Growth of the Blood Donation Sector

The growth of the blood donation sector is a pivotal factor influencing the US Blood Screening Market. As the demand for blood products continues to rise, blood banks and donation centers are increasingly focusing on implementing rigorous screening processes to ensure the safety of the blood supply. The American Red Cross reports that approximately 13.6 million units of whole blood are collected annually in the US, necessitating efficient and reliable blood screening methods. This surge in blood donations is likely to drive investments in advanced screening technologies, as organizations seek to enhance their testing capabilities. Additionally, collaborations between blood donation organizations and healthcare providers are fostering the development of innovative screening solutions. Consequently, the market is poised for growth as the blood donation sector expands and prioritizes the safety and quality of blood products.

Regulatory Enhancements and Compliance

Regulatory enhancements play a crucial role in shaping the US Blood Screening Market. The Food and Drug Administration (FDA) has implemented stringent guidelines to ensure the safety and efficacy of blood screening tests. Compliance with these regulations is essential for manufacturers and laboratories, as it not only ensures patient safety but also enhances market credibility. The FDA's focus on post-market surveillance and real-time monitoring of blood screening products has led to increased investments in quality assurance processes. This regulatory landscape is expected to drive innovation, as companies strive to meet compliance standards while developing new products. The emphasis on regulatory compliance is likely to foster a competitive environment, encouraging firms to enhance their offerings and expand their market share.

Rising Incidence of Bloodborne Diseases

The rising incidence of bloodborne diseases in the United States is a significant driver for the US Blood Screening Market. Conditions such as hepatitis B, hepatitis C, and HIV continue to pose serious public health challenges. According to the CDC, approximately 3.9 million people in the US are living with chronic hepatitis C, underscoring the urgent need for effective blood screening solutions. This alarming trend is prompting healthcare providers to enhance their screening protocols, thereby increasing the demand for advanced blood screening technologies. Furthermore, the growing prevalence of these diseases is likely to lead to increased funding for research and development in the blood screening sector. As healthcare systems strive to mitigate the impact of these diseases, the market is expected to expand in response to the pressing need for comprehensive blood screening services.

Technological Advancements in Blood Screening

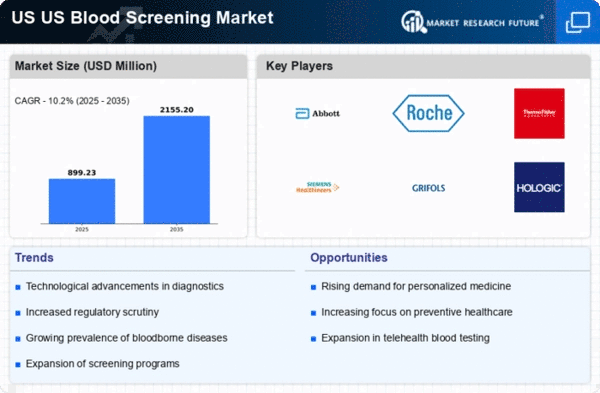

The US Blood Screening Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as nucleic acid testing (NAT) and next-generation sequencing (NGS) are enhancing the accuracy and speed of blood screening processes. These technologies allow for the detection of pathogens at lower levels, thereby improving safety standards. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 7.5% from 2025 to 2030, driven by the increasing adoption of these advanced methodologies. Furthermore, automation in laboratories is streamlining workflows, reducing human error, and increasing throughput. As a result, healthcare providers are more inclined to invest in state-of-the-art blood screening technologies, which is likely to bolster the overall market growth.

Increased Public Awareness and Health Initiatives

In recent years, there has been a marked increase in public awareness regarding bloodborne diseases and the importance of blood screening. The US Blood Screening Market benefits from various health initiatives aimed at educating the public about the risks associated with transfusion-transmissible infections. Campaigns led by organizations such as the Centers for Disease Control and Prevention (CDC) have highlighted the significance of regular blood screening, particularly for high-risk populations. This heightened awareness is likely to drive demand for blood screening services, as individuals become more proactive about their health. Additionally, partnerships between public health agencies and private sector entities are fostering community outreach programs, further promoting the necessity of blood screening. As a result, the market is expected to witness sustained growth fueled by an informed and health-conscious populace.