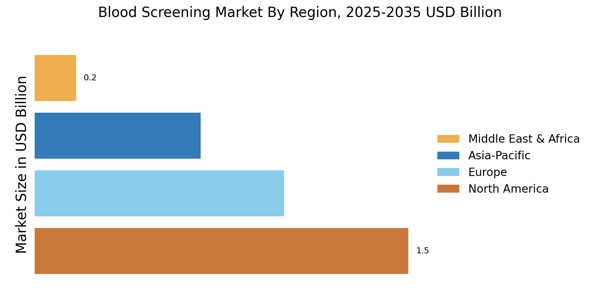

The expansion of healthcare infrastructure, particularly in developing regions, serves as a vital driver for the Blood Screening Market. As countries invest in improving their healthcare systems, the establishment of new hospitals and diagnostic centers increases the demand for blood screening services. This growth is particularly evident in regions where access to healthcare has historically been limited. The World Health Organization has reported a significant increase in healthcare spending in these areas, which is likely to enhance the availability of blood screening technologies. Consequently, the Blood Screening Market is expected to benefit from this infrastructural development, as more facilities seek to implement comprehensive blood screening programs.

Increasing Prevalence of Infectious Diseases

The rising incidence of infectious diseases is a crucial driver for the Blood Screening Market. As the world witnesses a surge in conditions such as hepatitis, HIV, and other blood-borne pathogens, the demand for effective blood screening solutions intensifies. According to recent estimates, the prevalence of hepatitis C alone affects millions, necessitating robust screening measures. This trend compels healthcare providers to adopt advanced blood screening technologies to ensure patient safety and effective disease management. Consequently, the Blood Screening Market is likely to experience substantial growth as healthcare systems prioritize the implementation of comprehensive screening protocols to combat these infectious threats.

Technological Innovations in Blood Screening

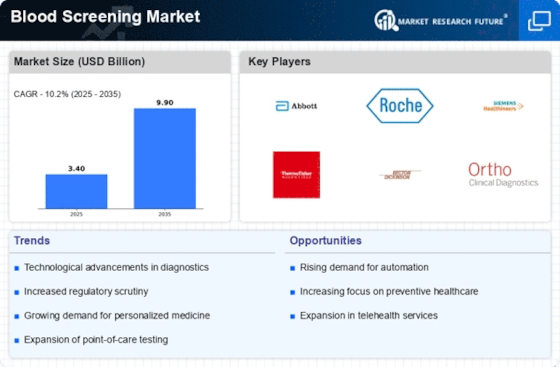

Technological advancements play a pivotal role in shaping the Blood Screening Market. Innovations such as nucleic acid testing (NAT) and next-generation sequencing (NGS) have revolutionized the accuracy and efficiency of blood screening processes. These technologies enable the detection of pathogens at lower levels, enhancing the safety of blood transfusions. The market for blood screening technologies is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 8% in the coming years. As healthcare providers increasingly adopt these cutting-edge solutions, the Blood Screening Market is poised for transformative growth, driven by the need for precision and reliability in screening practices.

Rising Awareness of Blood Donation and Screening

The growing awareness surrounding the importance of blood donation and screening is a significant driver for the Blood Screening Market. Educational campaigns and initiatives by health organizations have led to increased public participation in blood donation drives. This heightened awareness not only encourages more individuals to donate blood but also emphasizes the necessity of thorough screening to ensure the safety of the blood supply. As a result, the demand for blood screening services is expected to rise, with projections indicating a potential increase in screening volumes by 15% over the next few years. This trend underscores the critical role of public health education in bolstering the Blood Screening Market.