Growing Aging Population

The growing aging population worldwide is a crucial driver for the Global Colorectal Cancer Screening Market Industry. As individuals age, the risk of developing colorectal cancer increases, leading to a higher demand for screening services. By 2035, the market is projected to reach 15.7 USD Billion, reflecting the increasing need for effective screening among older adults. This demographic shift necessitates tailored screening programs that address the unique needs of older populations. Consequently, healthcare providers are likely to invest more in screening technologies and services, further propelling market growth.

Market Growth Projections

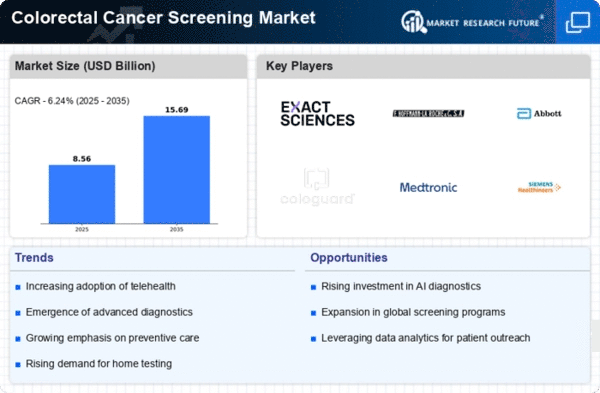

The Global Colorectal Cancer Screening Market Industry is anticipated to witness substantial growth in the coming years, with projections indicating a market value of 8.06 USD Billion in 2024 and an expected increase to 15.7 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 6.24% from 2025 to 2035. Such projections highlight the increasing demand for effective screening solutions driven by various factors, including technological advancements, rising incidence rates, and government initiatives. The market's expansion reflects a collective effort to enhance early detection and improve patient outcomes globally.

Increased Awareness and Education

Increased awareness and education regarding colorectal cancer and the importance of screening are vital factors driving the Global Colorectal Cancer Screening Market Industry. Public health campaigns and educational initiatives have successfully informed individuals about the risks associated with colorectal cancer and the benefits of early detection. This heightened awareness has led to increased screening participation rates, as more individuals recognize the importance of proactive health measures. As educational efforts continue to expand, the market is expected to experience sustained growth, with a projected CAGR of 6.24% from 2025 to 2035, reflecting the ongoing commitment to improving public health outcomes.

Government Initiatives and Guidelines

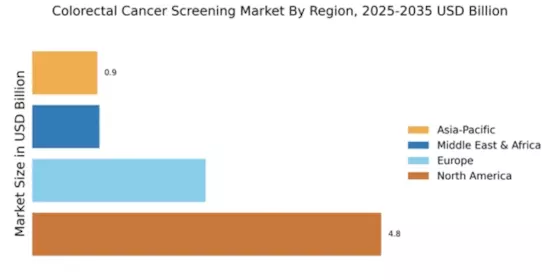

Government initiatives and guidelines promoting colorectal cancer screening significantly influence the Global Colorectal Cancer Screening Market Industry. Many countries have established screening programs aimed at increasing awareness and participation among at-risk populations. For example, the United States Preventive Services Task Force recommends regular screenings starting at age 45, which has led to increased screening rates. Such initiatives not only enhance public health outcomes but also stimulate market growth by creating a structured environment for screening services. As governments continue to prioritize cancer prevention, the market is poised for sustained expansion.

Rising Incidence of Colorectal Cancer

The increasing incidence of colorectal cancer globally serves as a primary driver for the Global Colorectal Cancer Screening Market Industry. Statistics indicate that colorectal cancer is the third most commonly diagnosed cancer worldwide, with millions of new cases reported annually. This alarming trend necessitates early detection and screening, leading to a heightened demand for screening services and products. As awareness grows regarding the importance of early diagnosis, the market is expected to expand significantly, with projections suggesting a market value of 8.06 USD Billion in 2024. Such figures underscore the urgency for effective screening solutions.

Advancements in Screening Technologies

Technological advancements in colorectal cancer screening methods are propelling the Global Colorectal Cancer Screening Market Industry forward. Innovations such as non-invasive tests, improved imaging techniques, and artificial intelligence applications in diagnostics enhance the accuracy and efficiency of screenings. For instance, the development of stool-based DNA tests has revolutionized the screening process, making it more accessible and less invasive for patients. These advancements not only improve patient compliance but also contribute to earlier detection rates, thereby driving market growth. As these technologies continue to evolve, they are likely to attract further investments and expand the market's reach.