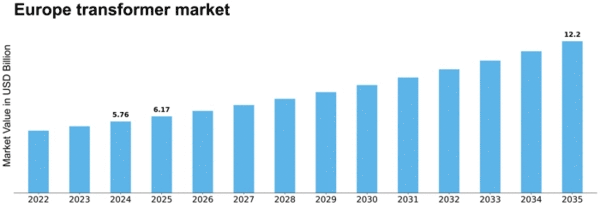

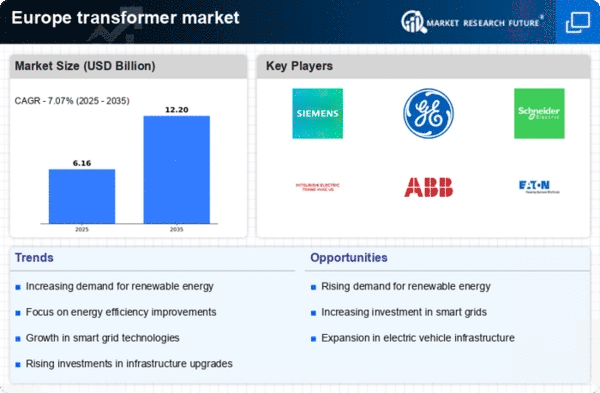

Europe Transformer Size

Europe Transformer market Growth Projections and Opportunities

The market dynamics of transformers in Europe have experienced significant shifts, influenced by several factors that shape the region's energy landscape. Transformers play a crucial role in electrical power systems, facilitating the efficient transmission and distribution of electricity. One of the primary drivers of the transformer market dynamics in Europe is the region's commitment to a sustainable and decarbonized energy future. European countries are actively transitioning towards renewable energy sources, including wind and solar power, necessitating a robust and adaptable electrical infrastructure supported by advanced transformers.

The increasing integration of renewable energy sources has led to a growing demand for transformers that can accommodate the variable and intermittent nature of these power inputs. As Europe strives to achieve its renewable energy targets and reduce greenhouse gas emissions, the transformer market has witnessed a surge in the deployment of smart and resilient transformers. These transformers are equipped with advanced monitoring and control capabilities, allowing for efficient management of the fluctuating power flows from renewable sources and contributing to grid stability.

The European Union's ambitious energy and climate policies have played a pivotal role in shaping the transformer market dynamics. The EU's commitment to achieving carbon neutrality by 2050, coupled with stringent energy efficiency standards, has led to the development and adoption of eco-friendly and energy-efficient transformers. This regulatory environment encourages innovation in transformer technology, promoting the use of materials with lower environmental impact and increased energy efficiency in transformer design.

Grid modernization initiatives in Europe have further influenced the transformer market dynamics. As the electricity grid undergoes upgrades to accommodate new energy sources and technologies, transformers are required to meet evolving technical specifications. The deployment of smart grids, which enable bidirectional communication between utilities and end-users, has increased the demand for transformers that support real-time monitoring, diagnostics, and control functionalities. This, in turn, enhances the overall reliability and efficiency of the electrical grid.

The electrification of transportation is another factor contributing to the transformer market dynamics in Europe. The increasing adoption of electric vehicles (EVs) and the development of charging infrastructure require transformers capable of meeting the growing demand for electricity in the transportation sector. This trend not only influences the distribution transformers near charging stations but also drives innovations in power transformers that support the overall grid capacity required for a widespread electric vehicle ecosystem.

The evolving energy mix in Europe, with a focus on a decentralized energy generation model, has implications for the transformer market. Distributed energy resources, such as rooftop solar panels and small-scale wind turbines, contribute to a more complex and dynamic grid environment. Transformers designed for decentralized energy systems must accommodate bidirectional power flows and ensure seamless integration into the broader grid infrastructure.

The resilience of transformers to withstand extreme weather events and natural disasters is a critical consideration in the European market. The increasing frequency and intensity of such events necessitate transformers that can withstand challenging environmental conditions and contribute to the overall grid reliability. This has led to advancements in transformer design, including enhanced insulation and cooling systems, to ensure optimal performance under diverse environmental circumstances.

The market dynamics of transformers in Europe reflect a confluence of regulatory imperatives, technological innovations, and the changing dynamics of the energy landscape. The region's commitment to sustainability, coupled with the integration of renewable energy sources and the electrification of transportation, has spurred advancements in transformer technology. As Europe continues its journey towards a cleaner and more resilient energy future, transformers will play a pivotal role in shaping the infrastructure that supports the evolving needs of the electrical grid.

Leave a Comment