Regulatory Support for Natural Additives

The US Natural Food Additives Market benefits from a favorable regulatory environment that supports the use of natural additives. Regulatory bodies, such as the Food and Drug Administration (FDA), have established guidelines that encourage the use of natural ingredients in food products. This regulatory support is crucial as it provides a framework for manufacturers to develop and market natural food additives without facing excessive barriers. Furthermore, the FDA's Generally Recognized as Safe (GRAS) designation for many natural additives enhances consumer confidence and encourages manufacturers to incorporate these ingredients into their products. As regulations continue to evolve, the US Natural Food Additives Market is likely to see an increase in the adoption of natural additives, further driving market growth.

Sustainability Trends in Food Production

Sustainability is becoming a central theme in the US Natural Food Additives Market, as consumers and manufacturers alike prioritize environmentally friendly practices. The demand for sustainable sourcing of natural ingredients is on the rise, with many consumers willing to pay a premium for products that are produced responsibly. This trend is prompting manufacturers to adopt sustainable practices in their supply chains, such as sourcing ingredients from organic farms and utilizing eco-friendly processing methods. As sustainability becomes a key differentiator in the market, companies that align their practices with these values are likely to gain a competitive edge. Consequently, the focus on sustainability is expected to drive growth in the US Natural Food Additives Market.

Innovation in Food Processing Technologies

The US Natural Food Additives Market is witnessing a wave of innovation in food processing technologies that facilitate the use of natural additives. Advances in extraction and preservation techniques enable manufacturers to derive natural additives from various sources while maintaining their efficacy and safety. For instance, new methods of cold extraction and enzymatic processing are being employed to enhance the quality of natural food additives. This technological progress not only improves the quality of the final products but also allows for the development of new applications for natural additives in food products. As these innovations continue to emerge, they are likely to play a pivotal role in shaping the future of the US Natural Food Additives Market.

Rising Health Consciousness Among Consumers

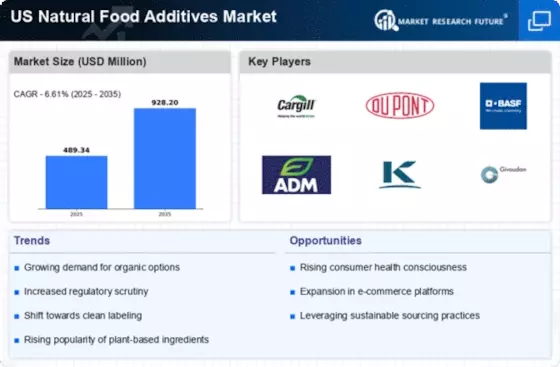

The US Natural Food Additives Market is significantly influenced by the rising health consciousness among consumers. As individuals become more aware of the impact of diet on health, there is a growing preference for food products that promote well-being. This trend is reflected in the increasing sales of organic and natural food products, which have seen a compound annual growth rate (CAGR) of over 10% in recent years. Consumers are actively seeking food additives that not only enhance flavor but also provide health benefits, such as antioxidants and vitamins. This shift in consumer preferences is compelling manufacturers to innovate and expand their offerings of natural food additives, thereby contributing to the overall growth of the US Natural Food Additives Market.

Increasing Consumer Demand for Natural Ingredients

The US Natural Food Additives Market is experiencing a notable surge in consumer demand for natural ingredients. This trend is largely driven by a growing awareness of health and wellness among consumers, who are increasingly seeking products that are free from synthetic additives. According to recent surveys, approximately 70% of consumers in the US express a preference for food products that contain natural ingredients. This shift in consumer behavior is prompting manufacturers to reformulate their products, thereby expanding the market for natural food additives. As a result, companies are investing in research and development to innovate and provide a wider range of natural additives that meet consumer expectations. This increasing demand is likely to propel the growth of the US Natural Food Additives Market in the coming years.