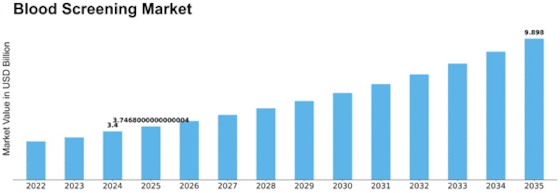

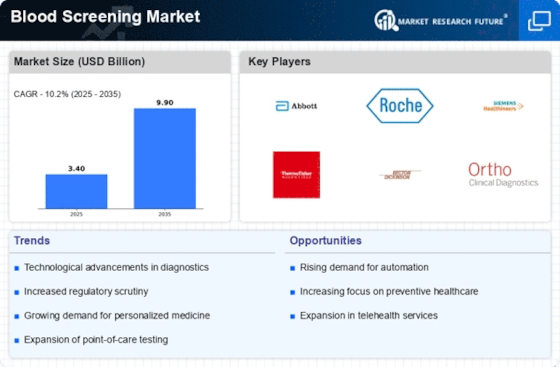

Blood Screening Size

Blood Screening Market Growth Projections and Opportunities

Various determinants shape the dynamics of the blood screening market. One major driver is the current increase in infectious diseases and chronic illnesses globally. Technological advancements also have a significant impact on the blood screening market. Relentless improvements in diagnostic tools and techniques refine the accuracy as well as effectiveness of blood screening tests. Such innovations have revolutionized blood screening, which enables precise detection of infections and genetic disorders, for instance, nucleic acid testing, polymerase chain reaction (PCR), and next-generation sequencing, among others. These technological improvements improve diagnostic capabilities while expanding the range of detectable conditions, thus contributing to market growth. Moreover, government initiatives and regulations also play a significant role in shaping this industry. The authorities' strict laws, coupled with mandated programs concerning health, contribute towards standardizing blood screening practices. They ensure that transfusions of blood, organs, or any other forms involve only appropriate usage of blood products. Also, public awareness campaigns leading to increased emphasis on preventive screenings and regular health checkups by members of society are helping boost the Blood Screening Market globally. However, economic factors also influence how people get to access these services as well as their affordability within some environments; availability, depending on the healthcare infrastructure available, may be costly, for example. Developed economies with mature healthcare systems often see higher adoption rates for advanced forms of technology in blood screening than developing countries do. Lastly, partnership strategies combined with mergers within the healthcare industry also determine how fast players gain or lose control over markets.

Leave a Comment