Rising Incidence of Colorectal Cancer

The increasing incidence of colorectal cancer is a primary driver for the Fecal Occult Testing Market. According to recent statistics, colorectal cancer ranks as the third most common cancer worldwide, with millions diagnosed annually. This alarming trend has prompted healthcare providers to emphasize early detection methods, including fecal occult testing. The Fecal Occult Testing Market is likely to experience growth as awareness campaigns and screening programs become more prevalent. Furthermore, the World Health Organization has recommended regular screening for individuals over 50, which could further boost the demand for these tests. As a result, the market is expected to expand significantly, driven by the urgent need for effective screening solutions.

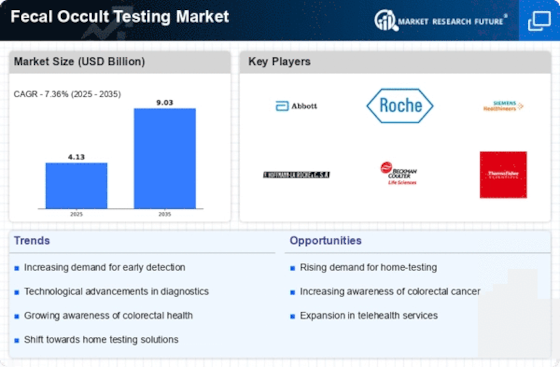

Technological Innovations in Testing Methods

Technological innovations in fecal occult testing methods are transforming the Fecal Occult Testing Market. Advances in testing technologies, such as the development of more sensitive and specific assays, are enhancing the accuracy of results. These innovations not only improve patient compliance but also increase the reliability of screening outcomes. For instance, the introduction of non-invasive testing kits that can be used at home is likely to appeal to a broader audience. As a result, the market is expected to expand as healthcare providers adopt these advanced technologies to improve screening rates. Furthermore, the integration of digital health solutions, such as mobile applications for test results, may also contribute to the growth of the Fecal Occult Testing Market.

Government Initiatives and Screening Programs

Government initiatives and screening programs are playing a crucial role in shaping the Fecal Occult Testing Market. Many countries have implemented national screening programs aimed at increasing the detection rates of colorectal cancer. These programs often provide fecal occult testing at no cost to eligible populations, thereby removing financial barriers to access. As a result, participation rates in screening programs have seen a notable increase, which directly impacts the demand for fecal occult tests. The Fecal Occult Testing Market is likely to benefit from these initiatives, as they not only promote awareness but also facilitate early diagnosis, ultimately leading to better health outcomes for the population.

Increased Awareness of Preventive Health Measures

There is a growing awareness of preventive health measures among the population, which is significantly influencing the Fecal Occult Testing Market. As individuals become more health-conscious, they are increasingly seeking out screening options to detect potential health issues early. This trend is particularly evident in developed regions, where healthcare systems are promoting regular screenings as part of routine health check-ups. The Fecal Occult Testing Market is benefiting from this shift, as more people recognize the importance of early detection in reducing mortality rates associated with colorectal diseases. Additionally, educational initiatives by health organizations are likely to further enhance public understanding of fecal occult testing, thereby driving market growth.

Aging Population and Rising Healthcare Expenditure

The aging population is a significant driver of the Fecal Occult Testing Market. As individuals age, the risk of developing colorectal conditions increases, necessitating regular screening. This demographic shift is accompanied by rising healthcare expenditure, as governments and private sectors allocate more resources to preventive healthcare measures. The Fecal Occult Testing Market is poised for growth as healthcare systems adapt to the needs of an older population. Increased funding for screening programs and the development of targeted marketing strategies aimed at older adults may further enhance market penetration. Consequently, the combination of an aging population and increased healthcare spending is likely to create a favorable environment for the expansion of the Fecal Occult Testing Market.