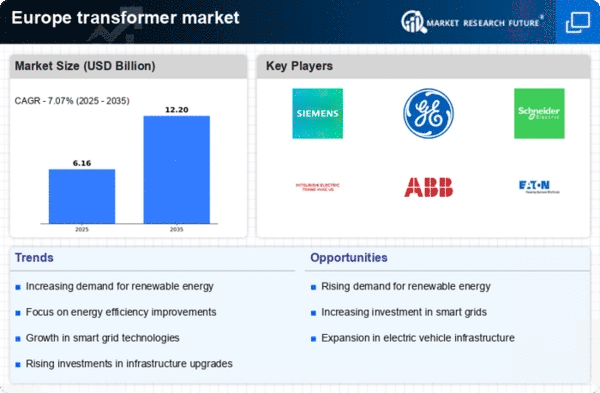

Rising Demand for Renewable Energy

The increasing shift towards renewable energy sources in Europe is driving the transformer market. As countries aim to meet their climate goals, investments in wind, solar, and hydroelectric power are surging. This transition necessitates the installation of advanced transformers to manage the variable output from these energy sources. In 2025, the renewable energy sector is projected to account for over 50% of the total energy mix in several European nations. Consequently, the transformer market is likely to experience substantial growth, as these systems are essential for integrating renewable energy into existing grids.

Infrastructure Modernization Initiatives

Europe's aging electrical infrastructure is prompting significant modernization efforts, which are crucial for enhancing efficiency and reliability. Governments and utility companies are investing heavily in upgrading transmission and distribution networks, which directly impacts the transformer market. In 2025, it is estimated that investments in infrastructure upgrades will exceed €100 billion across Europe. This modernization includes the deployment of smart transformers that can improve grid management and reduce losses, thereby fostering a more resilient energy system. The ongoing infrastructure initiatives are expected to create a robust demand for transformers.

Increased Urbanization and Electrification

The rapid urbanization in Europe is leading to heightened demand for electricity, which in turn influences the transformer market. As urban areas expand, the need for reliable power supply becomes critical. By 2025, urban populations in Europe are projected to reach approximately 75% of the total population, necessitating enhanced electrical infrastructure. This urban growth drives the installation of transformers to support new residential, commercial, and industrial developments. The transformer market is likely to benefit from this trend, as utilities strive to meet the rising electricity demand in densely populated areas.

Government Incentives for Energy Efficiency

European governments are increasingly implementing incentives aimed at promoting energy efficiency, which significantly impacts the transformer market. Programs that encourage the adoption of energy-efficient technologies, including transformers, are becoming more prevalent. By 2025, it is expected that these incentives will lead to a 15% increase in the adoption of high-efficiency transformers across various sectors. Such initiatives not only support environmental goals but also help reduce operational costs for businesses and utilities. The favorable regulatory environment is likely to stimulate growth in the transformer market as stakeholders seek to capitalize on these opportunities.

Technological Innovations in Transformer Design

Innovations in transformer technology are reshaping the landscape of the transformer market in Europe. Developments such as the introduction of high-efficiency transformers and digital monitoring systems are enhancing performance and reliability. These advancements not only reduce energy losses but also extend the lifespan of transformers. In 2025, it is anticipated that the market for smart transformers will grow by over 20%, driven by the need for improved grid management and operational efficiency. The integration of advanced technologies is likely to position the transformer market favorably in the evolving energy sector.