Increased Focus on Asset Management

An increased focus on asset management within the energy sector is propelling the Global Transformer Monitoring System Market Industry forward. Utilities are recognizing the importance of maintaining and managing their assets to ensure operational efficiency and reliability. Transformer monitoring systems provide valuable insights into asset health, enabling organizations to implement effective maintenance strategies. This proactive approach not only reduces operational costs but also extends the lifespan of critical infrastructure. As the energy sector continues to evolve, the emphasis on robust asset management practices is likely to drive the adoption of advanced monitoring solutions.

Growing Renewable Energy Integration

The integration of renewable energy sources into the power grid is a key driver for the Global Transformer Monitoring System Market Industry. As countries strive to meet their renewable energy targets, the need for reliable monitoring systems becomes paramount. Transformer monitoring systems facilitate the seamless integration of renewable sources by ensuring that transformers operate efficiently under varying load conditions. This is particularly crucial as the share of renewables in the energy mix continues to grow. The ability to monitor and manage transformers effectively enhances grid stability, thereby supporting the transition to a more sustainable energy future.

Government Initiatives and Regulations

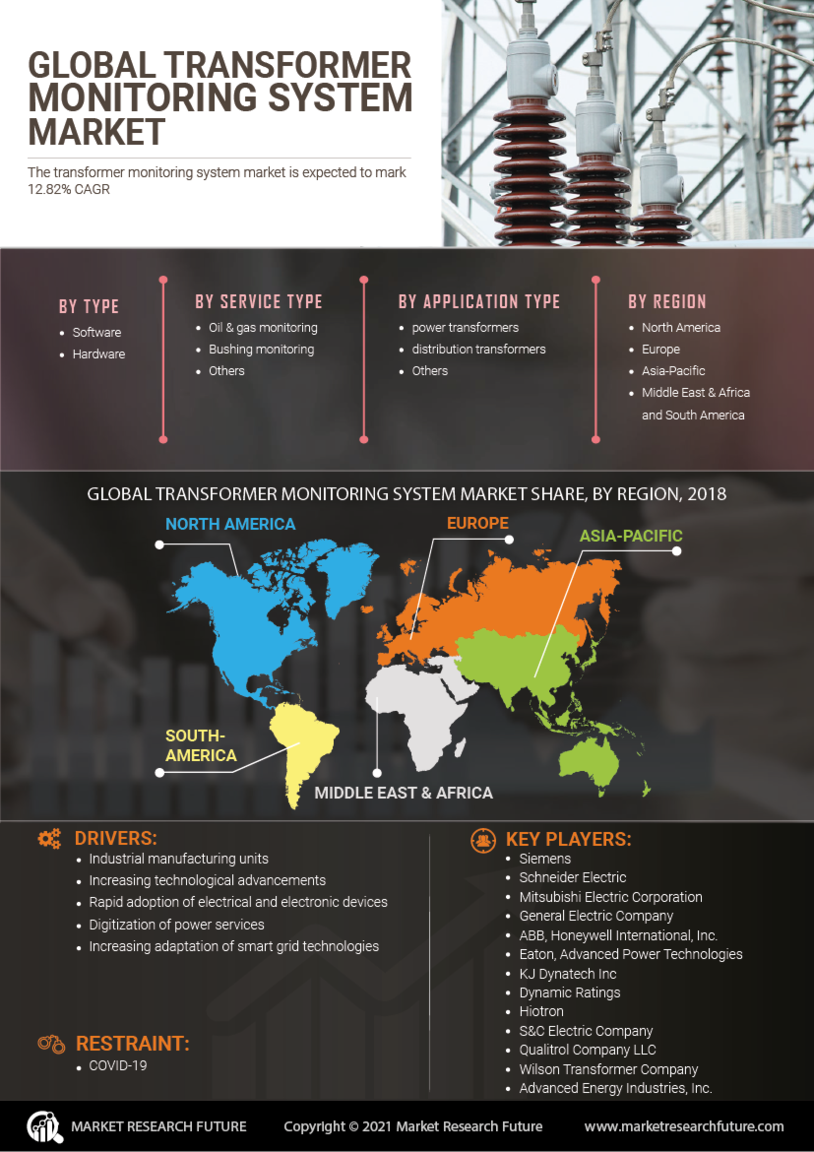

Government initiatives and regulations aimed at improving energy efficiency and reliability are significantly influencing the Global Transformer Monitoring System Market Industry. Many countries are implementing stringent regulations to promote the adoption of smart grid technologies, which include advanced transformer monitoring systems. These initiatives not only encourage investments in modern infrastructure but also aim to enhance the resilience of power networks. For instance, policies that mandate real-time monitoring and reporting of transformer health are likely to drive the adoption of these systems, fostering a more sustainable energy landscape.

Rising Demand for Efficient Energy Management

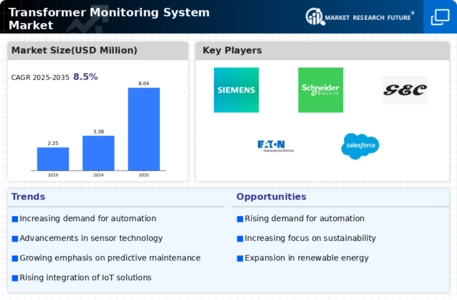

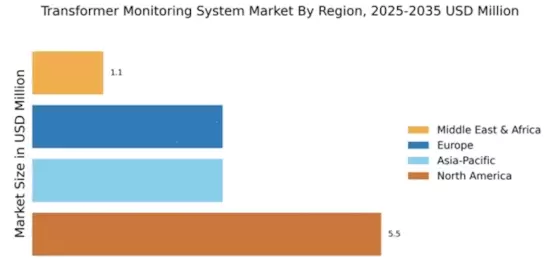

The Global Transformer Monitoring System Market Industry is experiencing a surge in demand for efficient energy management solutions. As energy consumption continues to rise globally, utilities and industries are increasingly adopting transformer monitoring systems to optimize performance and reduce operational costs. This trend is underscored by the projected market growth from 3.38 USD Billion in 2024 to 8.04 USD Billion by 2035, reflecting a compound annual growth rate of 8.21% from 2025 to 2035. Such systems enable real-time monitoring and predictive maintenance, thereby enhancing the reliability of power supply and minimizing downtime.

Technological Advancements in Monitoring Systems

Technological advancements play a pivotal role in shaping the Global Transformer Monitoring System Market Industry. Innovations such as IoT integration, artificial intelligence, and machine learning are enhancing the capabilities of transformer monitoring systems. These technologies facilitate predictive analytics, enabling utilities to foresee potential failures and address them proactively. The increasing sophistication of these systems is likely to attract investments, further driving market growth. As organizations seek to leverage data for improved decision-making, the adoption of advanced monitoring solutions is expected to rise, contributing to the overall market expansion.